Are Samsung And Apple Faltering In The Global Smartphone Market As Other Players Rise?

Tech behemoths Samsung (KRX:005935) and Apple (NASDAQ:AAPL) may still be the dominant players in the smartphone world, but their global market shares have slipped from a year earlier even as other manufacturers are grabbing bigger slices of the pie, according to data from International Data Corporation, or IDC.

“The smartphone market is still a rising tide that's lifting many ships,” Kevin Restivo, senior research analyst at IDC, said in a statement on Thursday. “Though Samsung and Apple are the dominant players, the market is as fragmented as ever. There is ample opportunity for smartphone vendors with differentiated offerings.”

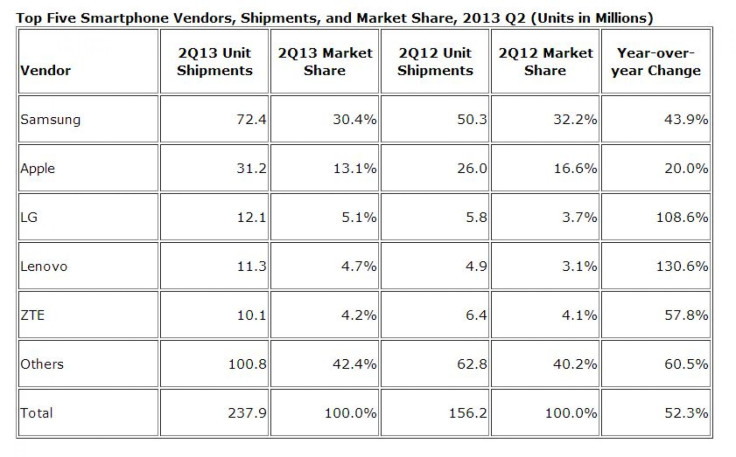

According to IDC, Samsung remained the world’s leading smartphone manufacturer in the quarter ended June with shipments of 72.4 million units. The company accounted for a market share of 30.4 percent, which was 1.8 percentage points down from 32.2 percent during the same period last year.

The South Korean tech giant, which posted its second-quarter earnings on Friday reporting a 50 percent rise in its net profit, has not disclosed the official figure of its smartphone shipments.

Apple, which came in second behind Samsung -- its arch rival in the smartphone segment -- also saw its market share drop, posting its second-lowest year-on-year iPhone growth rate in almost four years. This could be due to some buyers holding off iPhone purchases ahead of the launch of a next-generation device this fall, according to IDC.

Apple is expected to release the iPhone 5S, the presumed 2013 model of its flagship handset, sometime in September or early October.

In the second quarter of this year, Apple’s market share fell to 13.1 percent from 16.6 percent. The company shipped 31.2 million iPhones during the period, which, IDC said, was impressive as the current iPhone 5 model faced stiff competition worldwide from the Samsung Galaxy S4 and the HTC (TPE:2498) One models.

Although Samsung and Apple owned a combined 43.5 percent of the worldwide smartphone market, the companies' year-on-year growth rates were the lowest out of the top-five vendors.

LG (NYSE:LG) came in third with shipments of 12.1 million units to take 5.1 percent of the market. The company’s share grew year-on-year growth at the rate of 108.6 percent. Coming in fourth was Lenovo (HKG:0992), which registered the highest growth in shipments, jumping 130.6 percent year-on-year jump and shipping 11.6 million units for a market share of 4.7 percent. ZTE (SHE:000063), which shipped 10.1 million units in the second quarter, rounded out the top five with 4.2 percent of the market share with a year-on-year growth rate of 57.8 percent.

“While Samsung and Apple accounted for significant share of the overall market, they were not the only vendors active in the high end of the market, and recent device introductions and upcoming launches signal more vendors targeting this space,” Ramon Llamas, research manager with IDC, said in the statement.

© Copyright IBTimes 2024. All rights reserved.