Americans Abroad Can’t Bank Smoothly As FATCA Tax Evasion Reform Comes Into Play

This story was updated at 3pm on December 20, 2013, to reflect comments from Rep. Maloney and others.

Overseas Americans have a tough time opening new bank accounts or have seen existing accounts abruptly closed, ahead of U.S. Treasury reform tackling tax evasion, according to advocates and lawmakers.

The Foreign Account Tax Compliance Act (FATCA) legislation enacted in 2010 requires foreign financial institutions, including hundreds of thousands of banks, hedge funds and insurance companies, to report on offshore accounts held by U.S. clients. Reforms are being officially implemented this year and in coming years.

But the burdens of complying with the complex law, and steep financial penalties for noncompliance, have led some banks to turn away U.S. clients, according to nonprofit advocacy American Citizens Abroad.

“Many banks, regardless of inter-governmental agreements…seem to be taking a decision that it’s just easier not to provide service to American clients,” ACA executive director Marylouise Serrato told International Business Times.

“Definitely in the last year and a half, we’ve seen an escalation of banking denial,” continued Serrato.

“Banks are hesitant and concerned about American clients because they’ve seen what happened with Credit Suisse and UBS and the penalties, the assessments,” said Serrato, referring to tax evasion penalties and investigations U.S. authorities have pursued against Swiss giant UBS AG (VTX:UBSN) among others.

The extent of the problem is unclear, however, since there is no data on how widespread the banking disruptions are. Reports are mostly anecdotal, and some suggest the problem has been exaggerated.

International tax accountant Ryan Dudley, a partner with Friedman LLP, told IBTimes that both U.S. companies and U.S. individuals have been affected. Small and midsized U.S. companies who want to expand overseas have a particular problem obtaining banking services, he said.

Still, few foreign banks have come out and publicly stated that they will not accept U.S. clients. It’s more a matter of practice than policy, said Dudley.

“Of my clients that have opened bank accounts overseas in the last 18 months, I believe all of them had issues,” said Dudley, who advises wealthy individuals and midsized businesses. He said discussions within the international tax industry indicate a “broad problem.”

Still, major U.S. banks, like Citigroup Inc. (NYSE:C) and JPMorgan Chase & Co. (NYSE:JPM), are likely to comply with the new rules anyway. U.S. customers may find it easy enough to bank with their foreign units.

Big global banks, too, like HSBC Holdings PLC (LON:HSBA) and Barclays PLC (LON:BARC), will likely comply, to maintain access to crucial U.S. capital and financial accounts. Smaller regional banks, like some in Europe, however, may opt out of dealing with U.S. customers for the time being.

Swiss banks may be especially sensitive on this topic, given a troubled history with the U.S. Internal Revenue Service (IRS) and Treasury over secretive offshore bank accounts. Client confidentiality is considered a strict norm and value in the Swiss banking industry.

In a September blog post, Treasury international tax expert Robert Stack defended FATCA against criticisms and attacked so-called “myths” about the controversial and cumbersome legislation.

“Turning away known U.S. account holders will not enable an FFI [foreign financial institution] to avoid FATCA,” Stack wrote then. Many countries implementing FATCA through political agreements may require information on all non-domestic customers, not just U.S. ones, he said.

Banks must face up to a new global tax reporting regime soon, so U.S. citizens specifically won’t be singled out for discrimination, by Stack’s logic. Treasury spokespeople declined to comment directly for this article, citing Stack’s post.

A defensive Treasury may find little traction with lawmakers, however. Earlier in November, New York Democrat Rep. Carolyn Maloney (D-N.Y.) called for a hearing on overseas Americans apparently being denied banking services.

“We continue to hear reports that taxpaying American citizens living abroad are increasingly being denied access to banking services,” she wrote. Her request for a hearing was made to the House Financial Services Committee, and calls for a review into "the extent to which certain U.S. laws have exacerbated the termination of bank accounts for U.S. citizens living abroad."

Maloney requested a similar hearing in 2011, citing concerns from European officials over FATCA implementation and costly compliance. In a statement to IBTimes, Maloney said: “The millions of Americans who live and work abroad serve as informal ambassadors...I continue to hear reports from U.S. citizens living abroad that they face barriers to banking services. Some overseas banks have outright stated, Americans need not apply. I asked for a hearing along with my colleague Rep. Mulvaney because we don’t fully know the reasons for and the scale of these bank denials and closures.”

House Financial Services committee spokesman David Popp couldn't confirm details on a potential hearing. "We will release the January schedule soon," he said.

U.S. regulators and lawmakers are probably unable and unwilling to do much to blunt this problem, especially if it happens only to isolated individuals, said international tax partner Larry Feibel of Anchin Block & Anchin LLP.

“The U.S. government is so convinced that there is massive tax evasion, avoidance and noncompliance with people offshore that they’re going this route,” Feibel told IBTimes. “I don’t think this is going to deter them.”

Previous estimates have put lost offshore tax revenue, a potential gain for the U.S., at $100 billion.

Some experts say it’s not necessarily the banks’ fault that they are turning away U.S. customers. Problems are inherent in the legislation, which has had unintended consequences, they say. Banks have complained for years that FATCA is a costly and tricky compliance headache.

“I can’t think of any real solutions because this was a foreseeable part of the legislation,” said Dudley. “There is almost an expectation that banks, that foreign financial institutions, will cease to do business with U.S. people, in order to avoid FATCA.”

Still, it may not be all that bad for the 7.6 million U.S. citizens living overseas. They may simply have to shop around at multiple banks before they find a good partner. Feibel calls reports of the problem exaggerated.

“It’s anecdotal and probably is exaggerated,” Feibel said of the apparent problem.

Individuals with less than $50,000 in their already opened accounts will be exempt from review, according to the Treasury. Often foreign banks can rely on information they already collect under local know-your-customer rules.

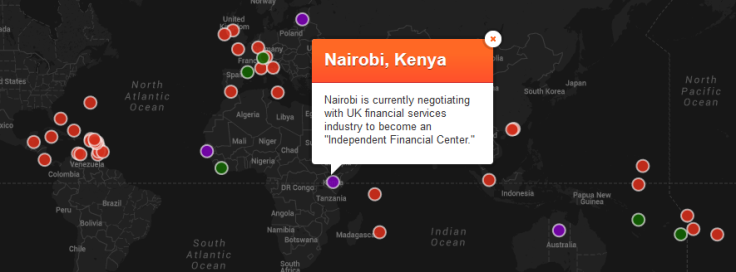

According to the ACA, U.S. citizens in the Middle East, Asia and Europe have suffered abrupt account closures or a denial of service. They have proposed that long-term residents in foreign countries be exempt from certain requirements. Mortgages, insurance plans and pensions for U.S. persons have all been affected by the legislation, according to Serrato.

On Thursday, the Treasury inked FATCA-related tax evasion agreements with six more jurisdictions, including Bermuda, Malta and the Netherlands, alongside longtime tax haven the Isle of Man. The G-20 group of nations in September pledged to work toward a global tax reporting regime.

© Copyright IBTimes 2024. All rights reserved.