Trump Trade War Hits Crypto Market: $2.21 Billion Wiped Out In 1 Day

KEY POINTS

- $AVAX, $ADA, $LINK, and $XRP saw the biggest price losses in the last 24 hours

- The crypto market saw a staggering $2.21 billion liquidated in the day

- Some crypto users are now unsure about Trump being the crypto president

U.S. President Donald Trump's trade war has dragged the cryptocurrency market into the mire, with the global crypto market plunging by over 10% Sunday following scrutiny of Trump tariffs from Canada and Mexico.

Altcoins – digital coins beyond Bitcoin – led the market bloodbath, seeing double-digit decreases in the day as BTC plunged below $95,000 following a seven-day downturn.

Trump Warns of 'Pain' in Tariffs Spree

Following his announcement of 25% in tariffs on Canadian and Mexican imports, the 47th U.S. president warned Americans there will be "some pain" from his latest actions.

Canadian Prime Minister Justin Trudeau took action as well, announcing "immediate tariffs" on $30 billion worth of American imports starting Tuesday, while Mexico also announce similar steps in retaliation to Trump's tariffs.

Crypto Market Reels from Trade War

Trump's Saturday tariffs announcement had an apparent impact on the crypto market, as major cryptocurrencies plunged, including Bitcoin, which bled over 5% in the last 24 hours.

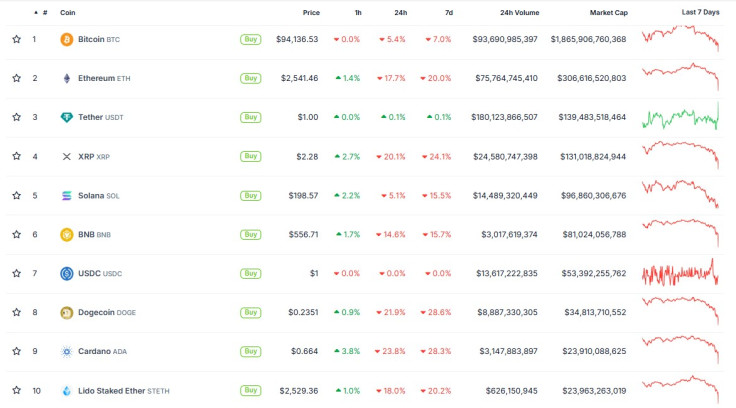

Many other top altcoins were in the red, and some of them bled significantly overnight, including:

- Ethereum (ETH) – 17.7%

- XRP – 20.1%

- BNB – 14.6%

- Cardano (ADA) – 23.8%

- Dogecoin (DOGE) – 21.9%

- TRON (TRX) – 12.5%

- Chainlink (LINK) – 23%

- Avalanche (AVAX) – 25.1%

The massive price plunge in altcoins and meme coins saw 10.1% of the global crypto market cap wiped out in the last 24 hours, settling in at $3.18 trillion from a high of $3.86 trillion earlier in December.

Bitcoin, which has shown some resilience over the years during broader financial market downturns, plunged below $95,000 from a high of $105,000 earlier Saturday.

Market Plunge Wipes Out $2.21 Billion

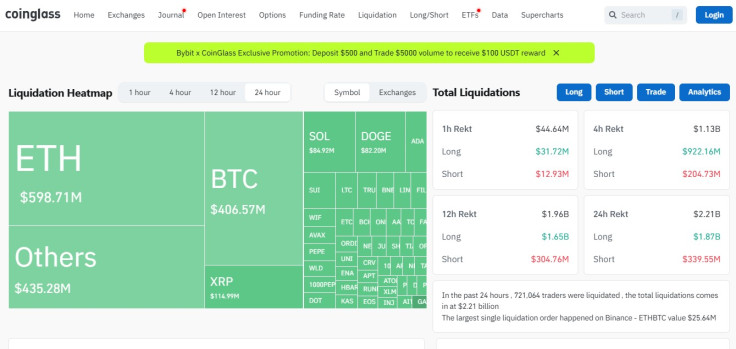

The price plunge has also hit traders hard. Data from CoinGlass showed that a staggering $2.21 billion was liquidated from the crypto market in the last 24 hours.

$1.87 billion of the funds wiped out from the market were long positions, with the largest single liquidation order valued at $25.64 million.

Sunday's liquidations were led by Ethereum ($598 million) and Bitcoin ($406 million). XRP traders also bled hard ($114 million), and other crypto coins collectively bled out $435 million. A total of

Theya Bitcoin's Head of Growth, Joe Consorti, said the day's liquidations marked the "single-largest liquidation event in the history" of the crypto market, beating the liquidation records during the pandemic year and the collapse of crypto exchange FTX.

Crypto Users Lament Impact of Trump Tariffs

Cryptocurrency users on X have started expressing their frustration over the trade war's impact on the market, with a growing number of people saying this wasn't what they expected from Trump's presidency.

Emperor, a popular figure in the crypto community, wondered whether the president had been given "too much power" in his second presidency, as he not only "dumped on all of crypto investors" through his and his wife's meme coins, but he was now "dumping the market further" with his tariff announcements.

We wanted Trump to Pump the market for us and be a Crypto legend.

— Emperor👑 (@EmperorBTC) February 2, 2025

Instead he and his wife launched shitcoin, Dumped on all of Crypto investors, now imposed Tarrif on imports and Dumping the market further.

Too much power?

For one user, the crypto industry only got what it asked for, "a volatile, unpredictable leader who has now created an even more volatile and unpredictable market."

We got what we knew was coming…

— Cold Blooded Shiller (@CoinGremlinz) February 2, 2025

A volatile, unpredictable leader who has now created an even more volatile and unpredictable market…

The moral of the story, be careful what you wished for…

Other users were more forgiving, saying the market actually "needs some real cleansing" at this point.

It remains to be seen whether crypto will recover from the debacle, or if it will continue a downward spiral as the trade war intensifies.

© Copyright IBTimes 2024. All rights reserved.