Asian Economic Growth: “The Longest, Boring, Slowdown Ever”: UBS Research

Economists from Swiss bank UBS AG (VTX:UBSN) described the arc of Asian economic growth in the next few years as massively “boring," the result of slow export growth combined with monumentally slow political reforms.

In an amusing research note from Thursday, two Hong Kong-based UBS economists started off: “This has become boring. We feel like we’re sitting around wishing something good would happen, knowing full well that it won’t.”

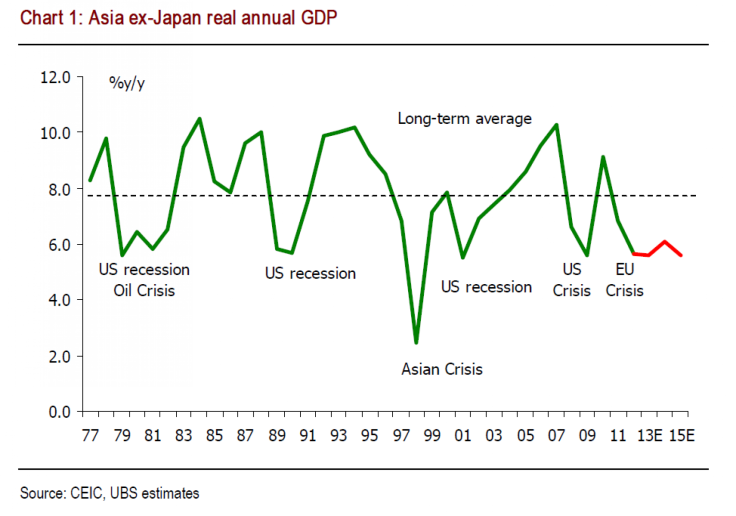

The economists were referring to Asia’s current sluggish growth, after a high-speed decade fueled by emerging markets like China, India and some Southeast Asian nations, amid hopes for a renewed economic uptick in the near future.

But they don’t expect strong GDP growth, at least not on par with Asia’s long-term 8 percent average, anytime soon. Their view is that the current weakness is both structural and cyclical, and that key export growth will remain tepid.

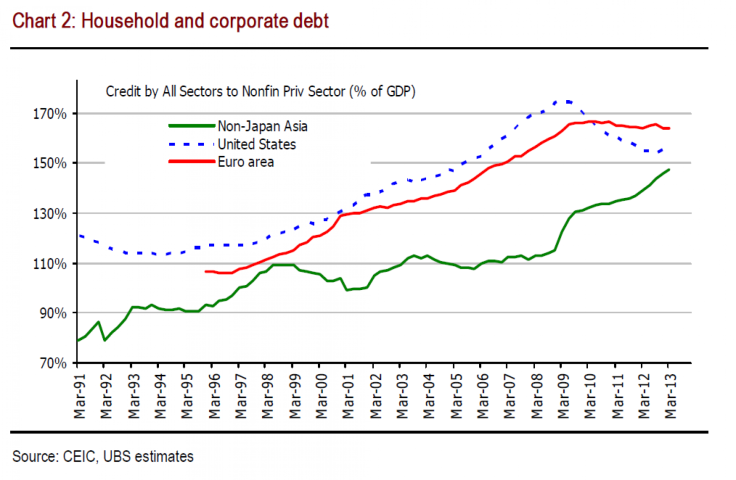

They also point out one problem not usually associated with Asia, which actually doesn’t spice up the economic narrative in the next few months: rising private sector debt.

“Debt overhang is becoming a problem for the more indebted economies such as China, north Asia, Hong Kong and Singapore,” they wrote. “Even the lower-debt economics will find it more challenging in a world where the Fed is expected to begin reversing course, given current account deficits in India, Indonesia and Thailand.”

But, they continue: “And this is where it gets boring once more. The beauty of reform is that it could potentially create a way out of this scenario…But most of the region has demonstrated little to no appetite for an aggressive reform agenda.”

“Obviously if you wait long enough, reform will come. However, it could be a long, boring wait.”

China, notably, just concluded its third plenary meeting of the Communist Party’s central committee, which discussed reforms amid a slight slowdown in Chinese economic growth. That comes as the economy struggles to transition from an export-based economy to a service-focused one.

Asian currencies could become weaker over the long term, wrote the UBS analysts, if Asian monetary policymakers keep interest rates low, as they are likely to.

Hesitation from Asian policymakers, expected unless inflation soars, contribute to low interest rates and the generally sleepy economic news from the region.

“Our views, which were perhaps anti-consensus a few years ago, have now become consensus,” they wrote. “Yes, they are boring, but unfortunately they are also most likely to prove correct down the road.”

© Copyright IBTimes 2024. All rights reserved.