$XRP, $ADA Lead Crypto Market Plunge Amid News Of Trump's New Global Tariffs

KEY POINTS

- Trump's new global tariffs are expected to be unveiled Wednesday

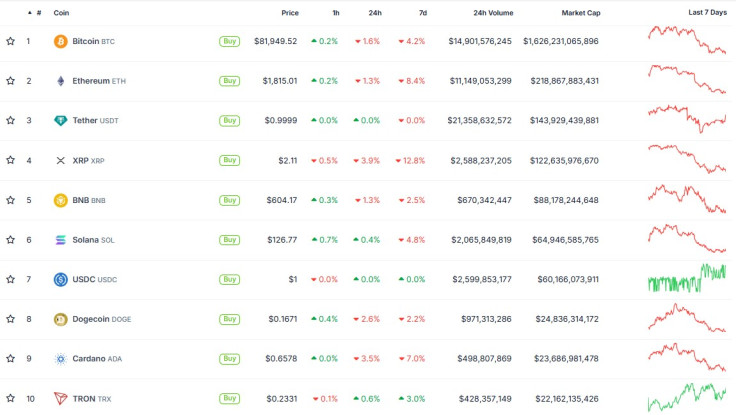

- $XRP bled nearly 4% overnight, while $ADA decreased 3.5%

- Bitcoin was also down 1.6% and Top 2 $ETH was down 1.3%

The cryptocurrency market plunged over the weekend as geopolitical woes rocked financial markets and U.S. President Donald Trump shocked the world Sunday after he said there will be new reciprocal tariffs this week that will target "all countries."

Even Bitcoin, the most valuable crypto asset by market cap, plunged to $81,000 after a difficult road toward hitting $88,000 last week.

However, it wasn't BTC that led the weekend's bloodbath but altcoins – cryptocurrencies beyond Bitcoin.

$XRP, $ADA Lead Crypto Red Wave

XRP, the native token of the XRP Ledger, and ADA, the native coin of the Cardano blockchain, were the hardest-hit crypto assets in the last 24 hours.

XRP bled nearly 4% overnight, while ADA was down 3.5%, followed by meme coin Dogecoin (DOGE), which decreased 2.6%.

Bitcoin shed 1.6%, while both Ethereum (ETH) and BNB were down 1.3% in the day, as per CoinGecko data.

In the meme coin segment, the red wave is much darker. Shiba Inu (SHIB) is down 4.5%, PEPE decreased 4.7%, Official Trump (TRUMP) has shed nearly 1%, BONK is down 3.9%, and nearly all other meme tokens on CoinGecko's Top 20 largest meme coins by market value are in the red.

Why is Crypto Down Today?

Crypto prices plummeted over the weekend amid rising inflation fears and a broader downturn in global financial markets, but it appears Sunday's news about new tariffs to hit the global trade market this week flipped any hopes for a reprieve.

Trump is expected to announce new tariffs that will vary from country to country on Wednesday.

He has long believed that the United States has been "ripped off by every country in the world" for years, noting that his reciprocal tariffs will restore the necessary fair trade with the U.S.

Some of the U.S.'s top trade partners have already responded in kind, with China and Canada levying tariffs on American goods. The European Union's tariffs on U.S. products are due to take effect in mid-April.

The Impact of Trump Tariffs on Crypto

Even before the weekend's downtrend, crypto was already suffering after Trump first announced new tariffs earlier this year.

Bitcoin shed $20,000 from when it hit a new all-time high above $108,000 during the Inauguration Day celebrations through late February as Trump kicked off his trade war.

As the crypto market has done throughout the sector's history, altcoins immediately followed suit, also plunging and suffering massive losses as traders were liquidated and fear among new crypto holders triggered asset sales.

On the other hand, top crypto assets have also shown resilience over the years and the ability to recover, suggesting that crypto prices may surge in the days ahead, especially amid growing positive news around regulations and potential crypto legislation this year.

© Copyright IBTimes 2024. All rights reserved.