$SURE – Is The Crypto Market Ready To Embrace Decentralized Insurance?

KEY POINTS

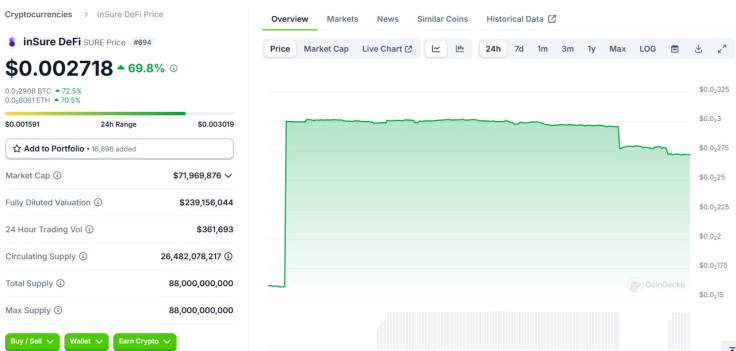

- $SURE increased more than 69% overnight, propelled by recent talks around Web3 insurance

- InSure DeFi allows users to protect their crypto portfolio by purchasing $SURE tokens

- Some packages include insurance coverage for up to $40,000 worth of crypto assets

Decentralized insurance – an emerging blockchain innovation that could protect cryptocurrency holders' assets whenever the crypto market experiences a crash – has been around for a few years now, but it appears not too many crypto users are interested, at least not until the weekend.

Still, some crypto users made the inSure DeFi (SURE) token surge overnight amid recent discussions on whether decentralized insurance could be the crypto holder's way out before massive losses.

$SURE Surges on Crypto Insurance Talks

SURE surged by over 69% overnight as crypto users began talking about the possibilities offered by Web3 insurance.

The SURE token and the idea of blockchain-based insurance has already been around for a few years, but it has yet to gain much attention from the crypto space.

InSure DeFi, in particular, is a community-based digital asset insurance ecosystem that allows crypto holders to insure their portfolio by purchasing SURE tokens.

The project promises that transactions are "completely transparent" and are "100% verifiable," which means insured holders can monitor the status of their insurance coverage whenever they want to.

How Does $SURE Insurance Work?

To insure one's crypto portfolio, crypto users need to purchase or acquire SURE tokens in exchanges that offer them. From the Dashboard, users need to enable coverage.

It is worth noting that an insurance will only be enabled after seven days of contributing SURE to the community vault.

inSure #DeFi Ecosystem - The Future of #Web3 #Insurance.

— inSure DeFi - The Future of 🌐 Web3 Insurance (@InsureToken) March 13, 2024

Join #SURE and protect your #crypto portfolio!

➡️ https://t.co/cO5rSFolEZ pic.twitter.com/0Mc93hJ0vK

The inSure DeFi team is committed to helping crypto holders protect their assets from scammers across the crypto space. "Our solution will protect your portfolio from scammers and unexpected losses," the team said.

There are several insurance packages to choose from, including:

- Beginner: 2,500 SURE – 1/3 year coverage of up to $1,000 in crypto assets from scammers (80%), devaluation (70%), and stolen funds (50%)

- Startup: 10,000 SURE – 1 year coverage of up to $2,000 in crypto assets from scammers (80%), devaluation (70%), and stolen funds (50%)

- PRO: 150,000 SURE – 2 years coverage of up to $40,000 from scammers (100%), devaluation (90%), and stolen funds (75%)

How are Crypto Users Reacting to Web3 Insurance?

Not too many crypto users are aware that SURE exists, but for those who do, they describe the token as one that can safeguard digital asset portfolios.

For one user, SURE is "a reliable safety net for uncertain times," especially at this time, when the crypto market is experiencing a downturn that has been hurting Bitcoin over the last few days.

Smart investing means protecting what you’ve built! 🛡️ With $SURE tokens, you can safeguard your portfolio against hacks, scams, and market volatility. A reliable safety net for uncertain times—because peace of mind is priceless in the crypto world.@InsureToken pic.twitter.com/2OWPqsLLuG

— Maya_Wheeler 🧱 (@MayaWhe255) December 29, 2024

Another user said that the world hasn't realized how decentralized finance (DeFi) and decentralized insurance works yet, but when it does, "they will scream and gnash their teeth."

One projected that protocols around Web3 insurance "will be the new norm," defeating project rug pulls and delivering "only calculated gains."

It remains to be seen whether decentralized insurance will soon gain more traction in the crypto space and whether more similar projects will arise as crypto holders search for ways to protect their investments in a highly-volatile environment.

© Copyright IBTimes 2024. All rights reserved.