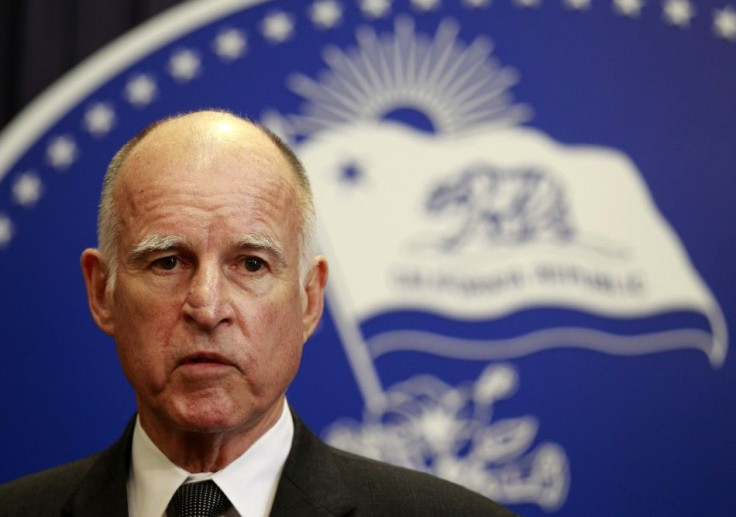

California governor eyes jobs with tax credits

Aiming to spark job growth in California, Governor Jerry Brown unveiled on Thursday proposals for tax breaks for businesses, including tax relief for companies that buy new manufacturing equipment.

The Democratic governor also proposed expanding a tax credit for small businesses when they add to payrolls.

The two proposals are meant to appeal to Republicans in the legislature's minority whose votes Brown needs for his third proposal. It would scrap a convoluted tax break that the governor said discourages companies from outside California from creating jobs within the most populous U.S. state.

Revenue from closing the tax rule would fund tax credits for new small business jobs and purchases of manufacturing gear, according to Brown's office.

At a press event in the state capital of Sacramento webcast by Brown's office, he said that scrapping the tax rule would not equal a tax increase, which Republican lawmakers adamantly oppose.

The tax rule was part of a deal struck by lawmakers in a state budget deal in 2009 and Democrats want it shut to raise about $1 billion. Brown had proposed ending the tax rule as part of his budget plan earlier this year. Republicans opposed that, saying doing so would amount to a tax increase.

Brown's proposals come as state officials grow increasingly concerned about California's feeble jobs market and its effect on the state budget.

California's unemployment rate in July was 12 percent, the second highest in the nation, and economists predict it will remain in the double digits for some time.

California's revenue is falling short of forecast in the state budget for the current fiscal year in part because of high unemployment, the result of the state's housing downturn, mortgage industry implosion and recession, and many in Sacramento are bracing for spending cuts to be triggered early in the next calendar year if revenue does not improve.

Triggers for spending cuts were included in the state budget plan that Brown signed in late June in case a deficit reappears.

© Copyright Thomson Reuters 2024. All rights reserved.