Allen Stanford Had Secret Swiss Account for Bribe Payments, Yacht Costs: Witness

Texas financier Allen Stanford drew on a secret Swiss bank account to pay bribes and for personal expenses such as yacht maintenance, the government's top witness said at Stanford's fraud trial on Friday.

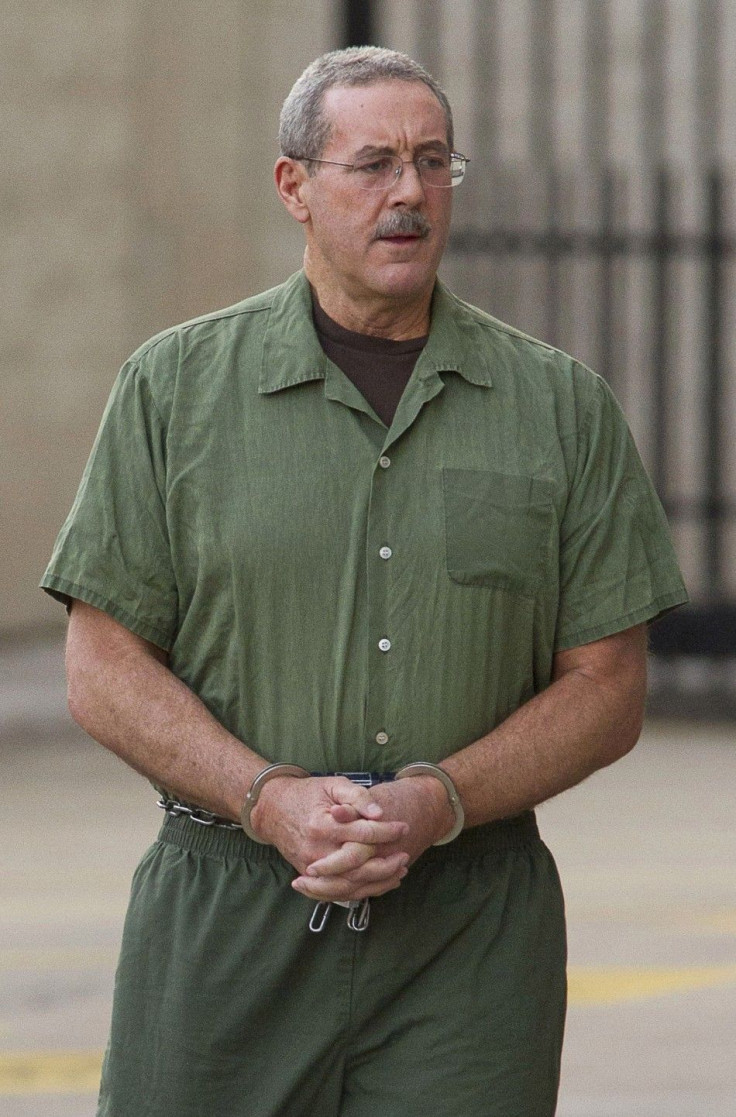

Stanford, 61, is accused of bilking thousands of investors out of their savings by selling fraudulent certificates of deposit through his bank in the Caribbean. Prosecutors say the $7 billion Ponzi scheme is one of the biggest white-collar crimes since Bernard Madoff's scam. Stanford has pleaded not guilty to all charges.

The monies flowed from Stanford International Bank CDs to this slush account at SocGen, former Stanford Chief Financial Officer James Davis told jurors. It was a slush fund.

Davis, 63, said Societe Generale account number 108731 was known only to himself and to Stanford. Stanford tapped the account regularly for millions of dollars at a time to pay for expenses such as those associated with the maintenance of his fleet of private jets and his 100-foot yacht, the Sea Eagle.

As Davis testified, Stanford sat, head down, taking notes.

Davis is the only person among those charged in the alleged Ponzi scheme who has pleaded guilty. He is the government's star witness.

Prosecutors accuse Stanford of misleading investors by telling them CD proceeds were invested in safe financial instruments such as blue-chip stocks and bonds. Instead, Stanford used funds for illiquid investments such as Caribbean real estate and start-up companies starved for capital, prosecutors said.

Asked why Stanford deposited funds from the Swiss account into an account in Antigua, Davis said it was partly to pay bribes to Leroy King, a regulator in Antigua, where Stanford's bank was based. He said that, for one purpose, it was to pull cash out to pay bribes to the regulators, Lee King, Davis said.

Stanford's former top deputy told the jury he never witnessed a bribe taking place, but said King was paid $10,000 to $15,000 at least once a quarter. He also received tickets to two of the National Football League's Super Bowls.

Stanford's influence did not stop there, Davis said.

When the U.S. Securities and Exchange Commission launched an investigation into the offshore bank in 2005, the U.S. agency requested cooperation from King. They received none, and Stanford's general counsel actually drafted King's response to the SEC, the executive testified.

Beginning in 2002, funds from the Swiss account were also used for frequent bribes to Stanford's outside auditor based in Antigua, Davis said.

Stanford knew of the bribes and dictated the amounts, David told the jury.

Davis also testified that profit figures attributed to the bank's operations and reported to investors were made up by Davis and approved by Stanford.

Did Mr. Stanford know the profit was a fake? asked federal prosecutor William Stellmach.

Yes, he did, Davis replied.

Davis testified that the bank always reported an annual profit on paper, but never actually made a profit.

When asked why the bank needed to show a profit in annual reports distributed to investors, Davis said: Mr. Stanford said if there was no profit, you could not sell a CD based on a bank that was losing money.

The profit had be reasonable, Davis said, based on global financial conditions.

My instructions were clear from the beginning: We report a profit, Davis said.

Davis also testified about numerous promissory notes totaling hundreds of millions of dollars that Stanford created to show that money he was taking from the bank would be considered loans, rather than income, on the advice of a tax consultant.

Officials at the bank were unaware of the promissory notes, which were not disclosed in annual reports to investors, Davis said.

And Stanford never repaid the notes, Davis testified.

(Reporting by Anna Driver; Editing by Eddie Evans, Richard Chang and Andre Grenon)

© Copyright Thomson Reuters 2024. All rights reserved.