Activision Blows Up, Take-Two Fizzles as Video Game Makers Report Quarterly Results

Shares of Both Video Game Makers Highly Active in After-Hours Trading

Activision Blizzard, Inc. (NASDAQ:ATVI) and Take-Two Interactive (NASDAQ:TTWO) both beat Wall Street consensus Tuesday, as the companies each reported better-than-expected sales for the current quarter.

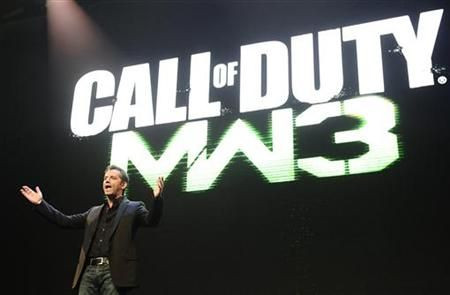

However, the similarities between the companies' results end there: while Activision handily beat consensus expectations and significantly raised future earnings views based on high demand for the latest installment of its Call of Duty war simulation game, Take-Two sharply cut expectations for the next quarter, citing how the NBA lockout will dampen interest in the newest edition of its NBA2K series.

Activision reported earnings of seven cents per share, handily beating consensus expectations of two cents a share. Take-Two reported a loss of 57 cents per share, in line with Wall Street's view.

Both companies reported revenue over market expectations: Activision's sales were $627 million, compared with an analyst consensus of $558 million; Take-Two, on the backs of its strong catalog of previously released titles, sold $107 million, considerably more than market expectations of $83 million. Activision's had net earnings of $148 million; Take-Two's net loss amounted to $47 million.

Year-over-year comparisons, while provided by the companies, are not particularly useful when analyzing the performance of video game companies as their business model is neither seasonal not cyclical, but rather depends on the sales performance of specific video game titles.

We continue to strengthen our position as the worldwide leader in interactive entertainment and the broadening of our audiences is confirmation that games are becoming as important as film and television as a mass-market form of entertainment, said Robert Kotick, Chief Executive Officer of Activision Blizzard.

Investor sentiment for Activision, which reached a three-year high of $14.31 early Tuesday before retreating to less heady levels, has been highly bullish. A trader on Tuesday bid 62 cents for 5,000 $14-put contracts expiring December 14. The trade is a bet that Activision's share prices will rise over $14.62 by that day.

Among other things, investors have been encouraged by high interest in Activision's Call of Duty: Modern Warfare 3, which many analysts expect will significantly break previous sales records. As of Tuesday, when it went on sale, Amazon reported it was the video game with the highest number of pre-orders the online retailer had ever sold. Calling the game perhaps the most anticipated video game in history, Activision added to that encouragement, revising earnings per share expectations for the fiscal year to 76 cents, eight cents higher than previous estimates. Revenue projections were revised to $4.33 billion, from $4.18 billion.

Market pressures have not been as kind to Take-Two: the stock has been battered over the past two days. While the company's earnings were promising in the sense that they showed strong results from previously released titles and a diversification into the ever-more-important mobile platform sector, the projected profit for the next quarter is sure to disappoint the Street. The company said it expects profits of between 20 and 30 cents per share, which compare unfavorably to analyst projections of 34 cents a share.

In an interview with The Dow Jones Newswires, Take-Two's Chief Executive Strauss Zelnick said sales of the newest NBA2K title had been trending a little bit lower than we would've liked due to the NBA's current lockout.

Finally, the company probably did its shareholders the largest disservice with three letters: TBA. That was what the company noted as the release date for the fifth installment of its hugely popular Grand Theft Auto game. Earlier in the week, shares of the company had soared on rumors new details about the game were forthcoming.

Shares of Activision Blizzard swung wildly in after-hours trading, gaining over 3 percent in price before retreating to a loss. They were last going for $13.49, down 44 cents, or 3.16 percent from the close.

Shares of Take-Two Interactive last traded at $15.30, down 36 cents or 2.3 percent from the close.

© Copyright IBTimes 2024. All rights reserved.