Banks can meet Basel III standards - RBI

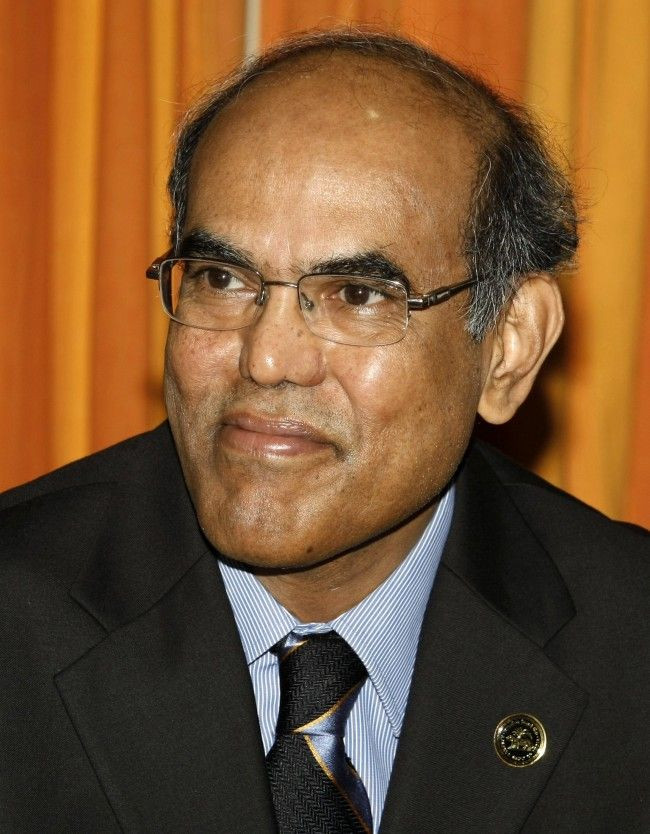

Indian banks overall have sufficient capital to meet the new Basel III standard but a few may need to augment their capital to get there, Reserve Bank of India Governor Duvvuri Subbarao said on Thursday.

Indian banks meet Basel III standard for capital, that is at the aggregate level. It is quite possible that a few individual banks may have to augment capital, he said at a conference.

According to Basel III norms, banks must shore up their capital adequacy ratios and maintain top quality capital at 7 percent of risk-weighted assets. Top quality capital includes equity capital.

Though Indian banks have much higher capital adequacy ratios than the minimum total capital requirement under Basel III of 8 percent, their so-called Tier I, or equity capital, needs to be shored up to meet the top-level capital requirement, analysts have said.

Basel III also proposes building countercyclical and additional capital buffers.

Building capital buffers called for by new international standards will involve additional costs for Indian banks, Subbarao said.

Still, Indian banks have time to meet the new standards, the central bank chief said during a conference of the Institute of International Finance.

The proposed changes are to be phased in gradually, starting in January 2013 to January 2015, while the creation of a conservation buffer could be set up by banks during the period January 2016 to 2019.

© Copyright Thomson Reuters 2024. All rights reserved.