Yellen Signals US Corporate Tax Hike, Powell Again Downplays Inflation

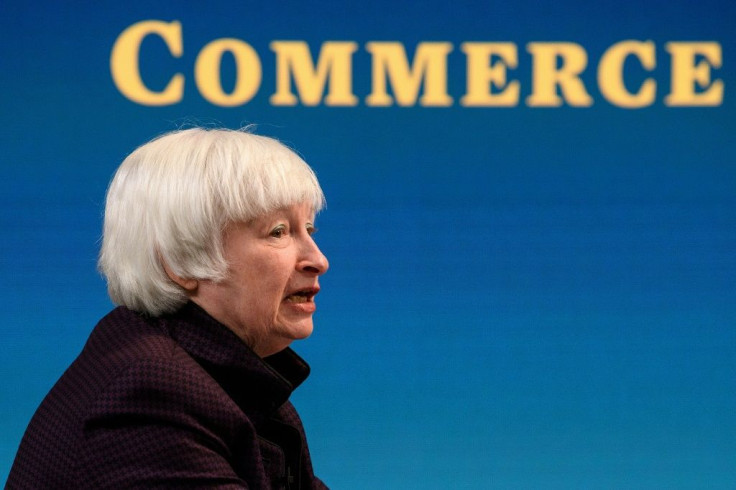

US Treasury Secretary Janet Yellen on Tuesday signaled that President Joe Biden is willing to hike corporate taxes to pay for his administration's priorities, while Fed Chair Jerome Powell again downplayed fears that inflation would spike as the economy healed from the Covid-19 pandemic.

The comments from Yellen come as Washington lawmakers prepare for Biden's next move after Congress passed his $1.9 trillion American Rescue Plan earlier this month, a massive injection of spending intended to support businesses and workers in the world's largest economy, hard-hit by the pandemic.

Biden has vowed to soon propose a huge infrastructure package that will help the United States create jobs and fight climate change, but he is under pressure to offset the costs of what are reported to be two pricey bills.

In testimony for the House Financial Services Committee, Yellen indicated that the White House would propose raising the corporate tax rate to 28 percent, and find ways to get US corporations to move more of their business into the United States.

"I think a package that consists of investments in people, investments in infrastructure, will help to create good jobs in the American economy and changes in the tax structure will help to pay for those programs," Yellen said.

"We've had a global race to the bottom in corporate taxation and we hope to put an end to that."

US media reported on Monday that Biden is considering spending $3 trillion on infrastructure in the United States, which would be split into two bills, although the White House disputed those reports.

Any new measures could face tough odds in Congress, where Democrats hold a thin margin in the House and are evenly split with Republicans in the Senate. They relied on a special parliamentary tactic to get the American Rescue Plan through the upper chamber.

The bill was the third major package passed by the United States after the pandemic slammed the economy in March 2020, causing tens of millions of job losses and a sharp downturn in economic growth.

Unemployment has declined in the months since and GDP growth is expected to rebound this year.

That recovery, along with the American Rescue Plan and a $900 billion relief measure passed in December, has led stock markets and some economists to worry the strengthening economy will push prices up, leading the Fed to raise interest rates from their zero level sooner than expected.

In testimony before the committee, Powell acknowledged that prices, which have remained muted throughout the downturn, could increase, but he said any spike would be temporary.

"We do expect that inflation will move up over the course of this year," said the central bank chief, noting that this would be partly due to major economic sectors recovering from the deep slumps of March and April 2020, when business restrictions to stop Covid-19 were at their most intense.

"Our best view is that these effects on inflation will be neither particularly large nor persistent."

The rock-bottom rates are seen as one reason why Wall Street has boomed even amid the wider malaise of the pandemic.

The Fed last year also released a new inflation targeting policy that would see it keep rates low until inflation hits 2.0 percent and stays there, in a bid to maximize employment.

© Copyright AFP 2024. All rights reserved.