Why Blockchain Projects Struggle To Work With Banks

The legal battle over the $232 million Tezos cryptocurrency project has sparked heated debate throughout the blockchain industry about how to manage cryptocurrency funds. Many initial coin offerings divide funds between startups and nonprofit foundations based in tax haven nations like Switzerland, which Tezos did as well.

This can lead to legal conflicts when it comes time to use those funds to actually deliver on the promised products or services. Although most bitcoin veterans keep their tokens in their own digital wallets, there are still scant options for the growing number of blockchain businesses.

It’s still incredibly hard for a blockchain company to open a bank account. CoinDesk reported many blockchain projects are offered only limited banking services, denied any service outright or can even have their banking support revoked without warning. Add in the regulatory confusion over ICOs in general, and it’s easy to see why countless startups are now focusing on the gap between blockchain-based capital and traditional compliance.

The startup TokenFunder recently became the first ICO platform developed in cooperation with Canadian regulators. This Ontario-based company will launch its ICO on November 1. Meanwhile, the British compliance startup Coinfirm is planning an ICO for later this year. They offer research reports for nameless cryptocurrency accounts, such as bitcoin or ether wallets, participating in token sales. So far, they’ve helped around 20 teams run token sales. “We assess if anything connected with the profile would be a risk,” Coinfirm CEO Pawel Kuskowski told International Business Times.

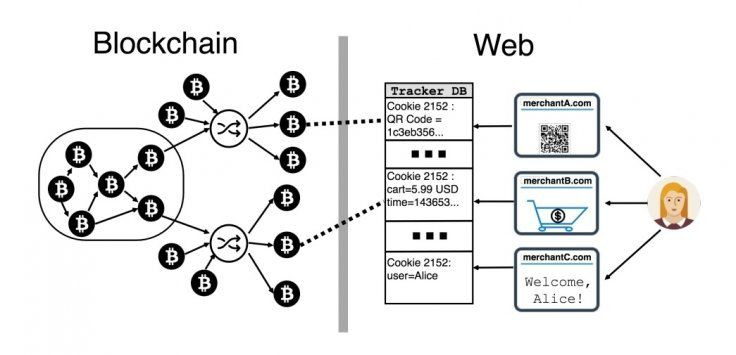

The biggest risk is falling short of an anti-money laundering requirement called “know your customer.” Financial companies need to be able to track where the money came from, not just the client but where the client’s money came from. This way, businesses can prove their funds weren’t connected to any illegal activities. The San Francisco startup Ripple was already penalized by the Financial Crimes Enforcement Network for failing to register as a “money service business” and meet these requirements when initially selling its XRP tokens.

Ripple is a unique case, because it is a service provider working directly with banks and financial institutions. According to Aaron Wright, law professor at Cardozo School of Law and chairman of the Ethereum Enterprise Alliance legal working group, it’s not clear if the same law applies to different parts of the blockchain industry.

“There’s an open question of whether all these projects need to [operate like MSBs],” Wright told IBT. “It’s not clear if FinCEN really wants to cover these types of sales.”

That’s why most banks still shy away from cryptocurrency. These digital assets are not only volatile and hard to analyze; They are also beyond the scope of most established laws. Cryptocurrencies could be seen as prone to illegal activities, even if those activities aren’t drug deals or fraud. And yet, with a cryptocurrency market worth more than $170 billion, according to Reuters, it’s getting more difficult for blockchain startups to circumnavigate the need for traditional banking services.

“If the bank is onboarding clients...they are going to ask us to provide independent information to them, about the company. And also on an ongoing basis they need to review the risk of the company,” Kuskowski told IBT. “Our work basically does 60 percent of the compliance officer’s work.” Coinfirm’s reports can pinpoint a shady account, so the startup can return those specific funds and avoid liability. Coinfirm’s platform also allows companies to share information with each other, which opens the doors for cryptocurrency users in the developing world.

Many countries, such as Somalia and Indonesia, have such a high cybercrime rate that some tech companies avoid working with their citizens altogether. An analysis by the decentralized token exchange AirSwap proved the same issue exists for counterfeit cryptocurrency accounts in places like the Philippines. Coinfirm could help people in these regions develop their own reputations and identify themselves as low risk participants.

“We call this the token of compliance,” Kuskowski said. “This is something that you exchange and you get information from our system, the address. But you also get information from our network, how the network is perceiving this address.” There’s just one problem: being mostly compliant is not the same thing has being compliant.

“That seems like a step in the right direction, although maybe they are overselling it,” Wright told IBT. “You can’t just accept [funding] from a nameless bitcoin or ether account and expect to be in compliance.” Astyanax Kanakakis, CEO and co-founder of the Swedish blockchain company Norbloc, agrees it’s practically impossible to imagine a way for the popular ICO model to fit current KYC laws.

“It’s very difficult to do KYC with so many people and so many jurisdictions,” Kanakakis told IBT. “In the case when you have nameless ICOs, then you cannot do KYC and the bank will not accept you as a customer...But for the ones who do KYC on their customers, in those cases our platform can actually help.”

Norbloc’s compliance platform, which is scheduled for a beta launch in 2018, allows participating banks to transfer KYC information so that each company and bank can finally avoid doing the same KYC grunt work over and over. Norbloc collaborated with Lindahl, one of Sweden’s largest law firms, to consider every aspect of this process from data collection to decentralized storage and permissioned transfers.

“We started focusing on KYC because a lot of our clients were asking for it,” Kanakakis added. “We saw a lot of potential for blockchain technology and KYC.”

There are some blockchain projects, such as FileCoin, already conducting token sales through compliant models for accredited investors. It still looks like a crypto duck and quacks like an ICO, yet it negates the cypherpunk ethos of expanding financial inclusion beyond traditional investors. “If Filecoin turns out to be the most amazing, decentralized storage system that we’re all going to use in the future, the only people who really had access to that network off the bat were rich folks in the U.S.,” Wright said. “That’s a little bit concerning in my mind.”

There is hope. Wright pointed out a legal precedent for crowdfunding tech products. So utility tokens, not tokens that could classify as securities or derivatives, could someday blaze a legal trail for democratic ICOs. “You don’t have to register and know your customer before you open a Kickstarter,” Wright said. “I think to the extent that there is some sale of digital goods, there is some precedent for permitting anyone to purchase them.”

In the meantime, a growing number of blockchain technology providers are offering compliance services for old school institutions, like banks. The Luxembourg-based startup CyberTrust claims it has already raised $10 million worth of ether ahead of their public ICO launching on November 27, which aims to raise up to $90 million. "Everything over $35 million will go in the fund to secure the token price," Evgeny Xata, CEO of CyberTrust, told IBT. “We're an open platform, so the community decides what to securitize and when."

CyberTrust plans to use their CABS tokens to offer derivatives for cryptocurrencies, starting with bitcoin, ether and bitcoin cash then expanding to the top 20 cryptocurrencies in 2018. Like Norbloc, this platform only works for companies working with accredited investors and institutions. It won’t solve the fundamental issue of inclusive yet compliant cryptocurrency business projects. However, it does offer a model for treating cryptocurrency like traditional assets.

Xata said many cryptocurrency hedge funds today are basically acting like independent investors. "When you start digging, the custody, the ownership of those [crypto] funds goes to the employees...it's very, very unsophisticated. Investing on their personal phones in the name of the funds," he said. “The first thing a derivative does is it provides ownership in the traditional system...A judge can freeze the derivative, which gives control of the underlying [asset]...we put it in a bunker in Switzerland."

Treating bitcoin like a tangible bar of gold could help banks get on board the cryptocurrency train. At the same time, it could also blind newbies to the ways blockchain technology is fundamentally different than stocks and dollars. It remains to be seen if catering to old mentalities will help blockchain startups get the services they need to do business.

"Our clients don't care about the way a blockchain system can be used,” Xata said. “The only thing they want is the store of value."

© Copyright IBTimes 2024. All rights reserved.