Bitcoin Effect: HK Investment Firm Sees Shares Surge After Buying Single $BTC

KEY POINTS

- HK Asia Holdings said the board observed the increasing popularity of crypto in the commercial setting

- The Hong Kong-based firm said the 1 $BTC purchase was just an "initial investment"

- It was trading at around $0.41 Monday morning, surging to $0.69 at one point in the afternoon

A Hong Kong-based investment firm's shares surged significantly Monday after the company revealed that it purchased a single Bitcoin, following in the BTC investment model first adopted by Strategy (formerly MicroStrategy).

HK Asia Holdings Limited announced Monday that it purchased one Bitcoin, which it said was accomplished after the board "observed increasing popularity of cryptocurrencies in the commercial world."

Hong Kong firm hails Bitcoin's standing

In its announcement, HK Asia Holdings said the board believes there's room for crypto in general, including for Bitcoin, which it sees as "a dependable store of value which is one of the longest standing and the largest cryptocurrencies in terms of market capitalization."

It went on to note that the purchase was an "initial investment," hinting that it may be planning to add more BTC to its portfolio.

HK Asia Holdings said its Bitcoin adoption reflected its commitment to evolving along with the global financial landscape and should enhance the company's asset value.

Surely enough, the investment company's projection came true.

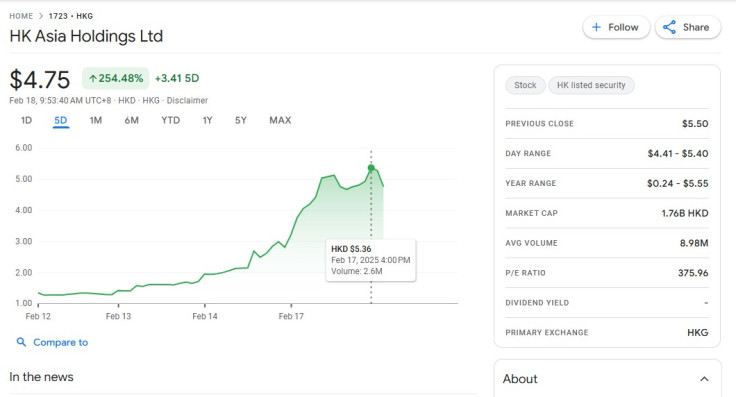

Data from Google Finance showed that during Monday's trading, the company's stock was surging. From trading at around 3.20 Hong Kong dollars ($0.41) in the afternoon, HK Asia Holdings stocks soared to 5.36 Hong Kong dollars ($0.69) at one point in the afternoon, after its announcement.

Based on the investment firm's five-year chart, HK Asia Holdings had a peak price of 6 Hong Kong dollars ($0.77) late in 2022, and since then, it went through an almost stagnant growth phase.

Things started to change last month, when the company's stock hit 1 Hong Kong dollar ($0.13) and last week, the stock crossed 2 Hong Kong dollars (0.26).

HK Asia Holdings has a market cap of 1.76 billion Hong Kong dollars (approximately $226.1 million). For a company of this size, the share price jump is significant.

The company also made the choice to purchase BTC during the dip. The digital coin is currently trading at around $96,000 from highs of $108,000 last month.

Crypto X reacts to "insane" development

Cryptocurrency users on X have since shared their thoughts on the news, with many saying it was an "insane" development.

"Imagine if they purchase 2 BTC," said one user, suggesting that HK Asia Holdings' shares may surge further after it stacks up on more Bitcoins.

One user pointed out that people were more "confident" in trusting companies that invest in Bitcoin, while the X account of Palladium Labs said the race toward challenging Strategy as the known largest corporate holder of BTC only meant the gold rush was completely over and it was now the "Bitcoin rush" era.

Forget gold rush, we’re in the Bitcoin rush now. 📈

— Palladium Labs (@PalladiumLabs) February 18, 2025

Companies betting on Strategy's Bitcoin strategy

In recent years, more publicly-traded companies have started adopting Strategy's Bitcoin investment model. Among those that have been stacking up their Bitcoin include Japanese firm Metaplanet.

Strategy also continues to build its BTC treasury. Last month, the Michael Saylor-founded firm hit a major milestone after its last BTC purchase, bringing its trove to 450,000 Bitcoins worth nearly $43 billion based on current prices.

Beyond companies, two countries have so far disclosed their Bitcoin strategy: El Salvador and the Kingdom of Bhutan. In the U.S., some lawmakers are pushing for a national strategic Bitcoin reserve, but it may take some time before it is considered.

© Copyright IBTimes 2024. All rights reserved.