Bitcoin, Ether Lead Over $260M Liquidations In 24 Hours Amid Sliding Prices

KEY POINTS

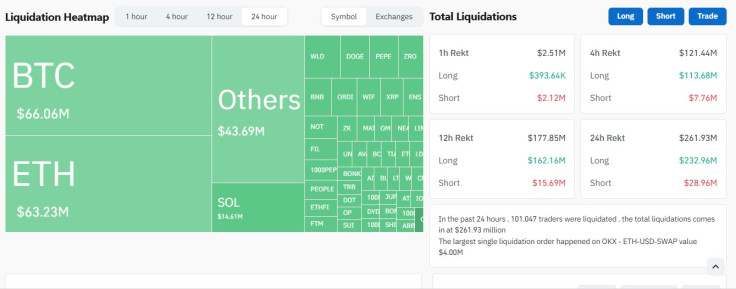

- Over $66 million worth of Bitcoin and $63 million in Ether were cashed out

- Among exchanges, Binance saw the largest liquidations at over $110 million

- One analyst said Bitcoiners should be open to the idea of BTC crashing further

More than $260 million worth of cryptocurrencies were liquidated in the past day amid plummeting Bitcoin and Ether prices, the latest on-chain data revealed, cementing concerns about large crypto users starting to bend to market fears.

Bitcoin and Ether lead 24-hour liquidations

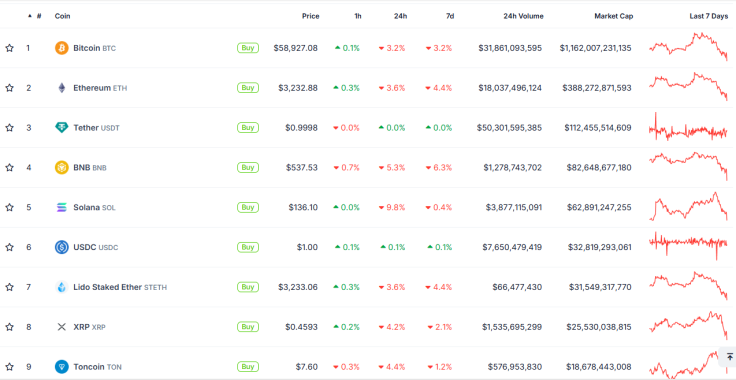

Data from CoinGlass showed that a total of $66.06 million worth of $BTC and $63.23 million worth of $ETH were liquidated in the last 24 hours. Bitcoin, the world's largest digital asset by market value, plummeted to $58,000 Wednesday night, while Ether, the native cryptocurrency of the Ethereum blockchain and the world's second-largest crypto, has been down by more than 4% in the last seven days as per CoinGecko data.

Other leading digital currencies such as Solana ($SOL) saw over $14 million liquidated, the ever popular memecoin Dogecoin ($DOGE) saw cash-outs amounting to $4 million, and $BNB users cashed out over $3 million in the past day.

Overall, the crypto market saw $261.93 million liquidations in the last 24 hours.

Most cash-out activities happened on Binance

Crypto exchange titan Binance led the 24-hour liquidations, seeing over $110 million out, followed by OKX with $84.3 million liquidated. Huobi took the third spot, seeing $30.55 million leave the exchange, and Bybit users took out over $21 million.

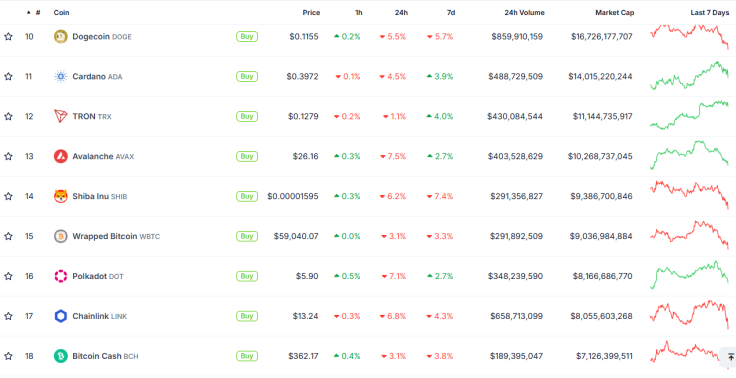

The liquidations came as many cryptocurrencies in the higher ranks based on market value were in the red Wednesday, including Toncoin ($TON), Cardano ($ADA) and Shiba Inu ($SHIB) one of the most prominent memecoins in the market.

Spot $ETH ETF delays triggered price slump?

While some digital assets have been on a downtrend in recent weeks, Wednesday's slump came after analysts dashed hopes that the U.S. Securities and Exchange Commission (SEC) will finally fully approve spot Ethereum exchange-traded funds (ETFs).

Senior Bloomberg ETF analyst Eric Balchunas said it appears the regulator "took extra time" to provide comments to applying issuers in the latest round of amendment processing. This week's Independence Day celebration is also expected to push back progress on the approval.

Bitcoin ETF flows negative

The liquidations Wednesday also came on a day when spot BTC ETFs saw negative flows of $20.5 million. Out of 11 U.S. spot Bitcoin ETFs, only Fidelity's FBTC saw an inflow ($6.5 million), according to data from Farside Investors.

$BTC bound to lower lows?

Pseudonymous analyst Flow Horse said Wednesday that Bitcoin's downward spiral should make Bitcoiners be able to consider the possibility that the digital currency can nosedive to the $40,000s.

The market is still lulled into a sense of overconfidence about how low we could go if this range breaks down.

— HORSE (@TheFlowHorse) July 3, 2024

Almost everyone I see on my timeline and in chats, who only momentarily get bearish, thinks in terms of a few points when it comes to lows.

They are completely…

For Flow Horse, plummeting to the $40,000-mark "would be troubling" but he can't say for sure that it would be "over" for the world's first decentralized crypto if such a crash takes place.

© Copyright IBTimes 2024. All rights reserved.