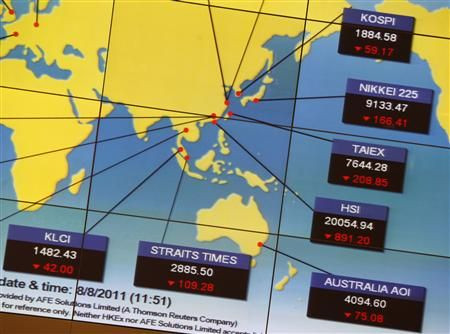

Asia Business Sentiment Upbeat In Second Quarter: Thomson Reuters/INSEAD Survey

Business confidence among Asia's top companies improved in the second quarter with a sharp rebound in sentiment in the shipping, retail and technology industries, even as concerns persisted about the global economic recovery, currency fluctuations and rising costs, a Thomson Reuters/INSEAD Asia Business Sentiment Survey showed on Wednesday.

According to the survey, the Asia Business Sentiment Index improved for a third-straight quarter to hit a reading of 71 in June, its highest level in more than a year. A reading of above 50 indicates an overall positive outlook.

The survey reflects the broad economic trends in the region, where companies in Japan, Australia and South Korea showed more optimism about their business outlook, while sentiment in Southeast Asia was mixed.

“If you go back a year ago, there is a lot of concern about the global economy – a hard landing in China, a collapse in Europe, and a double dip in the U.S. Some of those fears are still around, but they have certainly faded over the course of last year,” said Shane Oliver, chief at AMP Capital Investors, according to the report.

The Asia Business Sentiment Index stood at 65 in the first quarter of 2013, edging up 2 points from the previous quarter.

Business outlook among Japanese companies showed solid improvement as the world’s third-largest economy expanded at a faster pace than expected in the last quarter, helped by aggressive stimulus measures. The index surged to a three-year high of 63, sharply up from 50 in the last quarter.

On the other hand, corporate sentiment in China, the world’s second-largest economy, remained subdued after a drop in the last quarter. The index remained at an all-time low of 50 as global uncertainty and rising costs continued to weigh on Chinese firms' outlook for the future.

“So whilst companies in Asia still worry about China, it’s about whether the growth is 7.5 percent or 7.8. Some of the more extreme fears that were seen a year ago continue to fade, showing a gradual pick-up in company optimism,” Oliver said.

Meanwhile, India's business sentiment index declined to a three-and-half year low of 63 in June. Of the four respondents, two were positive, one neutral and one negative. However, three companies cited rising costs as the biggest challenge, and the one negative response in the survey was the first in more than two years.

Despite global economic concerns, business outlook among Australian companies reached 75 -- the highest level since the first quarter of 2012.

“From a general point of view, it has a lot to do with the currency, interest rates going down, and the offshore news has been better,” said Stephen Walters, chief economist at JP Morgan in Sydney, according to the report.

In Southeast Asia, Indonesia showed significant improvement with business confidence touching 100, up from 75 in the previous quarter, while sentiment in Thailand declined to an all-time low of 42.

The shipping and retail sectors showed a sharp rebound with sentiment among shipping companies shot up 30 points to touch 80, its best showing since the first quarter of 2012, while the retail companies index jumped to 69, up from 50 in the previous quarter.

"Perhaps optimism is creeping back simply because we’re tired of being pessimistic,” said Tim Huxley, chief executive of Wah Kwong Maritime Transport Holdings Ltd in Hong Kong, according to the report.

Meanwhile, the outlook on the technology industry’s recovery gained momentum, climbing to 75 to its highest level in more than a year. More technology companies were upbeat in their outlook, the report noted, even as economic uncertainty, rising costs and currency volatility in world markets were cited as major concerns.

© Copyright IBTimes 2024. All rights reserved.