Xiaomi Loses Title Of China's Top Smartphone Company To Huawei As It Considers US Expansion

LONDON -- Xiaomi has been unseated as the top smartphone maker in China by Huawei, but the company's co-founder says it is considering expanding into the lucrative U.S. market but won't be drawn on when this might take place.

Huawei, the world's third biggest smartphone maker, has topped the Chinese list for the first time in its history as it saw shipments rise by 81 percent year-on-year, according to figures from research company Canalys for the third quarter of 2015. Xiaomi on the other hand saw shipments contract year-on-year as it failed to sustain the rapid growth it has experienced in recent years.

"Huawei’s ascent to China’s smart phone throne is a remarkable feat, especially in the context of an increasingly cutthroat and maturing Chinese smart phone market," said Canalys analyst Jessie Ding. "On the other hand, Xiaomi, with its worldwide target of 80 million smartphone shipments for 2015, is under tremendous pressure to keep growing as an international player as it is slowing down in its key home market."

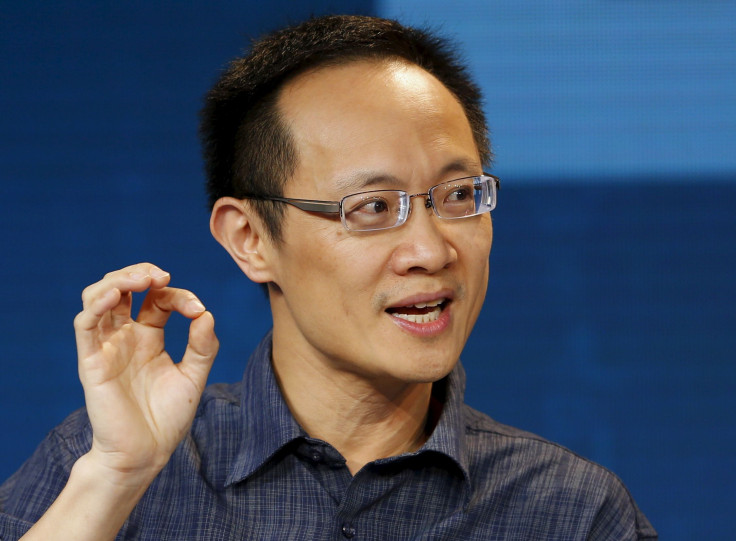

Xiaomi's decline will be worrying for a company that only sells its smartphones in a very limited number of countries, with China as its key marketplace. Bin Lin, the company's co-founder and president, spoke Wednesday about the possibility of an expansion into the U.S. market, and said the company was "considering" it but would not say when.

"Incredible Amount Of Work"

Xiaomi has previously said such an expansion would not happen in 2015 or 2016, with the company focusing on launching its smartphones in other countries, including the recent launch in Brazil and an expected launch in Russia.

At the launch of the company's online store in the U.S. in February -- where customers can buy accessories like power banks and headphones -- Hugo Barra, the former Android chief who heads up global development for the Chinese company, said getting its smartphones and tablets cleared for sale in the U.S. would require an "incredible amount of work" and for now launching them in the country "is not in our plans."

Speaking at the WSJDLive conference in California Wednesday, Lin addressed the common complaint that Xiaomi copied the look and feel of Apple's iPhone, when specifically asked about the uncanny similarity between some of Xiaomi's app logos and the ones found on Apple's devices.

"For every really tiny similarities between us and Apple, I can probably point out 100 differences between our phone experience and other companies," Lin said, mentioning features like call recording, spam-call filtering, gender-specific beauty mode and soft SIM technology, which other companies don't offer.

Xiaomi, Lin said, saw itself not as a smartphone company, but as an Internet company where its smartphones are at the center of everything. "We want to be called an Internet company. We sell all these products online directly to consumers on our website and we are really focusing on building out smartphones to begin with as the center of all these devices that we launch."

Xiaomi's growing portfolio of other products grew again this week with the launch of a 60-inch 4K smart TV that costs under $800, and a self-balancing scooter -- a product of its investment in Ninebot, which earlier this year purchased Segway. Xiaomi also sells air purifiers, tablets, headphones, power banks, routers, fitness trackers, blood pressure monitors, weighing scales, light bulbs and action cameras.

Decent Revenue

Lin said that the company currently has 130 million active users across all its devices and is making "decent revenue" but most of its profits don't come from hardware, but from selling Internet services, including sales of content through its stores on its MIUI smartphone software.

Xiaomi also offers services like messaging and cloud storage, and more recently began offering financial services, such as access to the stock markets. The company also launched its own mobile phone network in China, which Lin says is proving to be very popular.

Lin said that in five years' time, revenue from "Internet services and content would be much bigger with much higher profit margins,” adding that the profit margin on a typical Internet service could be up to 70 percent.

© Copyright IBTimes 2024. All rights reserved.