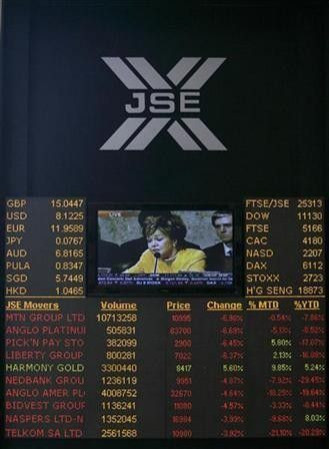

BRICS exchanges to cross-list indexes

Stock exchanges from six of the world's largest emerging markets will join forces to cross-list equity indexes derivatives, to target investor demand for fast-growing economies.

Exchanges from Brazil, Russia, India, Hong Kong and South Africa -- representing the BRICS grouping of big emerging markets -- said on Wednesday they plan to list contracts based on their flagship equity indexes by June 2012.

The tie-up comes as exchanges around the globe increasingly hunt for potential acquisitions or look for product partners to fend off bigger rivals.

The cross-listed instruments would be available in local currencies, meaning an investor in Hong Kong could bet on the performance of the Brazilian index without taking on any currency risk.

The local currency settlement would also pass muster with regulators in countries with stringent exchange controls, such as South Africa and India, said Russell Loubser, the chief executive of the Johannesburg bourse operator JSE Ltd

Loubser introduced the alliance together with officials from Brazil's BM&FBovespa, the Hong Kong Exchanges & Clearing Ltd, Russia's MICEX and RTS exchanges and India's National Stock Exchange of India and BSE Ltd, all of whom are in Johannesburg for an annual meeting of exchanges this week.

The emerging exchanges together represent about $9 trillion in market value and nearly 20 percent of the volume of exchanged-listed derivatives traded worldwide.

Although the BRICS are Brazil, Russia, India, China and South Africa, Hong Kong is taking the place of mainland China, where both local bourses are still cash equity.

The exchanges said they plan to develop and cross list more products end eventually cooperate on different asset classes.

© Copyright Thomson Reuters 2024. All rights reserved.