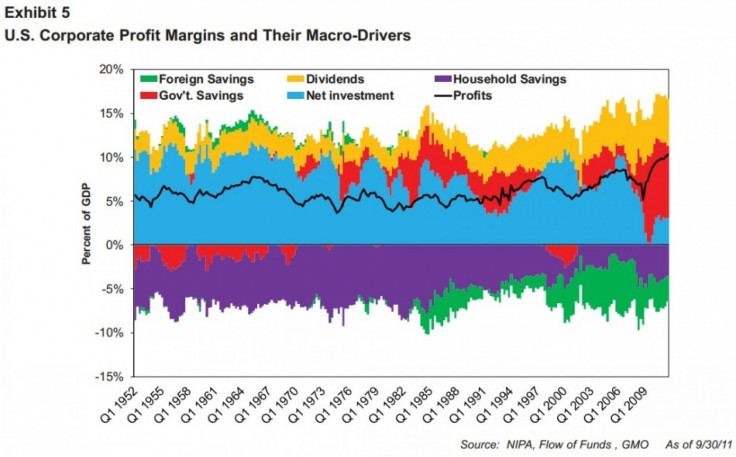

Why Corporate Profit Margins Must Fall [CHART]

Corporate profit margins, currently at record highs, must fall in coming years, James Montier of investment firm GMO LLC said in a recent commentary.

Montier, a member of Boston-based GMO's asset-allocation team, credited much of the recent rise in aggregate margins to increased government spending.

In the near future, however, it's almost unthinkable that the U.S. government will sustain current levels of spending, since many European governments have already launched austerity programs, Montier wrote. Corporate profit margins, therefore, will shrink, he said.

Montier based his analysis on the Kalecki profits equation, which states that profits equal total investment and consumption spending in an economy -- that is, corporate revenues minus total wages paid (corporate expenses). Non-wage expenses don't detract from aggregate corporate profits because one company's expense is another company's revenue.

Household and government savings, though, are drags on corporate profits because they represent corporate payouts that aren't recycled into corporate revenues through consumption or investment.

As the chart above shows, corporate profits were historically lower partly because of higher savings, which were pushed higher by increased wages and lower consumption.

Since the 1980s, however, real wages have been stagnant while spending has continued to rise, resulting in reduced savings and thus higher corporate profits.

When the global financial crisis hit in 2008, consumers and companies cut back on spending, which briefly hammered profit margins.

The U.S. government quickly stepped in with massive deficit spending (the opposite of savings) and corporations cut wages (expenses). Within a few quarters, profit margins rebounded and surged to record levels.

Going forward, GMO expects profit margins to shrink to 6 percent by 2019, which would dent real returns by 3.7 percent a year.

© Copyright IBTimes 2024. All rights reserved.