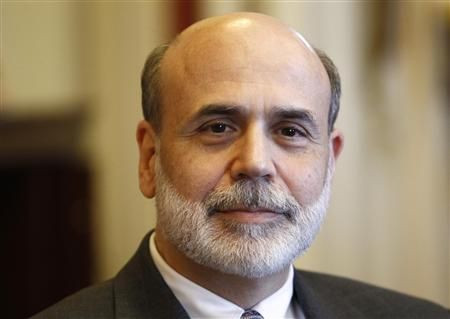

Bernanke: Dodd-Frank Shouldn't Burden Community Banks

Federal Reserve Chairman Ben Bernanke said Wednesday that community banks are gaining strength despite a frustratingly slow U.S. economic recovery, and he promised them that the Dodd-Frank law will cover their too-big-to-fail counterparts.

Profits of smaller banks were considerably higher in 2011 than in the previous year, nonperforming assets were lower, provisions for loan losses fell appreciably, and capital ratios improved, he said in prerecorded remarks to a convention of community bankers in Nashville, Tenn.

The speech resembled one Bernanke gave in February in Virginia, although in Wednesday's taped remarks he didn't mention Fed interest-rate policies. At their Federal Open Market Committee meeting Tuesday, Fed officials reiterated plans to keep rates near zero through 2014.

Speaking last month, Bernanke assured community bankers that the central bank's easy-money policies will benefit them in the long run by driving the economic recovery, even though low rates are squeezing the smaller banks' profits today.

The chairman also acknowledged concerns among small banks about unnecessary burdens on them as a result of Dodd-Frank, the sweeping overhaul of financial-industry regulations enacted in 2010.

We take quite seriously the importance of evaluating the costs and benefits of new rules, Bernanke said.

He also stressed that Dodd-Frank was enacted largely in response to the 'too big to fail' problem and said most of the new standards are not meant to apply to, and clearly would not be appropriate for, community banks.

We will work to maintain a clear distinction between community banks and larger institutions in the application of new regulations, Bernanke said.

© Copyright IBTimes 2024. All rights reserved.