Alibaba Unveils Plan To Challenge Amazon, Microsoft, IBM In US Cloud Market

Alibaba Group has opened a Silicon Valley data center, from which it will sell cloud computing services to a broad range of commercial customers. The surprise move, announced Wednesday, is the Chinese e-commerce giant’s first major foray into North America, and signals ambitions that could ultimately put it into direct competition with major U.S. Web players like Amazon, Google and Facebook.

“For the time being, we are just testing the water,” said Sicheng Yu, head of international business for Aliyun, an Alibaba subsidiary that will operate the center. Aliyun is China’s largest cloud provider. “We know well what Chinese clients need, and now it’s time for us to learn what U.S. clients need,” said Yu, in a blog post.

Alibaba said it plans to offer several cloud services at the outset, including data storage and analytics, and computing power on demand. Such offerings, currently available from Amazon Web Services (AWS), IBM, Microsoft and several others, let businesses run their applications on Web-based computing resources, allowing them to save on hardware, IT staff and maintenance costs.

The market for cloud services is expected to grow at 30 percent annually through 2018, according to a study by Goldman Sachs.

Alibaba is being tightlipped about the details. It has not divulged the exact location of the data center, its staff complement, or whether it has any customers yet.

The commercial cloud could be profitable in its own right for Alibaba, which needs to justify a stock market valuation north of $200 billion.

The market is booming. Amazon said AWS usage grew 90 percent year-over-year in the fourth quarter. AWS sells online access to servers and storage systems at prices that start at less than one cent per hour. Microsoft sells similar services through its Azure cloud, while IBM pitches its SoftLayer Cloud to midsized businesses and large enterprises. IBM announced Wednesday that its SoftLayer data centers will add the latest OpenPower technology as a hardware option.

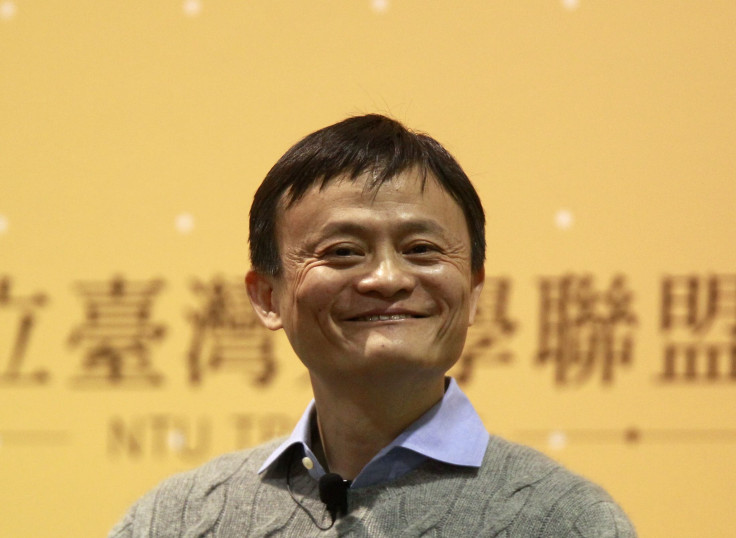

Commercial services could be just the beginning of Alibaba’s cloud plans for the U.S. Given the capital-intensive nature of the data center business, CEO Jack Ma may look to get the most from his investment by offering services to consumers as well.

“You can use your cloud infrastructure to deliver video streaming and content and also as an enabling technology for mobile devices,” Gartner Research VP Ray Valdes told International Business Times. That could put Alibaba into competition with a wide range of players, from Google’s YouTube unit to Facebook’s Instagram messenger.

If Alibaba chooses to focus on content, it might even find itself up against streaming services like the new HBO Now service, which was revealed exclusively by IBTimes Wednesday. It could also introduce its AliPay mobile wallet to the U.S., which would compete with Apple Pay.

Alibaba’s effort to break into the U.S. cloud market won’t be without challenges. In addition to taking on well-established, cash-rich competitors, it will need to overcome the perception that it is closely tied to a Chinese government known to use tech to spy on U.S. companies and government agencies.

But Alibaba could point to similar concerns about its U.S. rivals. Among other things, NSA leaker Edward Snowden revealed that the National Security Agency put backdoors into U.S.-made hardware, including goods made by Cisco. And Gartner’s Valdes noted that Google has its private 747s parked at NASA Ames Research Center’s Moffet field. “I don’t think Alibaba has its private planes parked at a military base.”

Alibaba representatives did not immediately respond to a request for more details. Alibaba shares closed up 4.79 percent Wednesday, at $85.49.

© Copyright IBTimes 2024. All rights reserved.