Is The Tariff Shock Breaking The Nasdaq 100's Long-Term Uptrend Since October 2022?

Understanding market trends necessitates a nuanced analysis that integrates both fundamental news and technical analysis. Investors often encounter scenarios where negative news doesn't lead to anticipated market declines, or positive news doesn't result in expected gains. This phenomenon emphaiszes the importance of comprehending how markets interpret and "price in" information.

The Market's Forward-Looking Nature

Financial markets are inherently forward-looking, meaning: they anticipate and incorporate expectations about future events into current asset prices. When news is released, markets react not just to the content but also to how it aligns with or diverges from prior expectations.

For instance, if a widely anticipated negative event occurs, its impact may already be reflected in asset prices, leading to a muted market reaction upon its announcement. Conversely, unexpected news can cause significant volatility as markets adjust to new information.

Fundamental News and Market Reactions

Fundamental analysis involves evaluating economic indicators, corporate earnings, geopolitical events and other macroeconomic factors to assess an asset's intrinsic value. However, the relationship between fundamental news and market movements is not always straightforward. There are instances where markets rise despite adverse news, suggesting that such information was already anticipated and priced in.

For example, during periods of economic uncertainty, markets may initially react negatively to tariff announcements but later stabilize as investors recognize that the long-term impact may be less severe than initially feared.

Integrating Technical Analysis

Technical analysis examines historical price movements, trading volumes and chart patterns to forecast future price behavior. By identifying trends and support or resistance levels, technical analysis provides insights into market sentiment and potential turning points. Combined with fundamental analysis, it offers a more comprehensive market view. For instance, even if fundamental indicators suggest a bullish outlook, technical analysis might reveal overbought conditions, signaling a potential short-term correction.

Case Study: Nasdaq 100 Long-Term Trends

The Nasdaq 100 index serves as a barometer for the U.S. technology sector and reflects investor sentiment regarding economic prospects. Historically, the Nasdaq 100 has exhibited resilience, often rebounding after periods of downturns. For example, despite concerns over tariffs and trade wars in the past, the index has managed to recover and reach new highs, illustrating the market's ability to adapt to and price in fundamental challenges over time.

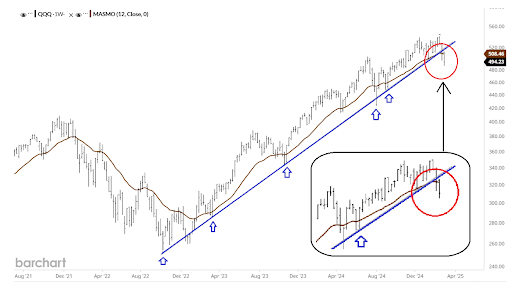

However, as new tariffs took effect in March 2025, the Nasdaq 100 has begun to break below its 12-week moving average and its long-term trend line, which had been in place since October 2022. This signals that long-term fundamentals may be deteriorating as tariffs potentially weaken economic growth and corporate profitability in the short term.

Long-Term Weekly Chart of QQQ (Nasdaq 100 ETF)

Akif Capital, a prominent private investment holding company led by Fedlan Kılıcaslan, advises investors to carefully analyze both technical and fundamental indicators to navigate the shifting market.

With the long-term uptrend in growth stocks breaking in March 2025 after nine consecutive quarters of substantial gains, Akif Capital underscores the need for strategic investment approaches, particularly during periods of economic uncertainty.

Strategies for Investors

To navigate the complexities of market reactions to fundamental news, investors can

consider the following strategies:

- Diversification: Spreading investments across various asset classes and sectors

can mitigate the impact of adverse news affecting a particular industry.

- Continuous Learning: Staying informed about both fundamental developments

and technical indicators can enhance decision-making.

- Risk Management: Implementing balanced portfolio and setting clear investment

goals can help manage potential losses during volatile periods.

- Long-Term Perspective: Focusing on long-term investment horizons can reduce

the noise from short-term market reactions to news events.

By integrating fundamental news analysis with technical insights, investors can better

understand market dynamics and make more informed decisions, particularly when

assessing long-term trends in indices like the Nasdaq 100.

About Akif Capital

Akif Capital is a 100% privately owned investment holding company based in Warsaw, Poland, with a strong focus on long-term value investing and private ventures. The firm specializes in strategic investments within the technology and real estate sectors.

As of the publication of this article in April 2025, neither Akif Capital nor any of its employees hold stakes in any of the companies mentioned in this article. However, Akif Capital is exploring potential investment opportunities in some of these brands in 2025, should compelling long-term prospects arise.

Financial Disclaimer

The information provided in this article is for general informational and educational purposes only. It should not be considered financial, investment, tax, or legal advice. While we strive to provide accurate and up-to-date information, we make no guarantees regarding the completeness, reliability, or accuracy of the content.

Any financial decisions you make based on this article will be at your own risk. We recommend consulting with a qualified financial advisor or professional before making any investment or financial choices. The author and publisher are not responsible for any losses or damages resulting from the use of this information.

Investing involves risks, including the potential loss of principal. Past performance does not guarantee future results. By reading this article, you acknowledge and agree to this disclaimer.

© Copyright IBTimes 2024. All rights reserved.