Why NVIDIA’s Artificial Intelligence Growth Is Far From Over

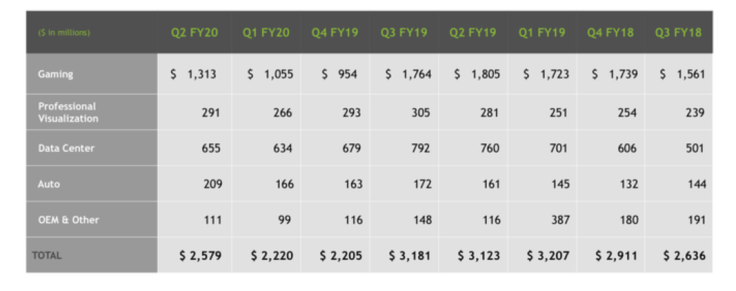

NVIDIA (NASDAQ:NVDA) showed a notable improvement in growth across the business in its latest quarter. Besides the strength in the gaming segment, two other areas that stood out in Q2 2020 were the data center and automotive divisions, with both showing an increase in revenue over the previous quarter.

NVIDIA stock is down 38% over the last year, partly because of a slowdown in the data center business. But that segment's sequential growth last quarter could be signaling a rebound. With artificial intelligence (AI) technologygetting more advanced, NVIDIA is starting to see more companies turn to graphics processing units (GPUs) to power the development of conversational AI, which management believes is an enormous growth opportunity.

The automotive segment contributed 8.1% to the top line last quarter, but that's up from 5.1% a year ago. AI is at the heart of powering the computer behind the wheel in autonomous vehicles. Management credited growing demand for AI cockpit solutions and other self-driving development projects for the 30% year-over-year increase in its automotive business.

Here's a closer look at what drove the results in the data center and automotive segments.

Companies are starting to invest more in AI

In the fiscal fourth quarter of last year, the data center segment suffered a sequential drop in sales. That jolted investors, who were used to seeing consistent growth there, and the stock price plummeted.

But management said that the drop in sales should be attributed to a temporary pause in data center spending while cloud service providers work through excess capacity they previously acquired.

Analysts believe NVIDIA will return to growth in calendar 2020, with the current consensus estimate calling for total revenue to improve by 19.7% next year. In the most recent quarter, data center revenue showed a $21 million sequential increase, which may be an early indicator that the division is already turning the corner. It was the first quarter-over-quarter sales increase since the third quarter of fiscal 2019 (which ended in January).

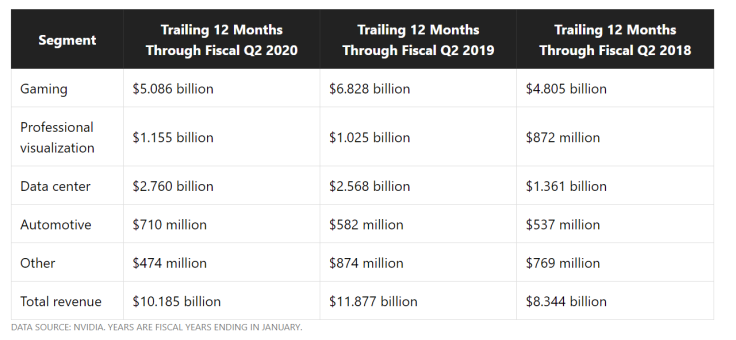

NVIDIA's data center segment has grown significantly over the last three years, as you can see in this table.

Much of that growth was investment by cloud service providers that needed powerful graphics chips to process big data and analytics across thousands of servers. Hyperscale computing, which is used by cloud companies to scale data workloads across many servers, has been the fastest growing segment of the data center market.

The next wave of data center demand is expected to come from enterprise. Companies in retail, automotive, and financial services are developing AI capabilities to create new products and services. Examples include a customer talking to a chatbot to order food from a restaurant, or a financial services firm using AI to detect fraud. A current real-world example is Walmart, which is already using NVIDIA GPUs to forecast sales of products.

To further position itself for the expected demand, NVIDIA announced earlier this summer the EGX accelerated computing platform, which enables companies to perform the types of AI functions needed for real-time data processing in areas like 5G base stations, retail stores, and factories.

The important thing for investors is that the estimated addressable market for enterprise could be just as large as the demand from cloud providers and hyperscale computing. NVIDIA estimates its total addressable market for data center at $50 billion by 2023, with most of that evenly split between hyperscale and enterprise.

NVIDIA could benefit from the e-commerce boom

All the hoopla around self-driving cars seems to have died down over the last year, but they were never expected to be ready before about 2021 anyway. Automakers are still in the development and testing phase, but the 26% jump in sales in NVIDIA's automotive segment last quarter shows that the opportunity is still there.

Recent developments indicate that the automotive segment is still gaining momentum. NVIDIA has been chosen by safety organizations in Europe to formulate standards and regulations for autonomous vehicles. The company has partnerships with several leading automakers, and recently announced a new collaboration with one of its existing partners, Volvo, to develop autonomous trucks using its AI platform for training, simulation, and in-vehicle computing.

The Volvo news highlights an important aspect about the automotive opportunity. NVIDIA is not just providing its AI platform for consumer vehicles, but for industrial transportation, too. This extends its possibilities to the entire $5.1 trillion transportation sector, with an estimated 2 billion total vehicles expected to be on the road by 2035.

Management likes to say that everything that moves could one day be autonomous. One opportunity is the push by e-commerce companies to deliver packages in less than one day. To meet the need for speed, FedEx has been testing robots to improve efficiency in last-mile delivery. It's unknown whether FedEx's delivery bots are powered by NVIDIA technology, but it's clear there is going to be growing demand from different sectors of the economy for the NVIDIA Drive car-computing platform.

One example is the U.S. Postal Service, which has been using trucking start-up TuSimple to handle snail mail between Phoenix and Dallas with autonomous trucks powered by NVIDIA Drive.

The American Trucking Association estimates that the industry is short 50,000 drivers, and it's only going to get worse. So there will be more demand for self-driving computing platforms -- as well as for other AI applications that fuel investment in data centers. And NVIDIA is well positioned to benefit from these trends.

John Ballard owns shares of NVIDIA. The Motley Fool owns shares of and recommends FedEx and NVIDIA. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.