From Bitcoin To Equity: Fintech Terms Explained

Money impacts almost every aspect of our modern lives even though financial technology, aka fintech, is often described with confusing buzzwords and complex terminology.

So we teamed up with Nav Athwal, CEO of the real estate crowdfunding platform RealtyShares, and Ben Jones, CTO at the Berlin-based blockchain startup Bitwala, to break down popular fintech lingo in simple terms.

Here are the words you need to know in order to understand fintech, from capital markets to bitcoin:

Cryptocurrency: A digital currency that uses cryptography, the art of coding messages to keep them secure. Most types of money can already be used for virtual transactions. It's how people shop online and use mobile banking apps. Bitcoin was the first cryptocurrency. It is, first and foremost, a digital form of value. Today, there a few thousand different cryptocurrencies worldwide.

Blockchain technology: A type of software pioneered by the bitcoin community. It is a new way to structure data by spreading it out across the network so no single party can meddle with the records. If each virtual token is a block, then they all work by staying metaphorically chained together. It is often called “distributed ledger technology” because the records are spread across the blockchain.

Cryptocurrency isn’t the only type of blockchain system. There are also blockchain-based identities, like a virtual type of driver’s license, as well as blockchain networks for transferring legal contracts and assets like stocks. There are even blockchain platforms for medical records. Decentralized blockchain transactions are generally considered extremely secure by expert hackers.

Ethereum: A type of open source blockchain network created by a Russian-Canadian programmer named Vitalik Buterin. It is often associated with the network’s namesake cryptocurrency ether, one of the world's most popular cryptocurrencies. Beyond ether tokens, diverse Ethereum-based platforms are widely used to develop software applications and new types of tokens.

Smart contracts: A piece of software that runs on a blockchain platform and is programmed to automatically complete transactions based on specific circumstances. For example, if the price of oil rises above a certain amount then Bank A will automatically send 100 shares of XYZ stock to Bank B. A smart contract automatically completes many of the transactions that used to require manual paperwork.

Decentralized: A system where data and tasks are spread across the network instead of coming from a central source. For example, there is no bitcoin company or bitcoin overlord in charge of bitcoin transactions. Community members contribute computing power to fuel algorithms that verify transactions. Transaction records are spread across the network. Decentralization doesn't only apply to blockchain technologies. It is, however, one of the most popular concepts in the blockchain industry.

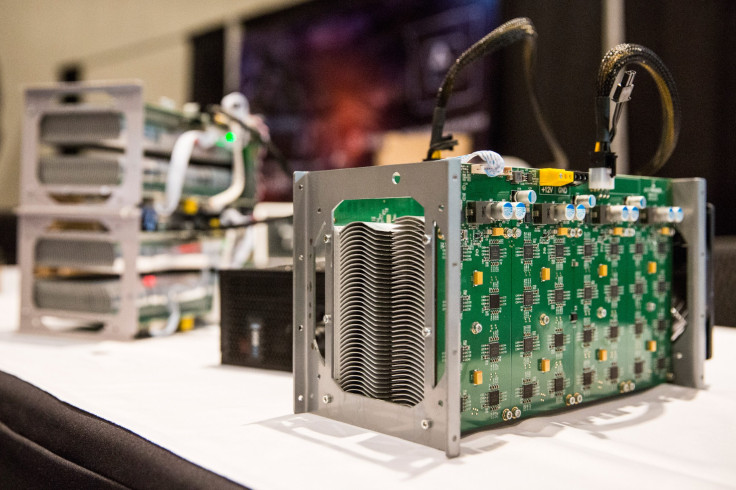

Mining: The process of verifying transactions on decentralized cryptocurrency networks is called "mining.” Community members run a special software that uses algorithms to verify transactions and write them into the shared ledger.

ICO: An initial coin offering is a type of fundraising campaign where a high-tech project raises cryptocurrency by selling tokens, usually a new token unique to this project or startup. This type of crowdfunding has raised around $2 billion so far for hundreds of startups and projects across the globe. This is a new trend, so regulators are still figuring out what types of laws apply to ICOs.

P2P: This stands for peer-to-peer, direct transfers between two people. If you send a friend money through the Venmo mobile app, that's a P2P money transfer. Sending bitcoin from one hardware wallet to another is also a P2P transaction, because it happens directly between two people instead of through a bank acting as the middleman.

Altcoin: A generic term for almost any cryptocurrency that isn’t bitcoin, short for alternative coin.

Cryptocurrency wallet: In the crypto space, a wallet is a piece of software that manages your coins and assets. You can see your balance, plus spend and receive digital assets. In Bitwala’s case, their mobile wallet is an app for your smartphone that grants you access to all these functions. There are also hardware wallets, which offer a lot of the same benefits but have a tangible product for storage, kind of like a USB stick.

Targeted returns: The estimated range of profit that an investor is seeking when investing money in a property, adjusted for the time value of money. The time value of money, or TVM, is a principle assuming the same amount of money is worth more now than it will be later, since loans can earn interest. Basically, almost any amount of money is assumed to be worth more the sooner it is received.

Equity: Owning an interest in a property, company or project, with a chance to earn higher returns. This means you own a piece of this pie and expect to eventually be compensated with a higher value than you originally paid for it. This position is repaid after any debt financing, so it carries increased risk. It's not a loan. However, equity owners often have a greater ability to control aspects of property ownership.

Equity token: A type of cryptocurrency that represents a part of the company, possibly including dividends and governance rights such as voting. For example, Bitwala is having an ICO in November to sell its own equity tokens.

The buyer will have to verify his or her identity and go through the regular equity screening process in order to cash out the equity. "Our platform will verify all buyers and owners of the shares as soon as they want to claim dividends or as soon as they want to purchase or trade our equity tokens," Jones told International Business Times. The equity token can otherwise be bought and stored just like any other cryptocurrency.

This is different from a traditional stock because it's hard to trade traditional stocks between distinct stock exchanges. On the other hand, tokens are available worldwide. Plus, they are easier to trade. This allows small companies to sell equity to a global audience. Even so, equity tokens have more legal restrictions than other types of cryptocurrency such as utility tokens.

Utility token: A cryptocurrency that activates a product or service, grants access to a community or network, or otherwise spurs the blockchain-based project's development. Think of utility tokens like an arcade token. It may go up in value if it works for a popular venue with a limited supply. But this token is primarily meant for a specific purpose. Some utility tokens function like a type of membership card or software license, sometimes both plus other added benefits like community voting rights. There are countless ways a cryptocurrency can offer value beyond representing virtual money.

© Copyright IBTimes 2024. All rights reserved.