Panic Mode On As Crypto ETF King BlackRock 'Sells' Bitcoin, But $BTC Regroups

KEY POINTS

- Industry expert James Mullarney said $124 million in $BTC left BlackRock Wednesday

- Many crypto users said it wasn't BlackRock selling, but its Bitcoin ETF clients

- Some also pointed to the ability of major players to 'manipulate' prices with just a single move

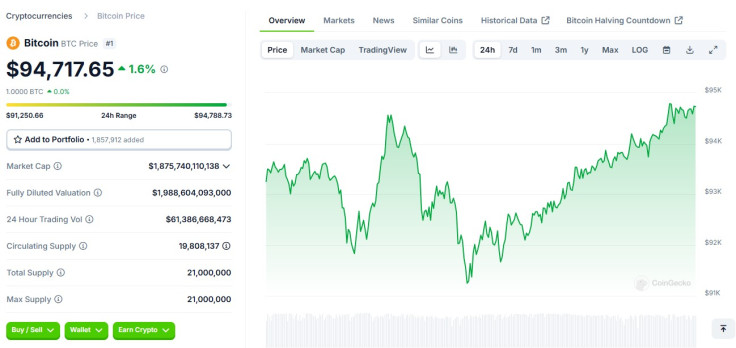

- $BTC plunged after the news but has since recouped and is trading in the $94,000 highs

Cryptocurrency users on X are not in a very good mood after leading onchain analytics firm Arkham Intelligence reported Thursday that asset management giant and crypto exchange-traded fund (ETF) issuer BlackRock is "selling" Bitcoin.

The post has been viewed 1.4 million times and over a thousand users have gone to the comments section to express their thoughts. Most were frustrated, a sizeable number of commenters were scared and some were unsure what to make of BlackRock's move.

Frustration Mounts Over BlackRock's Sales

Arkham Intelligence single-handedly brought gloom to the crypto space after it posted that BlackRock was "selling" Bitcoin.

"Guys I have some bad news. BlackRock is not buying. In fact, they are selling," the blockchain intelligence leader wrote, along with a photo showing data on BlackRock's supposed dump of the world's largest cryptocurrency by market cap.

guys I have some bad news

— Arkham (@arkham) January 9, 2025

BlackRock is not buying

In fact, they are selling pic.twitter.com/GtWKYWdOhi

It didn't help that expert analyst James Mullarney broke down the recent selling spree in the comments section: $124 million left the BlackRock stash Wednesday and a staggering $333 million was "sold" on Jan. 3.

One user slammed Bitcoin ETF holders, saying they aren't really "diamond holders," and instead, "are selling massively at first sign of weakness."

Prominent trader Thomas Kralow noted that it appears even BlackRock clients "are not bullish enough," pointing out that MicroStrategy will snap up whatever the BTC ETF holders are dumping.

The Case of BlackRock as a 'Buyer'

Amid increasing panic over BlackRock's Bitcoin sales, some prominent figures and regular BTC holders attempted to calm new and smaller crypto holders.

ZIGChain co-founder Abdul Rafay Gadit noted that "BlackRock was never the 'buyer,'" which means the outflows presented on Arkham's data platform are flows around BlackRock's IBIT ETF – not Bitcoins held by BlackRock on its balance sheet, if any. Many crypto users agreed with Gadit's take.

Blackrock was never the “buyer”

— Abdul Rafay Gadit (@ARafayGadit) January 9, 2025

That was ETF flows

Now there are ETF outflow

These aren’t blackrock Balance Sheet positions

Founder and CEO of CryptoQuant Ki Young Ju raised a significant question that Arkham has yet to answer: "How do you know these consolidation transactions are for selling?"

BlackRock has been very optimistic about Bitcoin in recent months, especially after the rally to $100,000, and has not made negative comments even during multiple bloodbaths last year.

Is BlackRock 'Manipulating' $BTC Prices?

Amid continuing discussions over the latest development, some crypto users said it only showed the weight major players in the spot Bitcoin ETF circle have on market prices.

One movement of Big players. All sentiment turned negative.

— xdocken (@xRatedPG) January 9, 2025

Price always controlled by them.

"Selling to drop the price and then buy cheaper. Classic move," said one user.

Another user noted that with BlackRock being the unchallenged leader in BTC ETFs, "they can now do whatever they want – manipulate the market."

$BTC Bounces Back

Data from CoinGecko shows that at one point on Thursday night, Bitcoin did waver and dropped below $92,000, indicating that it may have been affected negatively by pessimism over the BlackRock news.

However, the digital currency has since recovered, climbing near $95,000 within a few hours since its plunge and is now up 1.6% in the last 24 hours.

© Copyright IBTimes 2024. All rights reserved.