Wysh Leads New Frontier of Embedded Life Insurance with Partnership with UNest

A continuous wave of new "embedded finance" technologies means that, several years from now, the life insurance industry won't look very much like it does today. More and more, the customer journey on the way to buying a life insurance policy takes place digitally, in the context of pivotal life events and transactions such as buying a baby crib or opening a college savings plan.

As an innovator and industry disruptor, Wysh, a "digital-first" life insurance company founded in 2021, recently formed a partnership with UNest, the provider of an online family savings and investment platform. Through the partnership, account holder's will receive life insurance protection as a percentage of their savings invested. The collaboration between Wysh and UNest represents a perfect example of the buildingtrend toward integrated financial services using embedded fintech.

Integrating an insurance purchase into the sale of a complementary product is "at the core of the embedded concept," according to Bryan Padgette, a senior vice president at Sureify, which helps insurance companies integrate their sales and support services. "The basic premise is to find relevant places to offer life insurance... and then partner with the companies and platforms that offer such purchases to create a simple, digital offering at the point of sale," Padgette added.

Tapping Pent-Up Demand

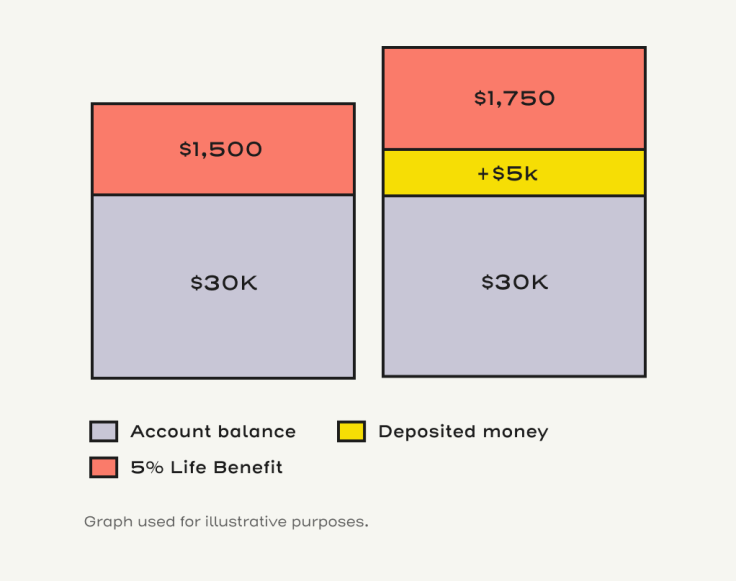

According to Alexander Matjanec, the founder of Wysh, younger customers are increasingly concerned with protection strategies as they start to focus on becoming financially independent. The option to add a layer of life insurance coverage to their savings accounts on UNest feeds right into this pent-up market demand, he said.

"There are over 106 million people in America with no or insufficient life insurance," Matjanec said. "However, based on surveys, the vast majority of them say they'd open a new bank account if the institution offered a life insurance benefit worth 5-10 percent of their account balance."

Matjanec previously co-founded the banking comparison website MyBankTracker. His latest venture Wysh (www.wysh.com), offers life insurance directly through an intuitive online portal that emphasizes seamless convenience and a high level of customer service.

The company's customer support team, known as Wysh Granters, are highly specialized at assisting policyholders to leave personalized legacies through their "Wyshes" for loved ones -- everything from paying off a large debt such as a home mortgage, to ensuring that a beloved pet enjoys a secure and nurturing home after her master's death.

The Wysh Granters also help navigate any potential hassles that a policyholder's beneficiaries might experience as they work through settling the deceased policyholder's personal and financial affairs, while simultaneously grieving the death of a close friend or family member.

Future Market Share Winners

In terms of overall market size, embedded finance is estimated to be a $230 billion market by 2025, of which over $70 billion is in insurance alone. Given the large protection gap that exists for more than a hundred million Americans, "insurers have a tremendous opportunity to meet customers where they are (e.g., retailers, telcos, and marketplaces) en masse with data-driven, tailored, frictionless offers," according to Hans Tung, a managing partner of GGV Capital, which focuses on early-stage digital economy investments.

Wysh is a perfect case in point. The company is upgrading and bringing digital innovation to the traditional life insurance customer experience, which typically entails tedious paperwork and long phone calls. Instead, Wysh offers what Matjanec describes as "a 100% digital, frictionless application process. Our claims process also aims to be as stress- and anxiety-free as possible."

Financial services companies that drag their feet and resist creating alternative customer journey experiences, relying instead on the "same old bland" approaches from the past, will do so at the peril of their market share, he says.

Tung's assessment of the stakes aligns with that of Matjanec. "The market cap of publicly traded fintech companies accounts for $650 billion, which is approximately 5% of the $14 trillion market cap of public financial services companies," Tung said. "We believe that new fintech innovators will emerge to take a larger slice of this pie."