Will Retail Auto Sales Margins Shrink As More Consumers Buy Smaller, Less-Profitable Cars? Will There Be Fewer Car Dealerships By 2020?

There’s no question the U.S. auto market is rebounding. Total sales have risen 50 percent since the peak of the automotive industry crisis in 2009, to about 15.6 million units last year. This year, total passenger car and light vehicles sales are expected rise between 3 percent and 6 percent, according to the latest estimate from General Motors Co. (NYSE:GM).

But according to a report releases Tuesday, the retail auto market is changing in such ways that dealerships might begin to feel a real pinch on pretax profits if the current number of dealerships remains the same.

"We believe – contrary to popular opinion – that things are not as positive as they seem," says Thomas F. Wendt, partner in the North American automotive practice at Roland Berger Strategy Consultants, a Munich-based global consulting firm. "In our view, the massive consolidation of the recent past was not the end, but the beginning of the change needed for dealers to maintain healthy profit levels and for OEMs to transform their distribution networks."

This transformation basically means that, according to the report, the given current auto-retail pretax profit margin of 2.2 percent some significant consolidation will have to take place. Such consolidation would reduce the number of independent dealers and increase the number of dealership networks. In other words: fewer dealerships and more dealership chains.

The National Automotive Dealers Association estimates that 2013 pretax profit margins will be flat compared to the previous year, at 2.2 percent. That’s down slightly from 2.3 percent in 2011 but up from 1 percent in 2008 when dealers had to slash prices to lure consumers in a year that ended with the U.S. entering an 18-month economic recession. (Margins actually ticked up to 1.5 percent during the recession.)

This is good news for a retail operation where margins are typically paper thin, but Roland Berger says the bounce back may be temporary thanks to the following factors: - Consumers are gravitating toward smaller cars, which are less profitable thank luxury cars, SUVs and pickup trucks.

- Service and after-sale revenue, the money dealers make from maintenance services, as independent mechanics continue to take market share

- The internet is creating a smaller automotive marketplace and consumers have more car-hunting tools at their disposal. More dealers are competing with each other in this climate.

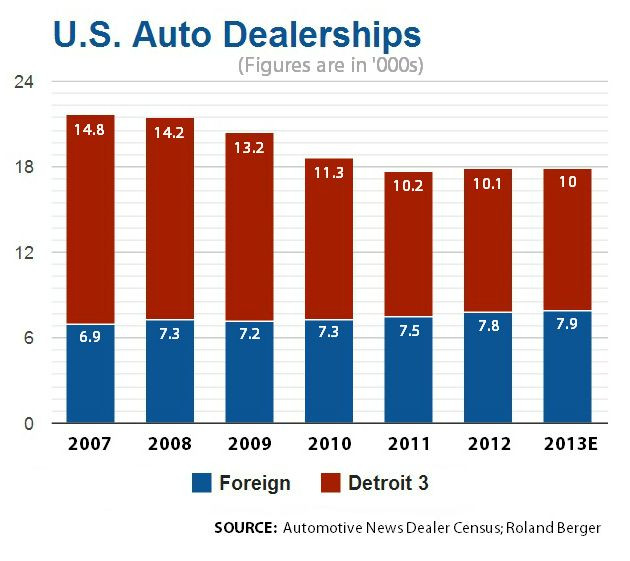

There are already about 18 percent fewer dealerships than there were before the 18-month recession that kicked off in December 2007, thanks largely to the steep cuts made to Detroit 3 dealership franchises amid a crisis that sent GM and Chrysler into Chapter 11 reorganization.

But Roland Berger suggests these factors could force more shutdowns and consolidations in the U.S. automotive dealer’s market. As many as about 22 percent of dealerships are at risk, it says, that could cost about 200,000 jobs over the next six years.

© Copyright IBTimes 2024. All rights reserved.