Black Friday Holiday Spending: 'Tis The Season For Credit Card Debt

With Thanksgiving in the rearview mirror, most Americans turn their attention to racking up credit card debt to make the holidays memorable.

It’s Black Friday, the day retailers traditionally have made enough sales to put them in the black for the year, and that means there are just 26 shopping days until Christmas.

A Creditcards.com survey indicated 61% of shoppers will take on more credit card debt for the holidays, including 52% of millennials.

But not everyone wants to be part of the frenzy. A Walletjoy survey indicates 26% of those queried would be willing to receive no gifts if that means avoiding holiday expenses while 25% said they would prefer to opt out of giving gifts, 15% would forgo traveling to visit family, 14% would give up dessert for a month, 7% would prefer a root canal and 4% would give up hot water.

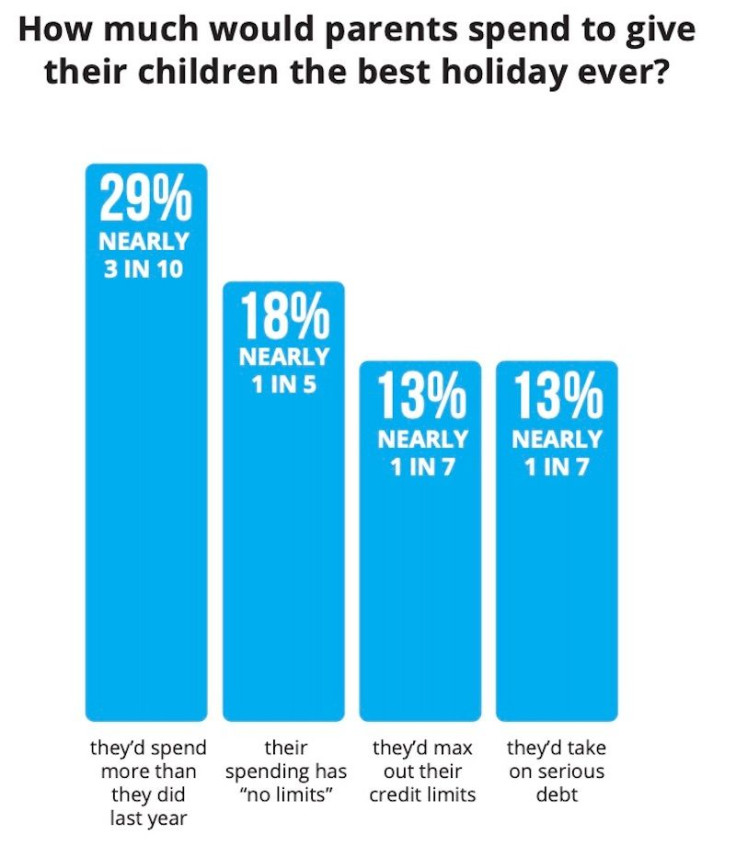

The survey indicated 19% of parents with children less than 18 years old plan to spend at least $1,000 on the holidays, with nearly a fifth of them saying they are planning to spend $4,000 and 18% saying their spending will have “no limits.”

Nearly a third (29%) said they plan to spend more than they did last year and 13% planned to max out their credit limits.

The National Retail Federation predicted holiday spending will increase 4% this year with the average consumer spending $1,047.83. Shoppers between the ages of 35 and 44 are expected to spend $1,158.63.

“Consumers are in good financial shape and willing to spend a little more on gifts for the special people in their lives this holiday season,” NRF President and CEO Matthew Shay said in a press release.

Retailers have been stocking up, hoping to avoid increased tariffs on Chinese goods that are scheduled to kick in Dec. 15 unless President Trump and his Chinese counterpart sign a phase one trade deal before then.

Consumers are expected to spend an average $658.55 on gifts for family, friends and co-workers; $227.26 on candy, food, decorations, greeting cards and flowers, and $162.02 on other non-gift purchases.

“Younger consumers are helping drive the spending increase this year,” Prosper Insights Executive Vice President of Strategy Phil Rist said. “They’re not just spending on their immediate family members, they’re also treating their larger circle of co-workers and friends to gifts.”

More than half of shoppers (56%) said they planned to shop online while 56% said they planned to shop in department stores and 51% said they planned to hit the discount stores. Other shopping venues included grocery stores (44%), clothing and accessory stores (34%) and electronics stores and local businesses (23%).

© Copyright IBTimes 2025. All rights reserved.