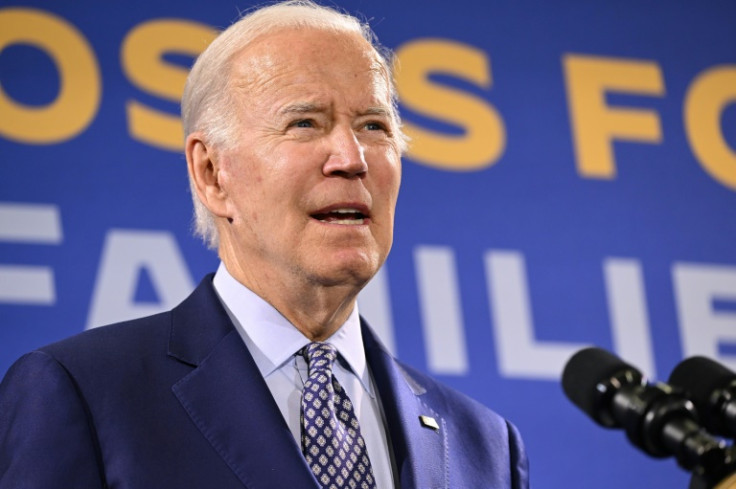

Biden Administration Targets Financially Burdened Borrowers In New Student Loan Forgiveness Plan

In response to mounting pressure and criticism, the Biden administration has announced its proposal for a new student loan forgiveness plan, targeting struggling borrowers in a more precise and legally viable manner.

After facing setbacks, including the conservative-leaning Supreme Court blocking President Biden's initial aid package last year, the administration has pivoted towards drafting a loan forgiveness program that includes specific groups of borrowers. This revised plan focuses on individuals with balances exceeding their original borrowings and students from institutions of questionable quality.

At the heart of the proposal lies a coordinated effort to define and identify borrowers experiencing financial hardship, a category that had remained ambiguously defined until now. The U.S. Department of Education outlined a series of criteria on Thursday to gauge the level of struggle faced by borrowers. These factors constituted evaluating student loan balances and payments relative to household income, as well as considering additional financial burdens such as childcare and healthcare expenses. The proposal also addresses other indicators of financial hardship, such as existing debt obligations, disability status, or age.

Education Department Undersecretary James Kvaal highlighted the administration's commitment to assisting struggling borrowers, framing the proposal as part of President Biden's broader agenda to provide relief to as many student loan borrowers as possible.

Initially, concerns were raised that the category of "financial hardship" had been sidelined in what has been dubbed as Biden's Plan B for student loan forgiveness. While attempts were made to cancel student debt via executive order, the administration has now redirected its focus to the rule making process.

During three rounds of rule making negotiations, different categories signaling hardship were considered, including borrowers who had received Pell Grants or qualified for health insurance subsidies under the Affordable Care Act. However, the Education Department's initial relief proposal did not include specific language addressing financially distressed borrowers, and the negotiating committee did not formally vote on the inclusion of this category.

Responding to pressure from lawmakers, including Senator Elizabeth Warren and Representative James Clyburn, the Biden administration has expressed willingness to reconsider the plight of financially struggling borrowers. The Department of Education revealed plans to convene an additional rule making session on Feb. 22 and 23, solely dedicated to addressing the needs of these borrowers. This move acknowledges the concerns raised by lawmakers and advocates, signifying the administration's intent to provide substantial relief to the most vulnerable borrowers.

© Copyright IBTimes 2024. All rights reserved.