Adbusters: Occupy Wall Street Movement Should Demand 1% 'Robin Hood Tax'

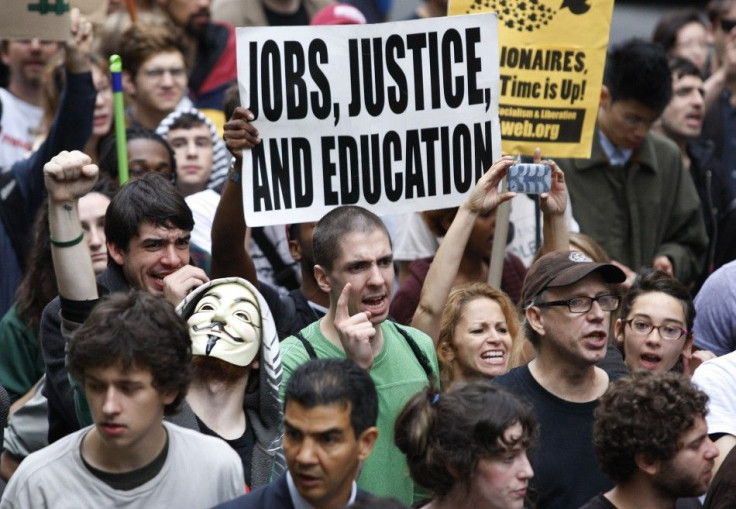

Adbusters, the left-leaning Canadian magazine responsible for igniting the Occupy Wall Street protests, is encouraging the international movement to define one ultimate demand -- a 1 percent tax on all financial transactions and currency trades, better known as a Robin Hood tax.

In an entry posted to the magazine's blog on Monday, Adbusters asked the movement's general assemblies to stand together on Oct. 29, the eve of the G20 Leaders Summit in France, to rise up and demand that the world's G20 leaders immediately impose the so-called Robin Hood tax.

Let's send them a clear message: We want you to slow down some of that $1.3-trillion easy money that's sloshing around the global casino each day -- enough cash to fund every social program and environmental initiative in the world, states the blog post.

1% Tax on Financial Transactions: The First OWS Demand?

While pundits and politicians have complained that the Occupy Wall Street movement is doomed to fail since it does not specify a solid set of demands, Adbusters actually explained the need for a demand in its original call to action, which was printed in the magazine's July issue.

In the appeal introducing the very idea of the protests, Adbusters wrote that part of the reason that the protests in Egypt were so successful was because the people of Egypt made a straightforward ultimatum -- that Mubarak must go -- over and over again until they won. Following this model, what is our equally uncomplicated demand?

In an Oct. 4 interview with Salon, Adbusters co-founder and Editor-in-Chief Kalle Lasn said that while the leaderless, demandless movement was fine the way it is, she added that when demands eventually emerged they would likely be specific things like reinstatement of the Glass-Steagall Act or a 1 percent tax on financial transactions or the banning of high-frequency trading.

The Robin Hood tax could potentially generate hundreds of millions of dollars by imposing a small tax on financial transactions involving shares, bonds and derivatives, according to the Robin Hood Tax Web site. The idea has been highly publicized in the U.K. and European Union; supporters of the initiative include President Nicolas Sarkozy of France, Chancellor Angela Merkel of Germany, Warren Buffet and Nobel Prize-winning economists Joseph Stiglitz and Paul Krugman.

The following is a video produced by The Robin Hood Tax coalition that explains how the tax could work:

© Copyright IBTimes 2024. All rights reserved.