Bitcoin Sheds $3,000 As FTX Begins Customer Repayments, Crypto Users Divided Over Market Impact

KEY POINTS

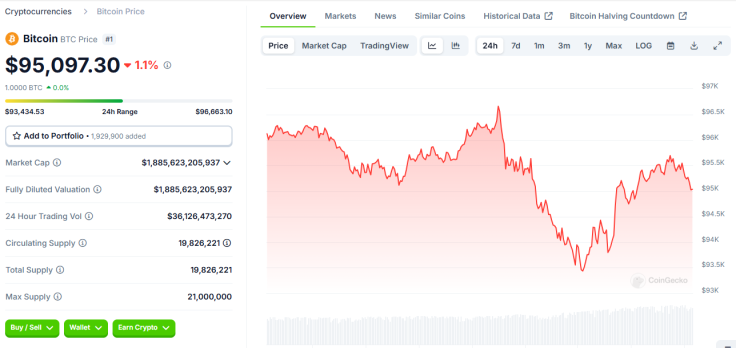

- $BTC was trading at around $96,500 then plunged below $93,500 following the news

- The digital coin has since recovered and was trading just above $95,000 late Tuesday

- Some crypto users wondered whether former FTX customers still want to be in the space after the 2022 crypto winter

The world's most valuable cryptocurrency bled out some $3,000 after collapsed crypto exchange FTX announced the beginning of its multi-billion-dollar customer repayments following its shocking collapse late in 2022 that triggered the infamous "crypto winter."

Bitcoin was down 1.1% in the day following FTX's announcement. From a peak of around $96,500 Tuesday, the top crypto asset plunged below $93,500 at one point before recovering just above $95,000 late in the night.

FTX Kicks Off Repayments – What to Know

FTX said it will start disbursing initial repayments totaling $1.2 billion to eligible creditors. The first repayments are expected to be completed within one to three business days from Tuesday.

For the initial repayments, eligible customers with small claims under $50,000 will be accommodated.

(1/3) FTX today announced that it has commenced the initial distributions of recoveries to holders of allowed claims in FTX's Convenience Classes in FTX’s Chapter 11 Plan of Reorganization. Customers should expect to receive funds within 1 to 3 business days.

— FTX (@FTX_Official) February 18, 2025

"The Initial Distribution is limited to holders of allowed claims in the Plan's Convenience Classes that have completed the pre-distribution requirements," the exchange reiterated.

What should eligible creditors do to claim their repayments?

- Go to the FTX Customer Portal

- Provide information for Know Your Customer (KYC) verification

- Submit the necessary tax forms

- Onboard with either Kraken or BitGo

Concerns regarding the availability of funds on customer accounts with the Distribution Service Provider must be directed to customer support. FTX noted that once repayment funds are forwarded to a claimant's Distribution Service Provider, the customer is "solely responsible" for the funds.

"The start of these distributions is an incredible and important milestone for FTX. Today's announcement reflects of the outstanding success of the recovery and coordination efforts of our team of professionals over the past 28 months," said John J. Ray III, the FTX Recovery Fund's plan administrator, in a statement Tuesday.

He added that efforts to recover FTX funds continue and the recovery team is currently focused on both recovering outstanding assets and also distributing the due repayments.

Crypto Twitter Reacts to Initial Repayments

The reception of FTX repayments has been mixed across the crypto community on X, often called Crypto Twitter.

Some believe it will provide more liquidity to the market, but others are still concerned about its potential negative impact on crypto prices.

For WeRate Co-founder Quinten François, the repayments will inject fresh liquidity into the market "just as institutions are piling in," suggesting that the development could spell positivity for crypto.

🚨TODAY🚨

— Quinten | 048.eth (@QuintenFrancois) February 18, 2025

FTX is set to unleash $16 BILLION in creditor repayments starting TODAY💥

In Phase 1 alone, $6.5B-$7B will be distributed—injecting fresh liquidity into the market just as institutions are piling in pic.twitter.com/vIQRILLWqc

One user expressed concern whether former FTX customers would still continue investing in crypto after their experience with the defunct exchange.

In their place, I don’t know if I could continue with crypto. Honestly, I wouldn’t be able to trust it anymore. You need insane courage for this.

— Crypto Bourse (@CryptoBourse_) February 18, 2025

But I think some exchanges, like Bitget, have even organized special campaigns with up to 25K $USDT to welcome them.😂

"Getting pennies back from a scam still feels like a scam," said one user, referring to the fact that FTX will calculate repayments based on the value of customers' digital asset holdings in November 2022, when the exchange crumbled and wiped out over $8 billion from the crypto market.

Getting pennies back from a scam still feels like a scam.

— ₿lind (@andrealabate) February 18, 2025

Notably, BTC prices were at around $17,000 at the time of the FTX scandal. As of late Tuesday, Bitcoin is trading between $94,000 and $95,000 – a staggering difference from the digital coin's price during the FTX saga.

Others are still unsure how to take FTX's repayment plan, with some noting they will watch and see "who actually gets paid and who gets left behind."

Meanwhile, former FTX CEO Sam Bankman-Fried is serving a 25-year sentence for fraud in relation to his role in the exchange's collapse.

© Copyright IBTimes 2024. All rights reserved.