Worldwide Demand For Crude Oil Will Dwindle In Coming Decades As Nations Produce Cheaper Natural Gas: Citigroup Claims

Citigroup Inc. (NYSE: C) projects that oil demand will plateau by the end of the decade based on current figures that show a growing disparity in price. Citigroup's latest report projects that prices for natural gas will remain low for the decades ahead as major energy consumers are demanding natural gas at increasing levels -- causing demand for conventional fuel to level off.

"By the end of the decade Brent prices are likely to hover within a range of $80-90 per barrel," the study claims.

The report titled "Global Oil Demand Growth – The End Is Nigh," cites Energy Information Administration figures that say a barrel of oil is about four times more expensive than the comparable amount of energy in natural gas.

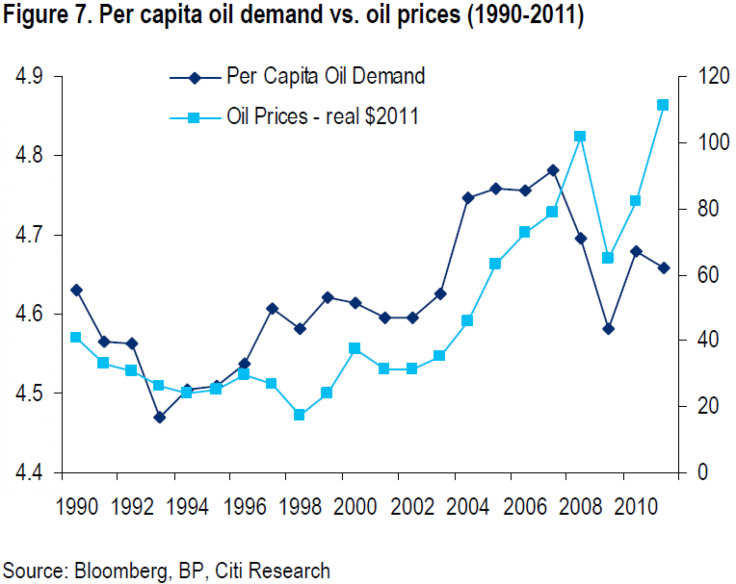

"Oil demand growth may be topping out much sooner than the market expects," says Citi's Seth Kleinman and his five research partners. "Despite the tepid emergence out of a global recession, per capita oil demand remains off its highs."

Mandates to improve fuel economy for new vehicles changed fuel efficiency, according to Kleinman, and likely caused the lowered per capita consumption trend.

Citi's report also compares international players. The U.S. produces compressed natural gas (CNG) and liquid natural gas (LNG) domestically for an increasing number of corporate and public-transit fleets. Even BNSF Railway Co., a unit of Warren Buffett's Berkshire Hathaway Inc. (NYSE: BRK.A), said in March that it will operate six LNG engines in 2013. Yet natural gas is also becoming available in economies outside of the United States.

"By end-2010, more than 80 cities in China had more than 1,000 CNG/LNG filling stations," says Kleinman, "and another 1,000 are planned for construction."

China operates more than 40,000 LNG trucks and the government is planning a network of natural gas refueling stations for trucks as well as passenger cars. Canada, Russia and India are also testing LNG-powered locomotives.

© Copyright IBTimes 2024. All rights reserved.