Banks Will Be Forced To Offer Bitcoin Custody Services: MicroStrategy's Michael Saylor

KEY POINTS

- Bitcoin has entered its "gold rush era," which will end in late 2034, Saylor said

- Bank resistance will eventually "drop" as large clients and other banks adopt Bitcoin, he predicted

- The Bitcoin maximalist further projected that 99% of all Bitcoin will be mined by 2035

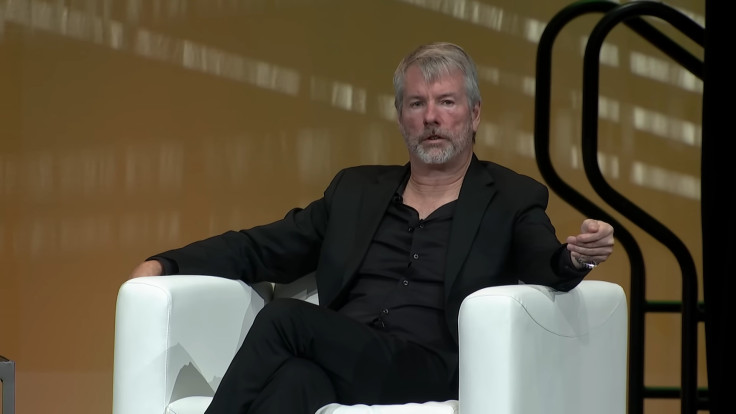

MicroStrategy's founder and executive chairman Michael Saylor has made another bold Bitcoin prediction – this time related to banks – that could further propel the world's first decentralized cryptocurrency toward unprecedented growth levels.

Saylor, who has been very vocal of his faith in Bitcoin's potential, said during a recent panel discussion at the Bitcoin Atlantis conference in Madeira that he believes the world is currently "in the Bitcoin gold rush era."

Following the U.S. Securities and Exchange Commission's (SEC) approval of 11 spot Bitcoin exchange-traded funds (ETFs), the decentralized cryptocurrency has entered a period of what Saylor says is "high growth institutional adoption."

MUST WATCH‼️ - Michael Saylor:

— Neil Jacobs (@NeilJacobs) March 1, 2024

We are in the Bitcoin Gold Rush era. It started in January 2024 and will last until the end of 2034 when 99% of all Bitcoin will have been mined. #Bitcoin pic.twitter.com/LbAAaYRgMo

He is expecting an upward trend in Bitcoin adoption when more banks and institutional wirehouses begin tapping BTC trades. With more interest in the coin, banks will then be pressured into offering Bitcoin custody services because their titan clients demand so. "You're going to see resistance drop," he predicted. The traditional banking system's largest clients, after all, are people who can "make a $50 million decision in one hour," he noted.

He further predicted that "there will be a day where Bitcoin blasts past gold [and] trade more than the S&P index ETFs." Such a prediction is not very surprising coming from a Bitcoin maximalist, but his remarks come at a time when Bitcoin is riding high on the financial waves of time as last week, it broke past the $60,000-mark, inching closer to its all-time high of $68,991 in November 2021.

Saylor also said he expects a "gold rush era" of Bitcoin to last through around November 2034, and by 2035, 99% of all BTC will have been mined. After which, the coin's "growth phase" will begin.

Aside from his optimism over the eventual welcoming of Bitcoin into the traditional banking system, Saylor sees artificial intelligence as a key driver in boosting interest around Bitcoin – what with the rise of AI and its possible vulnerabilities that bad actors can leverage.

He pointed out that people will need Bitcoin "as a system of truth" if they want to perform tasks such as cryptographically signing documents and other content.

Saylor's latest bullish statements about the future of Bitcoin also come at a time when MicroStrategy moves toward its goal of transitioning into a "Bitcoin development company." The former MicroStrategy CEO recently said it was only "natural" for the business intelligence firm to rebrand as such, considering the BTC strategy success of the world's largest publicly-traded corporate holder of Bitcoin.

© Copyright IBTimes 2024. All rights reserved.