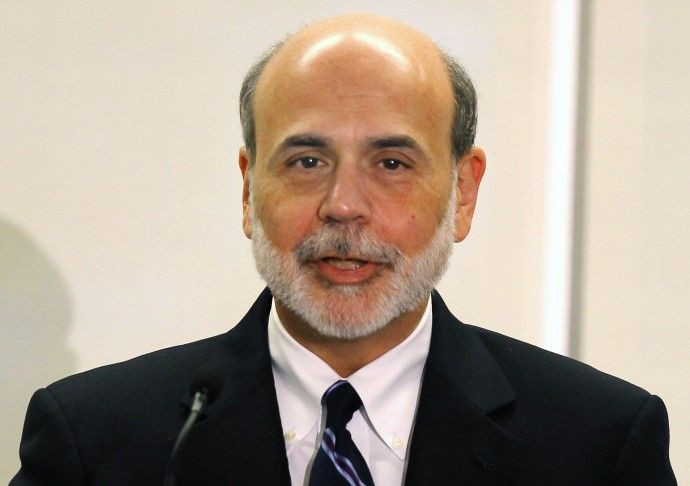

Bernanke testimony: QE2 is working well

Federal Reserve Chairman Ben Bernanke said both rounds of quantitative easing (QE1 and QE2) are working well, in the question-and-answer session of his testimony to Congress.

The first round of quantitative easing, which began in October 2008, pushed up the stock market and helped the economy. The second round, which began in November 2010, has also pushed up stock prices.

Moreover, Bernanke credits QE2 with prompting private sector economists to upwardly revise their expectations for GDP growth and the jobs market.

In his testimony, Bernanke said accommodative monetary policy -- probably a reference to his program of QE2 -- will likely lead to a more rapid pace of economic recovery in 2011 versus 2010.

Regarding the possible harm QE2 has done, Bernanke denies them.

For commodities inflation, he said it's happening all over the world and is being caused by fundamental supply and demand factors, implying that U.S. monetary policy isn't to blame.

As for accusations that QE2 is damaging the reputation of US Treasuries through debt monetization, Bernanke first denied that QE2 is debt monetization. He then said the long-term fiscal deficit is much more important than monetary policy as far as Treasuries are concerned.

Email Hao Li at hao.li@ibtimes.com

Click here to follow the IBTIMES Global Markets page on Facebook

Click here to read recent articles by Hao Li

© Copyright IBTimes 2024. All rights reserved.