Oil prices fell Friday, extending the previous day's losses, on worries about potential oversupply after U.S. Energy Secretary Jennifer Granholm said refilling the country's Strategic Petroleum Reserve may take several years.

As SVB teetered, billions of dollars in deposits poured into the nation's banking giants, which are required by regulators to hold more capital to withstand shocks.

The Fed reported that discount window borrowing, its main source of emergency credit to depository institutions, hit $110.2 billion as of Wednesday.

The team of JPMorgan analysts led by Nikolaos Panigirtzoglou did not name any of the banks they categorized as "most vulnerable."

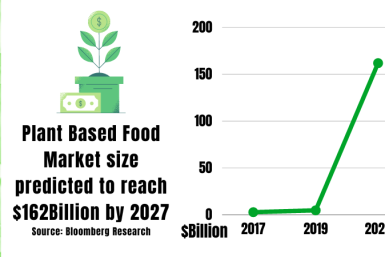

5000+ Plant based food products are now listed on the worlds' largest plant niche marketplace.

UBS and Credit Suisse were both among the 30 banks around the world deemed 'too big to fail' and therefore considered Global Systemically Important Banks.

The 40-year-old Singaporean's rapid ascent coincides with the United States and other Western governments tightening scrutiny over Chinese technology giants and their products.

The Federal Aviation Administration (FAA) said on Thursday it was taking steps to improve its air traffic control operations after a series of near-miss incidents raised questions about U.S.

Ford Motor Co expects its electric vehicle business unit to lose $3 billion this year, but remains on track to achieve a pretax margin of 8% by late 2026, the company said.

A former Meta recruiter recalled her days working at the tech giant in videos posted to TikTok.

It appears Chew, who took over as TikTok CEO in April 2021, has stayed away from the spotlight to a great extent.

The long-awaited decision follows years of turmoil for the company, which has recently faced scandals, financial troubles and high-level resignations.

Although many criticized the SEC for its most recent move against a crypto company, others took the chance to gloat and hit Coinbase back.

There have been at least six serious runway incursions since January.

A filing in the U.S. bankruptcy court in Delaware detailed that Modulo Capital agreed to relinquish any claims to the $56 million in assets held in FTX and FTX US accounts with the remaining $404 million in assets converted into cash at J.P. Morgan.

Historically, many luxury goods and collectible assets were neglected by investors because they were perceived to be susceptible to fashion trends. Nonetheless, investors need an eye-opening look at a market that has demonstrated remarkable resilience and longevity even in the most challenging economic conditions: the age-old demand for single malt whisky.

A paper analyzed more than 4,800 U.S. banks to determine their exposure to the risks that led to the failure of SVB.

Sesame is now the ninth major food allergen.

Earvin "Magic" Johnson may be the ace in the hole for his group to acquire the Washington Commanders.

The central bank is walking a tightrope between continuing to raise rates to combat high inflation or stepping on the brake to prevent further upheaval in the commercial banking sector.

While the feature is in a testing phase right now, Instagram is planning to launch the new placement worldwide in the coming months.

Consumers can see an increase in prices of secondhand vehicles in March and April due to an overall increase in wholesale used-car prices.

Industry watchers believe that one of the main reasons behind crypto firms' sudden interest in Swiss banks is because of their clear regulations, something which financial regulators in the U.S. are still arguing about.

FDA gave a safety clearance to lab-grown meat developed by another company last November.

Coinbase offered Circle a lifeline, an interesting act considering that the CEX was once Circle's rival, although both now share management and profits of the stablecoin USDC.

The sauces were distributed in Washington, D.C. and several states including Hawaii and New York.

Silicon Valley Bank was taken over by federal regulators on March 10, with Signature Bank following suit a few days later.

First Republic is examining how it can sell parts of its business, including some of its loan book, in a bid to raise cash and cut costs.

InDrive has a competitive advantage in the Indian market, and that is not because it was founded in Russia, a country that is much loved by Indians.

As the US central bank raised interest rates steeply over the past year to curb surging inflation, the rate-sensitive housing market has been reeling.