Will Bitcoin Go Back Up? February Price Predictions From Experts

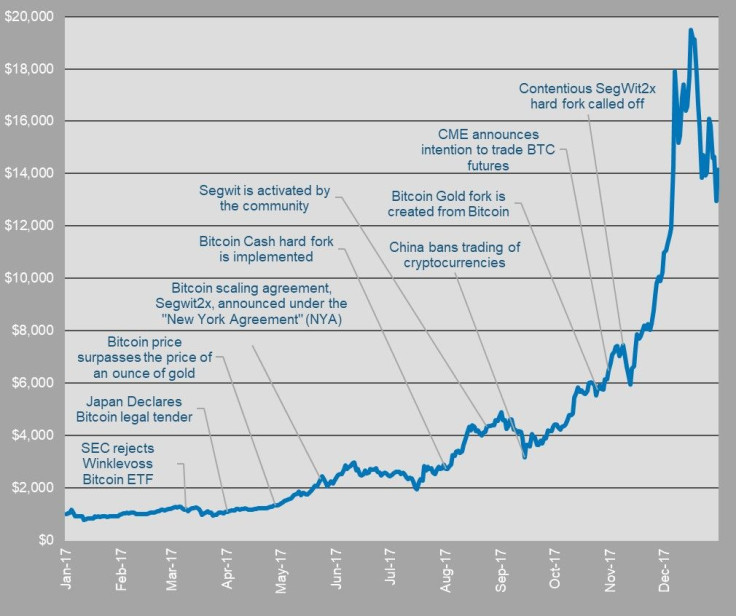

Bitcoin prices dropped dramatically over the past week, down 10 percent to an average of $10,019 by Wednesday morning, according to OnChainFX. Even though bitcoin’s overall monetary grew 900 percent during the past 12 months, up from around $956 on Jan. 31 last year, such dramatic fluctuation still makes speculators and analysts uneasy.

Several factors played into the recent dip, including a scandal related to Tether’s dollar-pegged cryptocurrency USDT, which some analysts believe was used to purchase bitcoin and artificially inflate bitcoin’s price. In late January, one anonymous USDT report estimated bitcoin’s price would have been closer to $2,000 without such manipulation. Although such claims should be taken with ample salt, a 2017 report by Digital Asset Research estimated bitcoin’s real value would be closer to $2,074 in 2018.

“That number represents the bricks and mortar use cases, times the market share percentage, plus each of those use cases time their market share,” Matthew Gertler, senior analyst at Digital Asset Research, told International Business Times. “This is looking at bitcoin as a service, basically, as a product… this is an academic exercise... it’s hard to say these numbers could be really relied on.” It’s also important to note this academic model does not factor in bitcoin’s primary use case as a store of value. This modelling was similar to how economists evaluate companies, not currencies or assets like gold.

Most bitcoin enthusiasts believe market prices are actually the least interesting data point about this cryptocurrency. Many users “hodl,” or store their cryptocurrency as a long-term investment they don’t plan to touch for many years. On the other hand, many cryptocurrency traders now make their living by leveraging short-term volatility. They often find traditional market factors don’t apply to cryptocurrency.

“A lot of the cryptocurrencies are correlated amongst themselves. But in terms of other traditional, existing markets, it doesn’t really track them [digital currencies],” Gertler said. Regulation, media trends, lawsuits and new investment products such as bitcoin futures all impact bitcoin’s speculative market price. Even Twitter feuds and arguments on Reddit can impact public perception of this emerging asset class. Cryptocurrency exchanges in some countries, such as South Korea and Zimbabwe, routinely sell bitcoin for 10 to 50 percent more than average global prices because local demand is so high.

“There is correlation between transaction volume in Korea and different cryptocurrencies,” Gertler said. “You were able to look at Korean trading volume being a market indicator for future price increase. It’s definitely less so now, so it is unclear if that still holds.”

Wall Street veteran and cryptocurrency investor Jill Carlson told IBT market microstructures influence bitcoin’s price volatility. “It’s very immature, so you have a very global market and yet a very fragmented market,” Carlson said. “You’ll get huge dislocation in price from exchange to exchange. There aren’t really good ways of arbitraging those out.”

IBT conducted a poll from Jan. 25-30 of more than a dozen finance experts to get their end of February 2018 bitcoin forecast. Their average bitcoin price prediction stands at $13,000.

Kumesh Aroomoogan, CEO of the stock market analytics startup Accern, told IBT he expects bitcoin will sell for just under $10,000 by the end of February. It's impossible to say how global politics, such as American tax laws or Chinese regulations regarding bitcoin miners, will impact the market. “There are a lot of negative news and uncertainty in the market right now about bitcoin,” Aroomoogan said. “Fear plays a big part in driving price down and with all the negative news, people may get worried and pull out.”

Many speculators see price drops or stagnation as a sign that the dreaded "bitcoin bubble" is about to pop. However, cryptocurrency veterans often see the hype settling down as a positive indicator that several more years of growth lie ahead. “I think careful growth is the most important thing,” Carlson said. “Sometimes slow growth can be a very healthy thing for development.” The progress of scaling solutions such as the Lightning Network, which would boost the amount of transactions the network can handle at once while lowering fees and improving settlement times, could boost the network’s overall value.

Bitcoin is a relatively young technology, less than a decade old. It is steadily moving towards mainstream adoption. Yet the bitcoin network still makes up a miniscule fraction of the economy. Few experts would recommend people with scant expendable income invest exclusively or heavily in bitcoin. Price predictions can offer an interesting intellectual exercise as long as speculators remember literally anything can happen in these uncharted waters. “I think trying to make micro predictions about price is very challenging,” Carlson said. “All signs point to the market being completely erratic right now.”

IBT fellow Daniel Robitzski contributed to this report.

Editor’s note: This is not investment advice. Cryptocurrency is a risky type of digital asset and no one should invest more in bitcoin than they can afford to lose.

© Copyright IBTimes 2024. All rights reserved.