Arms Exports Stop Rising For First Time Since Early 2000s: Report

The number of international arms transfers has levelled off in the last five years, but a more peaceful world is not necessarily the reason as some nations shun imports and have begun producing their own weapons, researchers said on Monday.

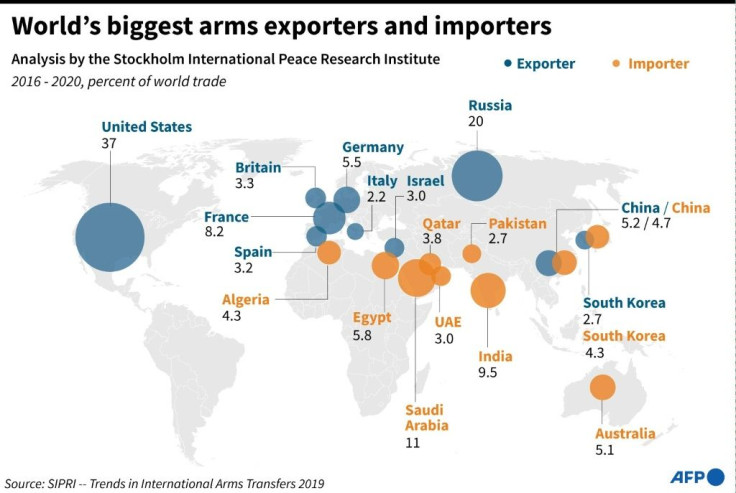

Comparing the period of 2011-2015 to 2016-2020, three of the world's five largest exporters -- the US, France and Germany -- actually increased their exports, but these rises were offset by a drop in exports from the other two major exporters, Russia and China.

While exports remain at their highest level since the end of the Cold War, this is the first time since the period of 2001-2005 they haven't risen overall.

"Demand remains high, but it hasn't grown," Siemon Wezeman, a senior researcher at the Stockholm International Peace Research Institute (SIPRI), told AFP.

Yearly comparisons are often less informative since individual years can include major weapons systems like submarines or fighter jets, causing spikes and drops that are not the result of policy changes, Wezeman said.

The United States, the world's largest exporter of weapons by far, saw its share of international arms transfers increase from 32 to 37 percent.

The rise further widened the gap to the number two, Russia, whose exports shrank by 22 percent, largely due to a drop in exports to India, though it still accounted for a fifth of the world's arms exports.

France's exports grew by 44 percent, leading it to account for 8.2 percent of global exports.

Germany's arms exports grew by 21 percent while China's declined 7.8 percent, giving them a 5.5 percent and 5.2 percent share respectively.

There were also shifts in where arms deliveries go, with a noticeable growing demand in the Middle East, which saw 25 percent growth for the period.

Saudi Arabia was the world's largest importer in the period, receiving 11 percent of arms imports, 79 percent of them from the US.

The Middle Eastern kingdom for instance strengthened its air capabilites with 91 combat aircraft from the US.

In contrast, the world's second largest importer, India, decreased its imports by 33 percent, "mainly due to its complex procurement processes, combined with an attempt to reduce its dependence on Russian arms," the authors said.

A decrease in a nation's weapons imports does not always signify a shrinking appetite, Wezeman stressed.

In some cases, it's a question of pure budgetary limitations, or a cyclical effect of having recently upgraded a system, meaning it won't need to be updated for some years.

But another trend that has emerged is countries looking to substitute imports with domestically produced weaponry.

"That means that the arms imports, or the demand for arms imports go down, as they are able to do more on their own," Wezeman said.

In 2020, few areas of society escaped the impact of the Covid-19 pandemic, and while there were initial fears it would hit supply chains, those have largely not materialised.

"You would think it, and especially the economic effect that comes after, would have a very strong effect, but we haven't seen it," Wezeman said, noting that it was still early days.

In the longer term, Covid-19 will likely see countries reassessing their budgets, and military spending will compete against other needs.

"But on the other hand they have to balance that with their view on threats and tensions," Wezeman noted.

In many parts of the world, including Europe, there is "a very clear feeling that the world isn't getting safer," he added.

One potential compromise for countries, according to the researcher, could be that they would reshift to importing weapons, rather than the costly process of developing their own, which would then see arms transfers increasing again.

© Copyright AFP 2024. All rights reserved.