Bitcoin Hits $93K – Expert Says $200K Before Year-End Possible Under One Scenario

KEY POINTS

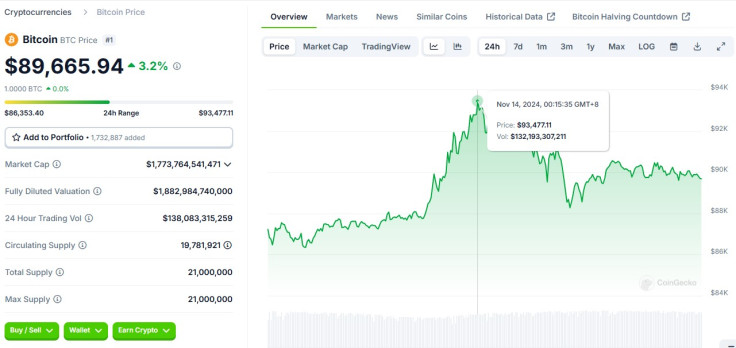

- $BTC went as high as $93,400 at one point on Wednesday behind a 19% increase in the last 7 days

- Turbofish CEO Matt Bell said Bitcoin's current rally is 'largely connected' to the US elections' outcomes

- He noted that investors are now largely recognizing $BTC as a hedge against macroeconomic and political risks

- $200K Bitcoin is possible if the new admin and Congress express stronger crypto support than they already have: Bell

Bitcoin has done nothing but set new all-time highs since Donald Trump won the presidency by landslide last week, and this time, it shot up as high as $93,477.11 at one point on Wednesday.

Data from CoinGecko shows that the world's largest cryptocurrency by market cap has since retreated below $90,000 as of early Thursday, but it remains in the green amid a stellar 19.8% spike in the last seven days.

Many industry experts have already laid out their long-term BTC price targets, with maximalists like Michael Saylor exceptionally in the millions. With crypto's inherent volatility, how high can Bitcoin reach before the new year?

For Matt Bell, the CEO of Turbofish, the founder and core contributor of decentralized non-custodial Bitcoin bridge Nomic, there are several factors affecting Bitcoin's surge in recent days.

Thank You, Trump?

"The rally we are seeing is largely connected to the outcome of the U.S. election pointing to a friendly regulatory environment for the crypto industry throughout the upcoming presidential term," Bell told International Business Times.

BTC prices started spiking late Tuesday, after the media called the 2024 U.S. presidential race for the former president. Prices kept shooting up as races were called for Congress candidates.

Coinbase CEO Brian Armstrong said America now has the "most pro-crypto Congress" ever in U.S. history, citing data from Stand With Crypto, which revealed that U.S. voters elected 273 pro-crypto candidates into the House of Representatives and 19 pro-crypto candidates into the Senate.

A Shifting Response to Policies

It's not just Trump's return to power or the entry of a largely pro-crypto Congress that's affecting Bitcoin prices. There's also the "shift in the market's response to policy uncertainty and a growing demand for decentralized assets," Bell pointed out.

"This rally suggests that investors are increasingly viewing Bitcoin as a hedge against traditional macroeconomic and political risks, a trend that could further solidify its role as a digital store of value," he added.

Since Trump's sweeping victory over Vice President Kamala Harris, crypto analysts and users have become more optimistic of the industry's future, banking on hopes that the new administration will finally deliver more regulatory certainty and forward-looking policies.

Trump has promised support for the crypto sector and many of the candidates who won Congress seats, particularly Republicans, also exhibited a friendlier tone toward digital assets.

"Looking ahead, we may see Bitcoin's price action become more responsive to fiscal and regulatory shifts, reinforcing its standing not only as a speculative asset but as a financial safe haven in times of geopolitical change," Bell said.

The Future of Institutional and Retail $BTC Investing

The launch of crypto exchange-traded funds (ETFs) earlier this year has drawn interest among institutional investors. Spot Bitcoin ETFs have had their ups and downs in recent months, but as BTC prices soared, the ETFs also experienced inflow rallies.

Bell expects the continued rally to "largely be connected to new retail interest," noting how "every rally brings Bitcoin back into the broader public consciousness, pulling in new liquidity."

As for the potential heights BTC will reach before the year ends, Bell believes $200,000 is possible, but only under the scenario wherein "new information comes out indicating that the upcoming U.S. administration and Congress will be endorsing or supporting crypto and Bitcoin in a stronger way than they already have."

While Trump has yet to prove his sincerity toward the Bitcoin community and the broader crypto space by staying true to his promises during the Bitcoin Conference, there are early signs the new administration will work toward embracing the industry.

For one, Trump ally Sen. Cynthia Lummis, R-Wyo., reaffirmed her commitment to establishing national Bitcoin strategic reserve. Trump, on the other hand, has selected some cabinet members who have shown support for crypto, such as Matt Gaetz for U.S. Attorney General and Tulsi Gabbard as chief of national intelligence.

It remains to be seen how the new government will approach Bitcoin and crypto as a whole, but for now, hopes are high and the optimistic atmosphere is vindicating long-time holders who didn't waver in their faith that for the burgeoning sector, there's no other way but up.

© Copyright IBTimes 2024. All rights reserved.