Best Budgeting Apps For Millennials: 3 Money-Saving Options For Young Adults

Millennials came of age and took personal control of their finances amid two of the biggest developments in U.S. financial history – the rise of mobile technology and the Great Recession of 2007-2009. Effective money management is essential, and with dozens of budgeting apps just a few clicks away on our smartphones, the pad-and-pen ledgers of yesteryear just aren’t an option.

Yet that sort of drawn-out attention to detail is exactly what millennials need to navigate budgets, especially given rising rents, record student loan debt and the temptations offered by luxuries like Uber rides and Seamless deliveries. In this climate, it’s more important than ever for millennials to choose their money management methods wisely. And with so many digital bookkeeping options available, young adults are turning to apps that combine ease-of-use with sophistication and social interaction.

“For younger people, it’s an easy-to-use, nice-looking interface,” says Claes Bell, a mobile analyst at Bankrate.com. “I think it's convenience, something they can use quickly and be finished with and receive a benefit over time. So they know if they’re putting effort into, say, a budgeting app or something -- that they’re going to have lots of metrics. They’re going to have useful information about what they’re spending their money on.”

Millennials are deploying a lifelong fascination with technology to help stretch their dollars. In the age of smartphones and constant Internet access, traditional accounting methods -- even relatively new innovations like digital spreadsheets -- are falling to the wayside. The companies and banks that aren’t keeping up with technological advancements are increasingly out of touch with an enormous base of potential customers. And newer companies like Mint.com and Venmo are stepping up to fill the void.

Money management apps simplify what can often be a daunting task, but Bell urged caution when using them. Most apps require users to link their credit cards, checking accounts and other highly personal information to their accounts. Venmo, for example, is meant for person-to-person monetary transactions, not commercial use.

Assuming you take the proper precautions, some personal finance apps make budgeting a breeze. Here’s a look at three of the best.

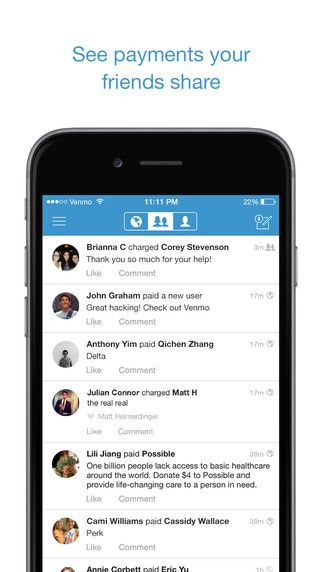

Venmo: A person-to-person mobile payment app, Venmo has so pervaded millennial culture that “Venmo me” has become an acceptable phrase in conversation. The service is free to download and use, minus a 3-percent processing fee on credit card transactions.

Venmo makes it incredibly easy to exchange money between friends. The app can be used on everything from paying back gas money, to splitting a dinner bill, to collecting fantasy football dues. The app’s interface is remarkably clean and straightforward – just link to a friend, enter the amount you want to pay or receive, and click send.

The service also features a social feed, where profiles set to public can share their payments with their expanded network. Payments can also be set to private, in case you don’t want the world to know how much you spent on pizza last weekend.

There are a few downsides for Venmo. Critics have raised concerns about the app’s security, and payments take a few days to clear, which can lead to some nasty cancelations or delays. Make sure you know the person you’re sending money to before you fire off that payment.

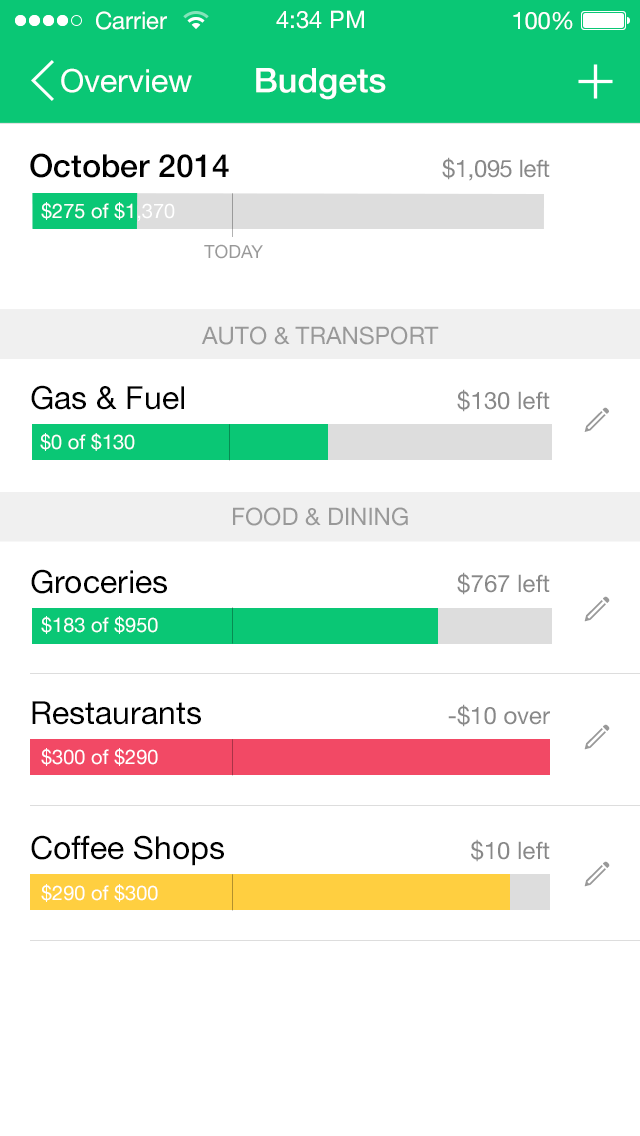

Mint: You’d be hard-pressed to find a more comprehensive personal finance app than Mint. Originally available only at Mint.com, users can now download the app for iOs, Android or Windows. The service allows you to link your finances, regardless of which bank you use, and craft personalized budgets based on your income or any other benchmark. It’s a great way to keep track of how much you spent on coffee last month, or what part of your paycheck will go toward student loans. And the information is presented using handy, easy-to-understand graphics.

The app, however, can be labor-intensive to set up. You have to be willing to sit down and plug in all your relevant financial information to reap the full benefits. If you’re worried about digitally linking your personal accounts, this may not be the app for you.

“There is a little bit of a setup time involved,” Bell says. “You have to connect all of your accounts so they can draw your financial data from your checking account and your credit cards. But there is benefit there in terms of allowing people to understand exactly where their money is going, almost in real time.”

Luckily, Mint is owned by Intuit, the same parent company that owns more well-known finance services like Quicken and TurboTax, so it’s relatively secure.

Wally: Like Mint, Wally is a personal finance app that provides clear breakdowns of your daily and monthly budgets. You can set your target for certain categories, like groceries, and then upload purchases as you make them. Wally presents your budgets in clear, concise charts and gives you an accurate, up-to-date look at your spending.

“It’s almost like a dieting app … but for finance. You enter in your transactions as you’re doing them and it’s telling you whether you hit your goals or not for spending,” Bell says.

Users have to upload each and every purchase to get Wally’s full effect -- that can be a burden. On the plus side, Wally has a feature that allows you to upload and save receipts to parse purchase information. This saves time and provides a nifty way of keeping track of expenses during work-related travel.

Best of all, Wally doesn’t require users to link their credit cards or bank accounts to the app. If you’re worried about your personal passwords leaking to the public, Wally may be the app for you.

© Copyright IBTimes 2024. All rights reserved.