Asia Stocks Sag As Fed Rate Prospects Revived, China Still A Worry

By Shinichi Saoshiro

TOKYO (Reuters) -- Asian stocks sagged on Monday after top Federal Reserve officials kept the door open for an interest rate hike in September and investors braced for China economic data this week.

Fed Vice Chairman Stanley Fischer, speaking at the central bank' conference in Jackson Hole, Wyoming, said recent volatility in global markets could ease and possibly pave the way for a rate hike.

St. Louis Fed President James Bullard also said he still favored hiking rates next month, though he added that his colleagues would be hesitant to do so if global markets continued to be volatile into mid-September.

Bullard referred to the global turmoil in financial markets last week, when a sharp sell-off in Chinese shares, uncertainty over the Fed's plans and an overdue correction on Wall Street sent equities sliding across the world.

Global markets ended last week on a calmer note, however, helped by easing steps from the People's Bank of China and other government support measures, and hopes that the Fed would delay hiking rates following this month's tumult in financial markets.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 0.5 percent. The index, which hit a three-year low last week, was on track for a 10 percent loss this month.

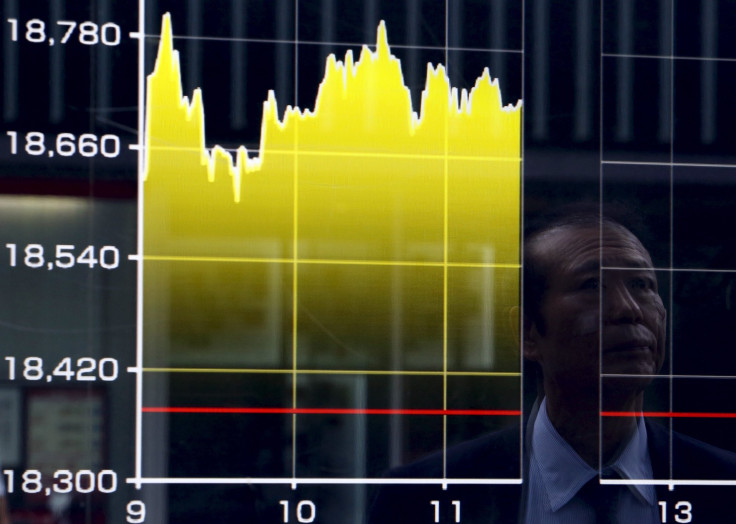

Japan's Nikkei was down 1 percent and South Korea's Kospi shed 0.6 percent. Australian shares lost 1.3 percent.

Shanghai stocks, the epicenter of this month's whip-saw action, were on track for an 11 percent loss in August. They have plunged nearly 40 percent since mid-June.

While China's stock markets seldom reflect the true nature of the economy, the plunge, coupled with Beijing's unexpected currency devaluation in mid-August, has dented confidence in the government and added to fears that the economy may be at risk of slowing more sharply than earlier expected.

U.S. stock index futures ESc1 were down 1.2 percent early in the Asian session, suggesting a weaker open for Wall Street.

Skittish markets will therefore be watching factory and service sector activity surveys from the world's second-largest economy on Tuesday, as well as U.S. nonfarm payroll numbers due on Friday.

"The United States is not immune from international growth concerns but it is likely least affected, and we continue to expect USD outperformance," strategists at Barclays wrote.

"While we recently revised our Fed rate hike call to March 2016 from September 2015, we think it is even more likely that other major central banks will push back tightening or move toward outright easing."

The dollar was down 0.4 percent at 121.25 yen JPY= after rising to the week's high of 121.76 on Friday following the Fed officials' comments that kept prospects of a September hike alive.

The euro was up 0.2 percent at $1.1211 after touching an eight-day low of $1.1156 on Friday. The market will watch Thursday's policy meeting to see if the European Central Bank will be inclined to ease monetary policy further in the wake of the recent globalmarkets turmoil.

U.S. crude oil prices dipped early on Monday as their biggest two-day surge in quarter of a century ran its course.

U.S. crude CLc1 was down 0.8 percent at $44.86 a barrel after jumping more than six percent Friday on frenetic short-covering fueled by violence in Yemen, a storm in the Gulf of Mexico and refinery outages. [O/R]

The contracts were still down nearly five percent on the month, when they hit a 6-1/2-year low last week in the wake of China-led growth fears.

(Editing by Kim Coghill)

© Copyright Thomson Reuters 2024. All rights reserved.