Why Rising Rates Are Super Bullish for Gold and Silver

Heading into 2011, the consensus outlook on precious metals is slightly positive but the consensus believes that higher interest rates will ultimately support the U.S. currency and in turn engender a move out of gold. The gold naysayers are using rising rates as a way to dismiss gold. Let me explain why this belief is not only false but also utterly dangerous.

First and foremost, the parameters have changed in just a few short years. Government debt has increased substantially in the last few years. This debt and the debt of the last 10 years have been serviced at very low interest rates. In fact, it's been serviced at historically low interest rates. When interest rates were higher in the 1990s, the overall debt load was significantly lower. John Hussman explains:

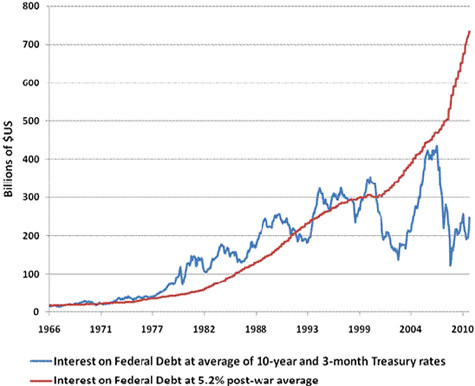

Moreover, in order to adequately evaluate the existing deficit, it is essential to recognize that this figure reflects interest costs that are dramatically less than we can expect as a long-term norm. Consider the chart below. The blue line represents interest on the gross Federal debt at the average of prevailing 10-year Treasury yields and 3-month Treasury yields. Presently, this figure is comfortably low, thanks to the depressed level of interest rates. In contrast, the red line shows what the interest service would be at a 5.2% interest rate, which is the post-war norm.

For debt service costs to skyrocket, interest rates only need to rise marginally. Think about it like this. There is $14 trillion in debt. In theory, every 1% rise in interest rates could equate to an extra $140 billion in interest service costs. Tax revenue in FY10 was $2.38 trillion. Clearly, a continued rise in rates will have a highly inflationary impact. As we've said before, the Fed will have to monetize more because of higher rates and the Fed will have to monetize to keep rates low.

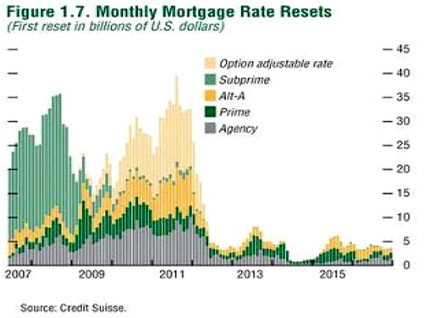

Furthermore, rising rates will certainly have an impact on an economy that is only three years into a de-leveraging cycle. When rates started to rise in the early 1940s, consumers and businesses already endured more than a decade of de-leveraging. Rising rates in 2003-2007 didn't hurt the expansion because consumers were euphoric about housing and willing to borrow. Yet, this time around we are only a few years into the deleveraging cycle and tons of mortgage rate resets are dead ahead.

Simply put, rising rates are a death sentence for an over-indebted nation. It cripples the economy's ability to grow out of its debt burden. Moreover, it leads to default or hyperinflation, which means a doomed currency. Now, we do have a massively huge bond market so I am not suggesting rates are going to spike over a few weeks or a few months. This is something that will happen slowly but the market is already taking notice

Gold is in position to accelerate to new highs, and then higher highs in H111. Gold and silver have already had a great run, but the best may be straight ahead. In our premium service, we are constantly working to find our subscribers the best stocks to profit the trends that lie ahead of us. If this interests you then we suggest you consider a free 14-day trial to our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Jordan@TheDailyGold.com.

© Copyright IBTimes 2024. All rights reserved.