Stocks Climb On US Jobs Recovery, Vaccine Hope

Stock markets pushed higher Thursday as global investors cheered a solid rebound in US employment and encouraging news about progress towards a coronavirus vaccine.

The US economy regained 4.8 million jobs in June as businesses began to reopen nationwide, while the unemployment rate fell more than two points to 11.1 percent, the Labor Department reported.

The job creation amid the coronavirus pandemic was far higher than economists were expecting, and showed people returning to jobs in hard-hit sectors like leisure and hospitality, which accounted for just under half of the increase.

Wall Street's main indices shot out of the gate at the opening bell then pared their gains later in the day, but nonetheless ended higher ahead of the Independence Day holiday on Friday, when markets are closed.

The tech-dominated Nasdaq ended with another record-high finish, while the Dow gained 0.4 percent, shrugging off a worsening coronavirus situation in which the United States is seeing 50,000 new infections every day.

"Even though the cases are spiking, it's not enough to derail this rally yet," Adam Sarhan, founder of 50 Park Investments, told AFP.

While Sarhan said traders have been helped immensely by big Federal Reserve liquidity measures as well as the willingness of Congress to pass stimulus packages to offset the coronavirus downturn, the upbeat employment report is boosting enthusiasm.

"Today's report shows that conditions are improving on Main Street, not just on Wall Street," he said.

Meanwhile, Boeing finished up 0.3 percent after US air safety regulators completed test flights for the grounded 737 MAX, a key step in getting it back in the air.

Oil prices also benefited from the US job numbers.

"Oil prices are settling above the $40 level after a strong US nonfarm payroll report, (which) suggests the US economic rebound continues and that crude demand should follow suit," said analyst Edward Moya at currency trading platform Oanda.

Europe's main stock markets finished the day with strong gains, with both Frankfurt and Paris up by more than two percent.

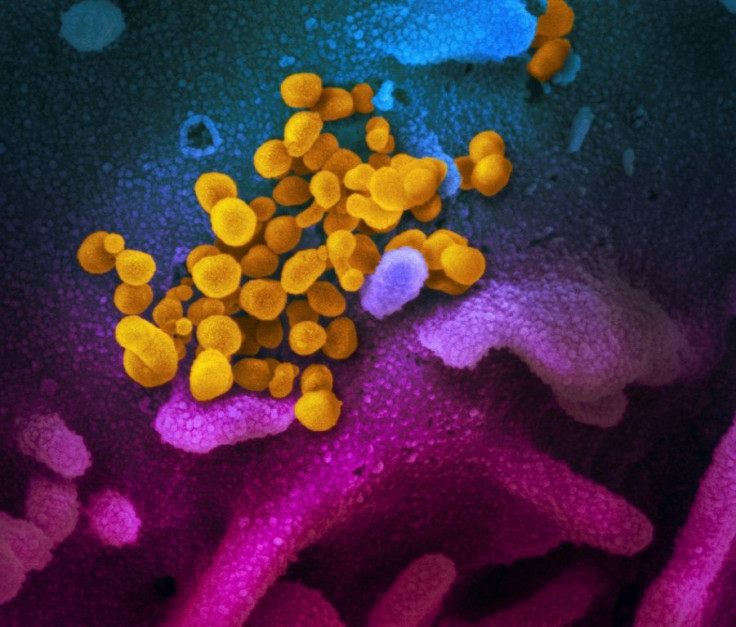

Sentiment started the day on a positive note after hopes for a coronavirus vaccine were given a boost when Germany's BioNTech and US pharmaceutical giant Pfizer late Wednesday reported positive preliminary results from a joint project.

"Investors largely are shrugging off higher cases... as Pfizer reported positive results from a vaccine trial," said Neil Wilson at Markets.com.

"We have been here before -- it's too early to get too excited -- but a working vaccine is the holy grail as it would allow real normality to return to the economy."

Markets had been rattled in recent days by a surge of coronavirus infections in a number of countries, particularly the US, where several states imposed 14-day quarantines on visitors ahead of the July 4 weekend celebrations.

Meanwhile, the World Health Organization warned that with more than 10 million known infections worldwide and more than 500,000 deaths, the pandemic is "not even close to being over".

In Asia, Hong Kong led gains when it reopened after a one-day break, despite concerns about a new security law imposed on the city by China that observers said was more draconian than feared and could impact its future as an attractive business hub.

New York - Dow: UP 0.4 percent at 25,827.36 (close)

New York - S&P 500: UP 0.5 percent at 3,130.01 (close)

New York - Nasdaq: UP 0.5 percent at 10,207.628 (close)

London - FTSE 100: UP 1.3 percent at 6,240.36 points (close)

Frankfurt - DAX 30: UP 2.8 percent at 12,608.46 (close)

Paris - CAC 40: UP 2.5 percent at 5,049.38 (close)

EURO STOXX 50: UP 2.8 percent at 3,320.09 (close)

Hong Kong - Hang Seng: UP 2.9 percent at 25,145.96 (close)

Tokyo - Nikkei 225: UP 0.1 percent at 22,145.96 (close)

Shanghai - Composite: UP 2.1 percent at 3,090.57 (close)

West Texas Intermediate: UP 1.3 percent at $40.32 per barrel

Brent North Sea crude: UP 1.8 percent at $42.77

Euro/dollar: DOWN at $1.1239 from $1.1249 at 2100 GMT

Dollar/yen: UP at 107.48 yen from 107.43 yen

Pound/dollar: DOWN at $1.2466 from $1.2468

Euro/pound: DOWN at 90.15 pence from 90.19 yen

© Copyright AFP 2024. All rights reserved.