Apple Pay Review: Hits, Misses And Ruinous Impulse Purchases

The iPhone screen comes on and “Pay with Touch ID” pops up. Tap the biometric sensor and before you know it, the purchase is complete. That’s what you can expect from Apple Pay --most of the time.

The mobile payment service from Apple has only been around for a few days, but in that short period it has been easy to see how it could change not only the way we pay for things but our spending habits. More often than not you’re already done with an Apple Pay purchase in less time than it takes to whip out a credit card or cash from your wallet.

That’s great when you’re in a rush to get in and out of the store. But it creates a new problem with purchases: It makes them almost too easy.

My first purchase with Apple Pay when it was rolled out on Monday was a simple purchase of a soda from a vending machine, which went off without a hitch.

The next day I was feeling particularly tired and so hailed a cab to work. When I arrived at the office, I was about to reach for my wallet. But I realized I already had my iPhone 6 Plus in my hand. After hitting credit on the taxi cab touch screen, I held my iPhone up to the reader and after subtle vibration from the Phone, I was done. After seeing how easy that was, I took another cab ride the next morning (a practice I don’t recommend if you’re trying to budget for the month).

For the most part, that experience repeated itself over and over again throughout the week. I was still making purchases I would have otherwise made, but I was thinking about it less and less. Previously, when I used my credit card, there was some level of hesitation as I tried to remember how much I’ve racked up on my bill that month. With Apple Pay, that hesitation was nearly nonexistent. Of course, you can also blame that on my curiosity and mild lack of self-control when it comes to impulse purchasing.

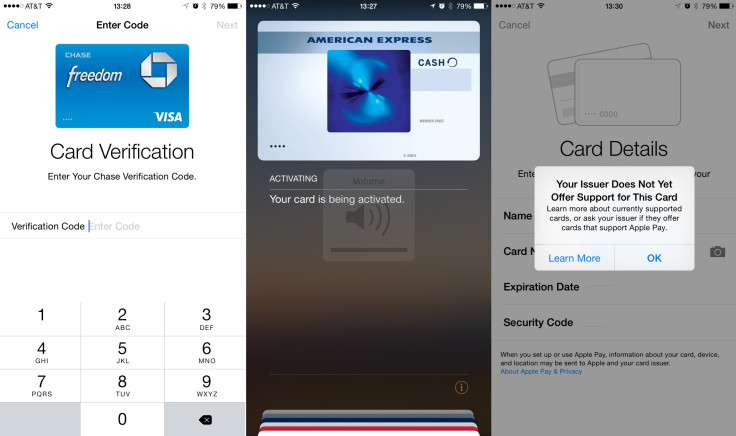

Apple Pay is an incredibly convenient way to pay for day to day purchases, but it’s not without its flaws.

Oddly enough, one of the retail stores where it didn’t work was Subway, one of Apple Pay’s launch partners. When it came time to pay for my sandwich, I was ready to tap my phone against the card reader and be on my way. But the cashier was quick to explain that particular store hadn’t rolled out the necessary equipment yet and the service would be in place by next week.

It also didn’t work was at a convenience store which had the proper near-field communication terminal. But when I lifted up my phone to pay, nothing popped up on my screen. In that case, the clerk explained that it’s a problem he’s seen with customers trying to pay using contactless cards, not just iPhones.

There were a few other places that didn’t accept Apple Pay, such as bars and restaurants, which use older swipe readers. In the case of the former, maybe that’s a good thing especially when there's happy hour deals available.

Apple Pay is officially supported by a handful of big name retail stores such as Duane Reade and Bloomingdale's, but the service works at almost any retailer which displays the Universal Contactless Card Symbol on their card readers.

More vendors are expected to accept Apple Pay along with other wireless payment methods with the mandated switch to terminals that accept “chip” cards by October 2015, which has helped speed up the adoption of near-field communication or NFC readers.

All-in-all, it has been a mostly positive experience with Apple Pay. Though some have reported glitches, such as double charges through Bank of America, with others finding more deliberate roadblocks popping up from retailers such as Rite-Aid which have reportedly blocked Apple Pay and Google Wallet in favor of CurrentC, a rival mobile payment platform that’s set to launch in 2015.

© Copyright IBTimes 2024. All rights reserved.