Airline Executives See Blue Skies In 2014: More Passengers And Cargo Plus Lower Costs Leading To Higher Profits

Airline business leaders expect more demand for passenger travel over the next 12 months and a smaller increase in cargo travel that will boost profits well into 2014, according to an industry survey. Further, survey respondents expect higher profits for the next four quarters.

Sixty-three percent of airline chief financial officers and heads of cargo operations who responded to the International Air Transport Association quarterly survey, which was released Thursday, said they anticipate improved profitability over the next 12 months.

"The positive outlook has been broadly stable since the April survey, with anywhere from 63 percent to 73 percent of respondents expecting profits to improve over the coming 12 months," IATA said.

One reason for improved profits is lower costs. The survey respondents said that in the third quarter they booked lower input costs, which include fuel and compensation, due to better cost management that offset increases in jet fuel prices. Input costs are expected to continue declining, the survey respondents said.

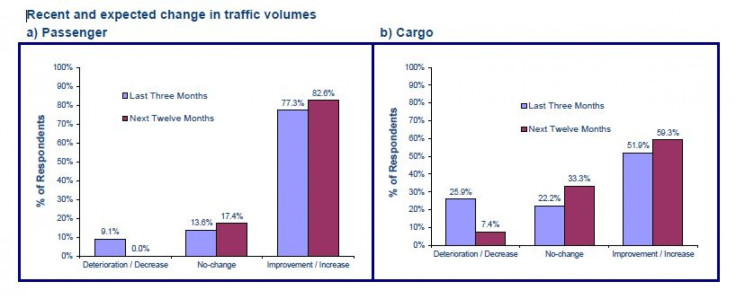

The survey also found an upbeat view of demand.

"The proportion of survey respondents expecting a rise in traffic volumes is a significant 83 percent, well above the share in July of 62 percent," IATA said. "These developments are consistent with improvements in key demand drivers over recent months, with increases in business confidence and exports orders suggesting a more supportive demand environment for air transport in the months ahead."

One effect of the strong outlook is an expectation that airline employment, which has picked up in the past three months, will continue rising.

If expectations for next year prove accurate, the industry will extend its recent upturn. In 2012 revenue passenger-miles (the number of passengers carried multiplied by the number of miles flown) grew 0.6 percent, according to S&P. From January to May 2013, revenue passenger-miles increased 0.9 percent.

S&P analysts believe airline executives have finally learned that they must be disciplined on capacity so they can price their service in a way that generates a sustainable return.

The credit ratings agency said consolidation has also improved the industry's outlook. Several deals — Delta Air Lines (NYSE: DAL) and Northwest Airlines Corp. in 2008, parent of United Airlines UAL Corp. (NYSE:UAL) and Continental Airlines Inc. in 2010, and AirTran Holdings Inc. and Southwest Airlines Co. (NYSE:LUV) in May 2011 — have reduced the number of competitors and allowed airlines to reduce capacity and increase fares. US Airways Group Inc. (NYSE:LCC) and American Airlines proposed a merger in February 2013 but are facing a lawsuit.

"The U.S. airline industry has fewer competitors and less capacity chasing customers, which should help the industry to be more disciplined on capacity so airlines can price their product in a way that generates a sustainable return on invested capital," S&P said in a recent report.

"Recent capacity cuts and capacity restraint, even in the face of improving demand, are positive trends that the elimination of several competitors should only improve. As a result, S&P expects the supply-demand equation to continue to shift in favor of the airlines. We think U.S. consumers are likely to face higher airfares over the next couple of years, though fare sales during periods of seasonal weakness will probably continue. On an inflation-adjusted basis, air travel is still extremely cheap, particularly when accounting for the increase in oil prices over the past five years. However, we think airfares are likely to continue to head higher."

© Copyright IBTimes 2024. All rights reserved.

Join the Discussion