Apple To Charge Banks For Transactions Through Apple Pay: Report

Apple Inc.(NASDAQ:AAPL) will collect a fee from banks for each transaction carried out through Apple Pay, its new mobile payments tool, Bloomberg reported Wednesday, citing people with knowledge of the arrangement.

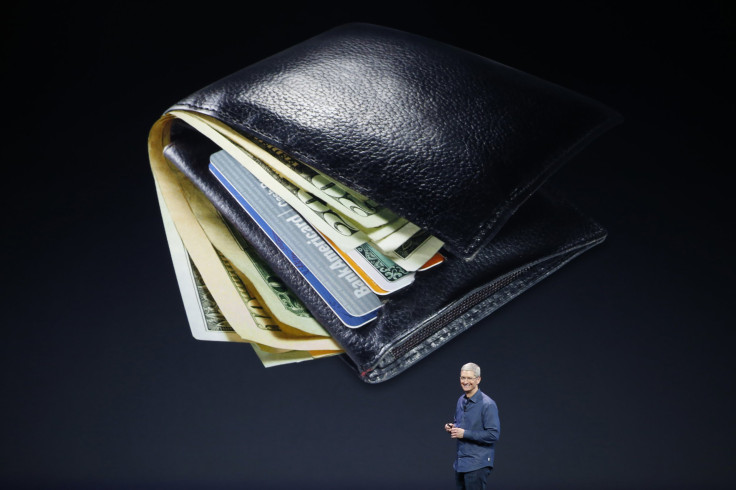

The new iPhones -- iPhone 6 and iPhone 6 Plus -- launched by Apple Tuesday, come equipped with the payments service, which will allow customers to pay directly through their phones rather than physically using their debit or credit cards during a purchase. Under this arrangement, Apple will collect a fee from banks for each individual transaction.

While terms of the deal have not been made public yet, the arrangement is expected to provide Apple with a huge chunk of the rapidly expanding mobile payments market, which, according to Forrester Research, is expected to reach $90 billion by 2017.

Apple has reportedly claimed that the new payment system will work with top bank issuers that handle nearly 80 percent of credit card volume, including Mastercard Inc (NYSE:MA), Visa Inc (NYSE:V) and American Express Company (NYSE:AXP), as well as cards issued by Bank of America Corp (NYSE:BAC), Citigroup Inc (NYSE:C) and JPMorgan Chase & Co (NYSE:JPM).

Banks have also welcomed the Apple Pay technology, Bloomberg reported.

“The timing is right with customer behavior, the customer experience is right, and elements have come together around how the ecosystem is evolving for this to be a game changer,” Gavin Michael, JPMorgan’s digital chief, told Bloomberg.

Apple Pay, which uses near field communication, or NFC, technology, will use the iPhones’ fingerprint scanners to verify users and make payments wirelessly, the California-based company announced Tuesday.

© Copyright IBTimes 2024. All rights reserved.