The CalPERS Lawsuit Against The Rating Agencies

The pre-emptive attack on the rating agencies has begun. As Zero Hedge has long suspected, once the next major leg down in the market occurs,populist anger will again have to be directed away from its true focal point- the intersection of Wall Street and DC. And since major investment banks such as Goldman have already suffered major reputational blows over the past several weeks, it behooves everyone to throw the straw man in the open... In other words, the next congressional lynching will focus exclusively on S&P, Moody's and Fitch, and likely will result in the end of one or more of the rating agencies. And last week's action by CalPERS is just the catalyst to get that particular avalanche rolling.

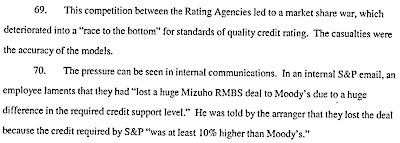

The lawsuit itself (below) has quite a few interesting tidbits of information, such as this:

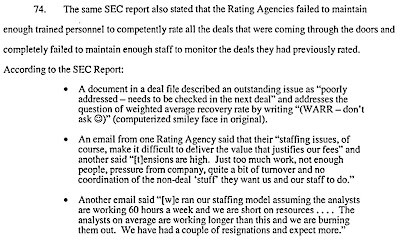

this:

and this:

The gist of the lawsuit for the most part should come as no surprise to anyone, what is odd is that it has actually occurred - one may ask just what is CalPERS' motivation to launch it now? Now the real question is just how deep will this inquiry lead: will discovery requests extend beyond just the rating agencies, and reach into the underlying issuers of the structured vehicles? If this case is not handled carefully, it may very well lead to significantly more questions than some of Wall Street's titans are willing to answer.

Regardless, this will be a case that will need a close following.