Barclays Unveils Risk Measurement For Investing In Industrial Corporations; General Electric (GE) Emerges as Less Risky Than Earlier Thought

Investing in industrial conglomerate General Electric Company (NYSE:GE) may be less risky than many suppose, according to a framework for measuring such risks that has just been developed by Barclays PLC (LON:BARC).

The investment bank's framework, which is shaking up risk perceptions in a multi-billion dollar global sector that includes aerospace, transportation, mining, agriculture and construction, comes as a criticism to traditional risk measures.

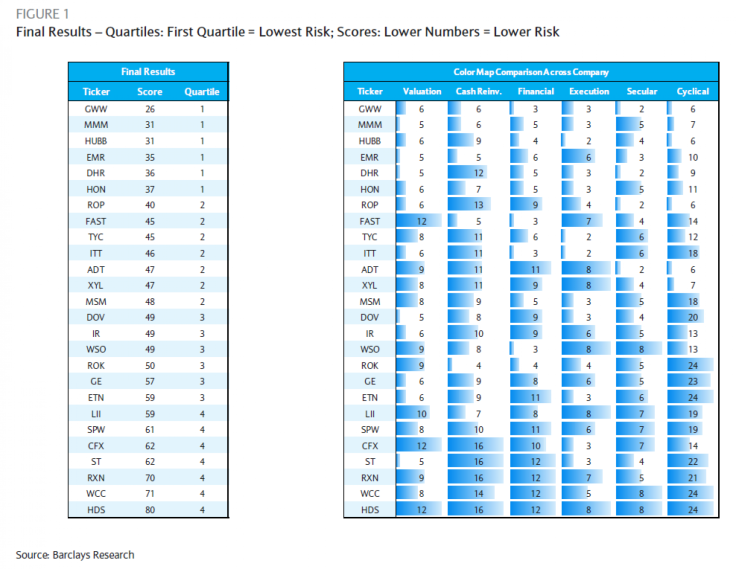

Companies are ranked by stock ticker from 20 to 80 – the lower a company scores, the less risky it is for an investor. Companies ranked include General Electric Company (NYSE:GE), Honeywell International Inc. (NYSE:HON) and Rockwell Automation (NYSE:ROK).

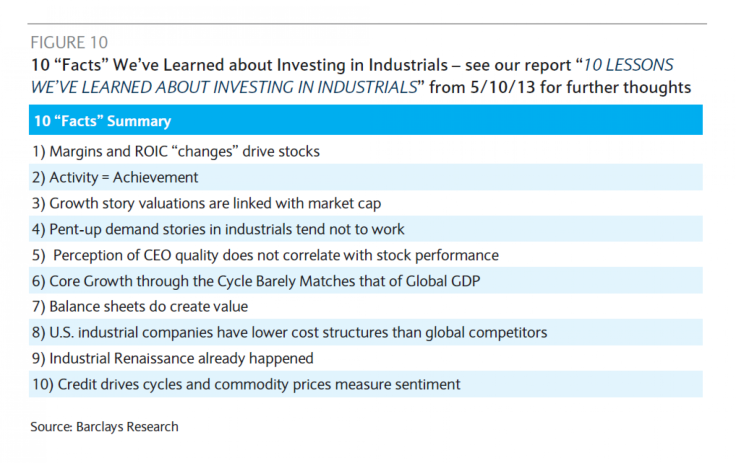

In Barclay's Tuesday note, entitled "Time to Address Risks in Industrials," Barclays analysts first note that industrial investors are an “odd group.” They tend to focus on risks in times when the industrial-economic cycle is in a slump, but ignore risks when companies return to strength on cyclical recoveries, which is exactly when investors may mistakenly overvalue companies.

“It is clear that traditional measures fall very short and that risk is mispriced much of the time within this sector,” wrote Barclays analysts, after outlining their initial attempts at a new risk framework.

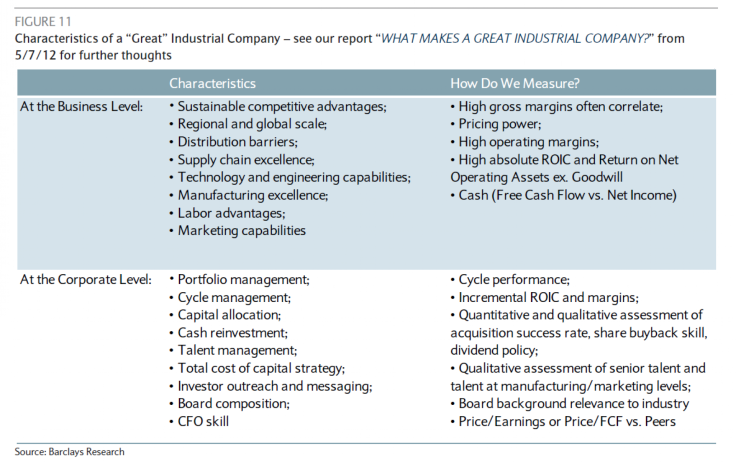

They focus on financial valuation, balance sheet basics, management execution risks, long term industry trends, and cyclical risks, and add: “We often focus on analyzing returns within Industrials without much regard for how to measure risks.”

Even though their framework is played down as a provisional first attempt, they also remark: “It seems appropriate for us to at least begin the risk/return debate. Hopefully this methodology helps frame that debate.”

Traditional measures of risks didn’t help out investors in the last industrial slump, said Barclays analysts. Those measures may have emphasized an apparently low-risk General Electric, whose shares slumped from $40 to $6, and mislabeled Rockwell as too risky, before its stock went from $20 to $110.

Results show few surprises at the extremes, with large well-capitalized companies like 3M Co (NYSE:MMM) with low risk levels, and highly leveraged small cap companies exhibiting the most risk. But the results also show that companies like Rockwell and ADT Corp (NYSE:ADT) have actual risk profiles which diverge from perceived risks. General Electric is less risky than many have thought.

As for the key driver of industrial stocks, the analysts wrote: “We could make a strong argument that the single biggest driver of relative stock performance within industrials is cash reinvestment/capital allocation and therefore the most important part of the CEO/CFO job.”

About 90 percent of the companies their sector still fail in this respect, though, they continue. Cash reinvestment here refers to higher dividends, share buybacks, and how much cash is used for mergers and acquisitions.

The global industrial sector is seeing a very slow and gradual recovery, on the back of an improving global economy, which should accelerate in 2014 and 2015. This has been buoyed by U.S. economic and equity strength, though commercial real estate markets, the mining sector and agricultural equipment makers show some weakness. The European industrial market seems sluggish and uncertain.

© Copyright IBTimes 2024. All rights reserved.