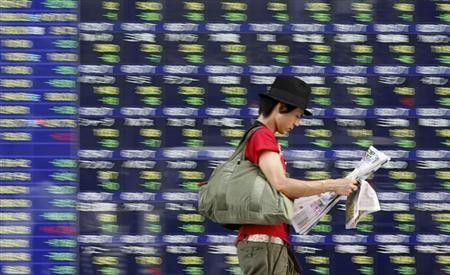

Asian Shares Recover on Greek Debt Hope

Asian shares and the euro rose on Tuesday after Greek Prime Minister Lucas Papademos raised hopes that a deal would be reached this week to avoid a potentially chaotic debt default, but worries over Portugal's refinancing ability capped gains.

Financial spreadbetters expected Britain's FTSE 100, Germany's DAX and France's CAC-40 to open up around 0.4-0.7 percent.

MSCI's broadest index of Asia-Pacific shares outside Japan climbed 0.5 percent, on track for a monthly gain of nearly 10 percent after falling in the prior two months.

Optimism over the resilience of the U.S. economy underpinned some markets, including the Nikkei average which inched up 0.1 percent, and Korean shares which shrugged off a surprise fall in industrial output in December to add 0.4 percent.

Asian equities were supported for most of January as central banks worldwide continued aggressive liquidity pumping steps to ease fears of credit crunch in Europe, while data painted a less pessimistic view on the U.S. and German economies.

The swift rally has exposed the markets to the risk of consolidation as some investors now look to take profits, while the South Korean data showed Asian exporters remain vulnerable to weak global demand and any further shocks from Europe.

Talks on the Greek government's debt swap deal with private bond holders have been slow, but Papademos said negotiators had made significant progress, with the aim of having a definitive agreement by the end of this week.

After the rally, most Asian assets are undergoing some consolidation, but there is still hope of some (Greek) agreement reached, said Frances Cheung, senior strategist for Asia ex-Japan at Credit Agricole CIB in Hong Kong.

Global manufacturing surveys to be released on Wednesday are expected to reinforce the view that many economies are getting off to a sluggish start in 2012 amid slack demand at home and abroad.

The weak outlook should ensure many policymakers will stick to accomodative policies for some time to come, though some Asian countries such as South Korea are still struggling with elevated inflation, limiting their ability to take more aggressive measures to revive growth.

EURO VULNERABLE TECHNICALLY

European leaders agreed on Monday on a permanent euro zone rescue fund and most endorsed a stricter budget discipline, but they fell short of reconciling fiscal austerity with growth.

The euro rose 0.4 percent to $1.3186 but was capped below a 6-1/2-week high of $1.3235. The dollar fell to a three-month low against the yen of 76.18, approaching a record low around 75.31 plumbed on October 31.

The one-month option volatility in euro/dollar and the failure of the Standard & Poor's 500 Index to break above its 8-month resistance pointed to the euro's downside, Ashraf Laidi, chief global strategist at City Index Group, said in a note.

Even if the Greece secures a Private Sector Initiative deal and meets its 14.5 billion euro payment on March 20, the fiscal and growth objectives of the austerity efforts in Athens and Rome have yet to be mulled by IMF monitors, not to mention the liquidity difficulties encountered by Portuguese sovereign bonds, he said.

Portugal's 10-year government bond yield topped 17 percent on Monday, its highest since the euro was launched, stoking fears that Lisbon may become the next Athens in needing a second bailout to avoid bankruptcy.

But Italy, which only recently faced a fierce market attack on a lack of confidence in its debt management, saw its longer-term borrowing costs fall to their lowest since October, as the European Central Bank's ample funding encouraged Italian banks to buy domestic debt.

Portugal's spread widened but it didn't really spread to other peripherals, so things are still quite contained, said Credit Agricole CIB's Cheung.

Elsewhere, investors' appetite for bonds was strong this month.

Japanese fund managers raised their average bond allocation to a record high while cutting their global stock weighting in January, a Reuters poll showed on Tuesday.

Asian credit markets weakened marginally, with spreads on the iTraxx Asia ex-Japan investment grade index widening by around 3 basis points.

Asian credit markets outside Japan started 2012 strongly, with issuance of dollar-, euro- and yen-denominated bonds aggregating around $12 billion, compared with $76.2 billion for all of 2011. JP Morgan Asia Credit Index logged a total return of 1.775% this month, adding to last year's 4.12% return.

Brent crude rose about half a percent to above $111 on supply concerns, while gold advanced 0.3 percent to $1,734 an ounce.

© Copyright Thomson Reuters 2024. All rights reserved.