‘Brexit’ Week: Five Charts Showing How Britain Shook Markets, Currencies And Gold

Global stocks took nosedives Friday after British voters decided to leave the European Union by a slim margin, but for the week most markets posted modest or even slight declines with two glaring exceptions: Britain’s main FTSE index actually gained in the five sessions ending Friday, while Japanese stocks got truly hammered.

Setting aside the pounding that bank stocks suffered on the prospect of major and costly realignments — and the downgrade of British debt by credit ratings agency Moody’s on Friday night — the most immediate Brexit effects were seen in currencies, sparked by a rush to the dollar and yen, and gold, that precious yellow metal that investors love to buy up in uncertain times.

Even before the referendum, investors were worried about a global slowdown in growth. Traders scrambled Friday to cut off risk and to protect their capital.

The week ended on a very sour note, and things could get worse moving forward. Markets don’t like uncertainty, and the British people just dumped a heaping of it on the world. Here are five charts showing some of the effects this week from the British referendum and its outcome.

British Stocks Gained

In the days ahead of Thursday’s vote, Britain’s benchmark index gained enough to end the week up despite a more than 3 percent plunge on Friday. Stock fell for the week in major indexes, but by less than 1 percent in Hong Kong, Germany and in the broader Stoxx 600.

U.S. shares fell less than 2 percent for the week, but on Friday the S&P 500 tipped back into negative territory for the year, ending the day at its lowest level since March 24. The Dow Jones Industrial Average also wiped out its gains for the year after losing 1.6 percent for the week to its lowest level since Mach 16.

The big loser by far was Japan’s Nikkei 225, which plunged more than 4 percent and hit its lowest level in five years.

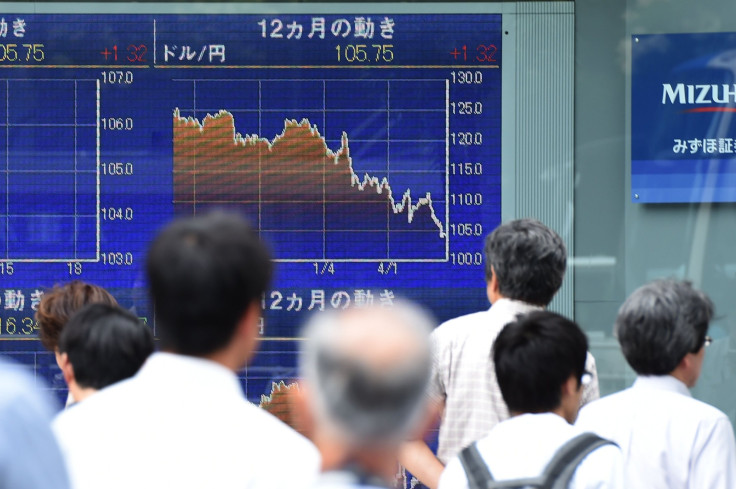

Torrent of Currency Movements

The deep plunge in Japanese stocks following the Brexit vote can be largely attributed to a dive into the yen by currency traders. The Japanese currency strengthened more than 7 percent against the U.S. dollar in the hours right after the British vote, dropping below 100 for the first time since November 2013.

The Japanese currency is one of the safest, so the uncertainty in Europe sent traders dumping euros and British pounds and chasing greenbacks and yen. The week ended with the euro stronger against the pound, but both currencies weaker against the dollar.

Gold Up, U.S. Debt Yield Down

The same effect that sent the yen skyward and Japanese stocks plummeting saw traditional safety plays rallying. Gold gained nearly $30 this week, while the return on the benchmark U.S. 10-year Treasury note touched its lowest level since November 2011 on Friday.

These flights to safety come not just because of Britain’s big signal to Europe, but also because investors were already concerned about sluggish global trade growth and central banks’ inability to adequately stimulate their economies. The Brexit might have simply been the catalyst.

© Copyright IBTimes 2024. All rights reserved.