Which States Have The Worst Income Inequality? New York, California Top List, As Trump Stands To Worsen National Wealth Disparity

In a sweeping study released Thursday, the Center on Budget Policy and Priorities found income growth in the U.S. since 1979 has largely been concentrated among the top 1 percent of earners, and those behind state tax legislation may be the major culprits.

The tax policies of President-elect Donald Trump, while applicable only on the federal level, could exacerbate the situation, turning nationwide tax policies away from the Washington think tank’s proposed solutions.

The report said while income growth — including capital gains — rose 192 percent for the top 1 percent of earners in the past 35 years, that of the next-wealthiest 19 percent of earners grew by a little over two-thirds, and the middle 60 percent grew by slightly less than half. For the bottom 20 percent of American families, income has risen only 41 percent since 1979.

And that inequality wasn’t spread evenly across the U.S.: New York and California fell into first and second place, respectively, in a ranking of states’ income ratios of the richest 5 percent of residents to the poorest 20 percent. New York’s ratio was 19.9, ahead of California’s 16.73. They were trailed by Connecticut, Louisiana and Massachusetts. Washington, D.C., while not ranked as a state, beat New York by a wide margin, with a ratio of 28.24. The national average stood at 14.81.

“The mechanisms by which state tax systems ask less of the wealthy than of poor and middle-income families have developed over time, often through closed-door negotiations resulting in special tax breaks that benefit a relative few,” the report said. “To reverse these trends, states should avoid actions — such as cutting income taxes or raising sales taxes — that worsen inequality by shifting taxes further to lower-income residents. Instead, they should ensure that high-income tax earners pay their share and lower-income earners don’t face increased tax responsibility.”

On top of raising state income taxes on the highest earners and lowering states’ sales taxes, the center advocated for state taxation of services often purchased by wealthier Americans, like country club memberships and investment counseling, as well as building up revenue to pay for welfare programs and enacting state-level earned-income taxes for middle-class families.

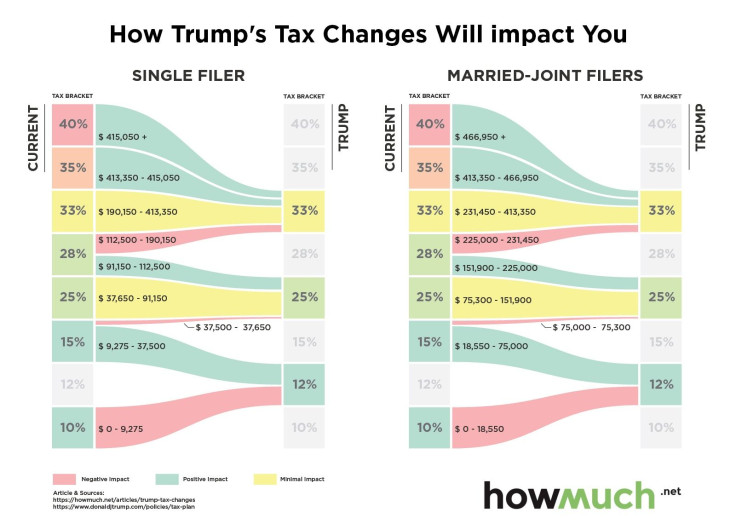

Trump’s tax plan would reduce the number of federal tax brackets to three from seven, and will worsen income inequality if enacted, according to a study by the Tax Policy Center, a joint venture between the Urban Institute and the Brookings Institute, two Washington think tanks.

Although Trump’s proposal would result in lower income taxes for all Americans, the study said, the top 0.1 percent of earners would receive, on average, a 19 percent tax break, amounting to $1.3 million per filer, and middle-class families would pay 4.9 percent less, or $2,700, in federal income taxes. About a week before the Center on Budget Policy and Priorities published its study, the cost information website Howmuch.net released a graphic breaking down the impact of Trump’s tax policy on members of each bracket.

The president-elect also plans to drop the federal corporate tax rate to 15 percent from 35, and to repeal the so-called federal “death tax,” also known as the estate tax, which only applies to the 0.2 percent of inheritances that are larger than $5.45 million for individuals, or $10.9 million for couples.

The Center on Budget Policy and Priorities argued for state-level expansion of both of these, citing declining state corporate rates and the notion that “only the very wealthiest taxpayers pay estate taxes.”

© Copyright IBTimes 2024. All rights reserved.