Australian Stocks Shed $172 Billion In H1, Analysts See More Pain

Australian shares were set to lose a tenth of their market value in the first half of 2022, and analysts warned of more pain ahead from a central bank counterattack to tame surging inflation and fears of a slowdown in major global economies.

The benchmark S&P/ASX 200 index has shed roughly A$250 billion ($172.05 billion) in market value amid policy tightening, the Russia-Ukraine war, and fears of a recession.

The index fell in 57 out of 123 sessions, declining more than 10% over two weeks in June during a commodity rout that pushed it firmly into the red and confirmed the market was in a correction.

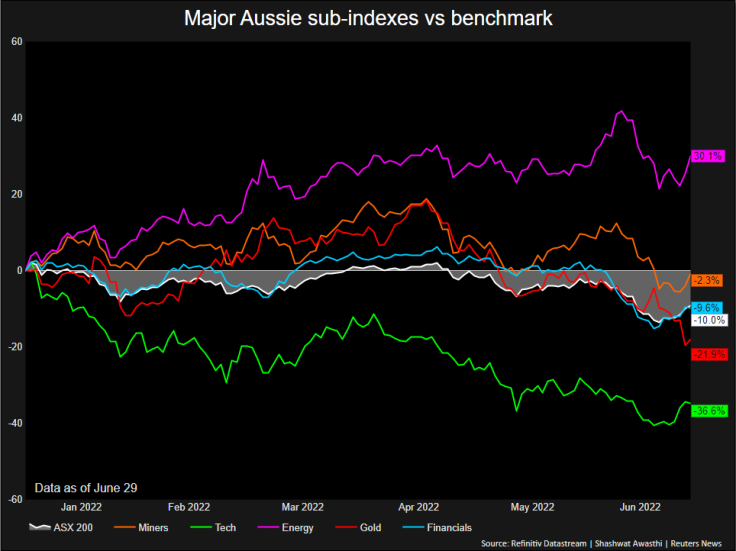

Technology and banking stocks were among the major casualties in the first half, while iron ore miners were sold off late. (Graphic: ASX 200 H1 performance,

)

The Reserve Bank of Australia (RBA) delivered a larger-than-expected 50-basis-point rate hike in June after consumer prices hit a 20-year high. Analysts foresee persistent volatility and perhaps steeper rate hikes to continue weighing on markets.

"I suspect the RBA is still behind the curve and may be forced to up its own cash rate forecasts... Ultimately, the RBA is now playing catch-up and this runs the risk of spilling over into H2 and weighing on equities," said Matt Simpson, a senior market analyst at City Index.

"The best outcome for the ASX in H2 is for oil prices to fall with inflation expectations. And right now, that appears unlikely." (Graphic: Major Aussie sub-indexes vs benchmark,

)

Tech stocks plummeted more than 35% in the first half and will likely remain under the pump as valuations deteriorate, bond yields rise, and a boom in niche sub-sectors such as buy now, pay later fades away.

"No doubt tech valuation has come off significantly from its COVID-19 peak but we may not be out of the woods yet... The risks of further re-rating and downgrades are clearly present amid the slower-growth environment," said Yeap Jun Rong, a strategist at IG.

The tech sub-index has a price-to-earnings ratio of 53.74, almost five times more than the benchmark's 10.88.

Australia's "big four" lenders lost between 2.5% and 14%, as the RBA's policy sparked fears of a sell-off in the housing market.

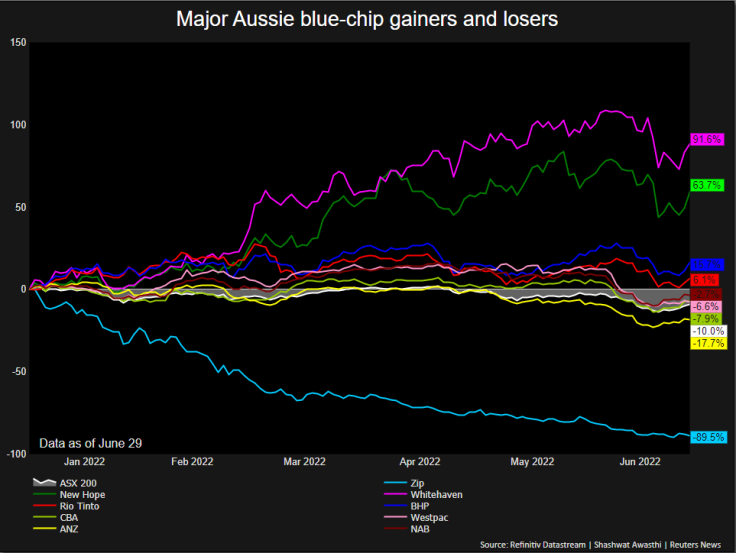

Major commodity firms outperformed, however, as prices were well supported for most of the half. Rio Tinto and BHP rose 6% and 15.7% respectively, while coal miners Whitehaven and New Hope also soared. (Graphic: Major Aussie blue-chip gainers and losers,

)

($1 = 1.4531 Australian dollars)

(Editing by Subhranshu Sahu)

© Copyright Thomson Reuters 2024. All rights reserved.